What Would A Crypto Crash Mean For Markets And The Economy

By Peter Tchir of Academy Securities

On “bitcoin infinity” day (apparently 8/21 is symbolic of ∞ infinity, the projected value of bitcoin) divided by 21,000,000 (the total number of bitcoin that can ever be mined), it seemed like a good time to explore what a crypto crash would look like and what it would mean for markets and the economy.

We all know what a mortgage bank collapse looks like (Washington Mutual). We’ve seen broker dealers collapse (Lehman), we’ve seen the stress on the system when money center banks and insurance companies come under intense pressure. Heck, we’ve even endured a sovereign default (Greece). We’ve also experienced flash crashes in equities and bond yields.

In all those cases, I would argue that having a gameplan ahead of time allowed companies and investors to profit from the events (both positive and negative). I haven’t seen much on what a crypto crash would mean, so I figured we could examine that today.

Jackson Hole

I could have written the 900th Jackson Hole primer, but I couldn’t bring myself to do that. I’ve already covered a lot that is applicable to Jackson Hole in Taxi Strategies, Orwellian Moments, Things You Won’t See, and Inversion and Inventories.

My focus right now is pretty simple:

- What is the real story on jobs?

- The weak data is a more accurate sign of the current situation.

- How bad is the inventory build?

- I think it might be the worst we’ve seen in my lifetime.

- Is the wealth effect a problem?

- I think that the concentrated nature of the wealth effect in disruptive stocks and crypto is different than anything else we’ve experienced historically, and the housing sector weakness is ominous to me.

- Inflation Fighting.

- Be careful what you wish for is all that comes to mind. Time and again, lower commodity prices have accompanied stock prices as they became much lower as well and I’m not sure why that will be different this time.

Anyways, let’s get back to being off topic and discussing a crypto crash.

6 Impossible Things Before Breakfast

I cannot come up with 6 impossible things before breakfast, but as the Queen suggested to Alice, you do need to practice.

Let’s start with the premise of a crypto crash or crypto collapse. If it is impossible, then there is no point even thinking about it. However, not only is it possible, but I put the possibility of it occurring in the next year at 10% or higher. Still unlikely, but a high enough probability that I should think about what it would mean.

Why a crypto crash or collapse seems possible:

- It has already happened. Luna/Terra is gone. Poof. XRP is down 80% from its highs, Cardano is down 85%, Bitcoin Cash (you got to love the name) is down 91%, and Dogecoin is down 90% as well. Dogecoin was allegedly started as a joke, which makes it all the more ironic (or moronic) that an SNL skit helped pump it to the moon. So, collapses and crashes have occurred in some segments of the market, which alone tells me that it is worth exploring more.

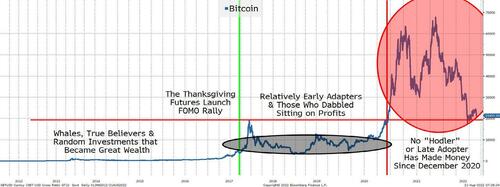

- This chart is precarious.

- Bitcoin continues to hover near levels that would ensure that no “hodler,” or someone who buys crypto and will never sell (diamond hands as opposed to lettuce hands), has made money on any purchase in almost two years. That is a long time to wait to make money (or to sit on large losses). FOMO is a big part of crypto trading, and we are on the precipice of declining to levels where many could decide to take their money and run. There is an ongoing theme in crypto that the “whales” keep buying dips, which might be possible, though it seems more likely to me that many have decided to lock in massive amounts of wealth into the much maligned (but useful) “fiat” currency. Crypto bounced here recently, but that was just the first test and I suspect that there were some heavily incentivized holders who went out of their way to support the price (there really are no rules in this space). This chart, by itself, doesn’t convince me that a crash is possible, but when I highlight the other issues, it certainly adds to that overall theme that a crash or collapse is a non-zero probability event.

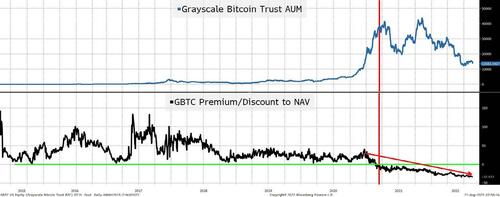

- The chart isn’t much better.

- The $13.5 billion trust, GBTC, is currently at a 32% discount to NAV. This isn’t an ETF, so it has the ability to trade at a discount or premium to NAV for extended periods. A 33% discount lets you buy bitcoin at the equivalent of under $14,000 ($21,000 * 67%). There is, to some extent, over $4 billion in “free” money in this stock if the discount closes to 0. It is bizarre and scary to me that the discount continues to widen. In ETF’s, I believe that discount/premium to NAV leads the way (cheapness begets lower prices and vice versa). While that view doesn’t quite translate given the nature of GBTC, it is cautionary to me.

- A lack of interest. Recently one of the largest asset managers on the planet announced plans to collaborate with one of the largest public companies focused on crypto to work on some crypto projects. Two years ago, I can only imagine the impact that headline would have had on bitcoin. My guess is $10k in a heartbeat, but we are already back below the price when that deal was announced. Every headline like that (a year or more ago) was met with thousands (if not millions) of social media posts touting ADOPTION! While adoption is growing and more big banks have announced crypto strategies, the response seems to be more like “well, of course they are going to see if they can make money in it” rather than “OMG, XYZ just endorsed crypto, BUY!” Subtle shift in response, but an important one (albeit subjective).

- The best “use” cases are diminishing. China, to me, has always been the best use case. A large population with enough money to matter. For all the talk about banking the unbanked, etc., which sounds nice, this isn’t what will drive crypto prices higher. There are stats saying that as many as 4 billion people are unbanked across the globe. According to the World Bank, about 700 million people make less than $2.15 per day. That is depressing, scary, and almost mind-boggling, but from the crypto perspective, it is not the poor that will drive prices (there just isn’t enough money). But China, where millions of “middle class” citizens exist under a regime where they may want to keep money outside of the system, it has always been a good use case. With the property market in tatters, a slowing economy, and the government continuing to crackdown on crypto (outside of the digital Yuan), that use case may be dropping rapidly. Sanction avoidance as a use case may also be diminishing. If you were illicitly trading embargoed products (like oil), crypto may have been the “currency” of choice. But with the U.S. looking to ease restrictions on places like Iran and Venezuela (hypothetically), maybe some of the alleged trade will come back onto the books. With China and India openly buying Russian oil and Chinese currency gaining in stature (at least amongst some nations), there is less reason to use crypto when the Yuan is about 10 times less volatile than bitcoin (30-day vol of 5.4 versus 53). Criminal activity still flourishes, though the ability to track and reclaim ransomware payments seems to be increasing.

- It’s about blockchain and blockchain technology. The number of pundits, experts, and companies that seem to be doing contortions to pitch themselves as blockchain rather than crypto is high. Again, this is subtle, but it seems that re-positioning oneself as blockchain rather than crypto is occurring, which doesn’t bode well for crypto.

- It’s a Ponzi scheme, but it’s our Ponzi scheme. There were always the slogans that accompanied crypto, like “have fun staying poor” but they often included passionate explanations about the greatness of crypto. The use cases would take up pages including such themes like it is banking the unbanked (already discussed), that it is an inflation hedge (hasn’t worked on that front for some time), that it is outside the reach of the government (it is being regulated more by the day, and many in crypto, after some recent highly visible failures, now seem to embrace this), that it is lower cost (costs remain high and there is little protection against mistakes or fraud, unlike with bank accounts or credit cards), or speed (but how many people really need to instantaneously shift large amounts of money, but aren’t already served by Venmo or Zell or some similar product?) I still see those arguments being made, but with far less enthusiasm. However, there is another “use case” that seems to be getting traction (at least in my social media streams). It basically amounts to the argument that convincing more people to participate will help. Kind of like “adoption” but with a more cynical tone. Basically, it is admitting that it only really works if more people get in (so get in, and get more people in). It has the advantage of being true and seems honest, but it seems like the last vestige of a pump and dump scam.

I’m not sure about you, but that is enough for me to at least take a look at what a crypto collapse or crash would mean.

Crypto Market Cap

Let’s start with the market capitalization of crypto currencies as that is the most obvious and direct hit to investors. We will use coinmarketcap for this section (beware of using the link as it will ask to send notifications, know your location, etc., but I figured there should be a link to something to verify).

- Bitcoin at $21,262 has a market cap of $406 billion.

- Ethereum at $1,628 has a market cap of $199 billion.

- Binance Coin at $286 has a market cap of $46 billion.

- Then XRP, Cardano, and Solana come in between $13 billion and $17 billion.

- Dogecoin, Polkadot (love the name), and Shiba Inu are all about $7 billion, with Avalanche, Polygon, TRON, and Uniswap, all a bit over $5 billion.

Let’s call it about $750 billion in total market capitalization for crypto.

To make things “simple” let’s assume that after the top 3, most of the coins could disappear and people would hardly notice (I’m assuming that many of those coins are not widely held, and a few “whales” would lose a lot, but the average person wouldn’t lose much more than what they are already prepared to lose.) If you believe that this is an area where many have spent their “winnings” or took money made in bitcoin or Ethereum to really roll the dice (which I believe), that gives us further reason to argue that the hit here would be minimal on the economy (it also makes the analysis much easier as we only have to focus on a few key currencies).

Stablecoin Market Cap

We need to also consider the stablecoins. Terra/Luna was supposed to be a stablecoin. Stablecoins, in theory, are backed by assets of some sort, except those that were algorithmically backed (whatever that means).

Tether (USDT) is still the biggest at $67 billion. I love how much everything is made to sound like dollars (USD) despite the rhetoric against fiat. This stablecoin, in particular, attracts a lot of negative posts about how it is backed. The company asserts that Tether is backed by T-bills, commercial paper, etc., but to my knowledge, it has never produced a detailed list of its holdings, let alone an audited list of its holdings. This behemoth of an account ($67 billion is large even in money markets) is unknown by any money market participant I speak to (albeit that is only a handful of people outside of Academy’s strong short-term liquidity desk). Someone recently pointed out that they apparently manage that much money without a Bloomberg terminal account (there is no Bloomberg account linked to a company called “Tether,” but they could use a different name on Bloomberg to obfuscate their existence, which isn’t unheard of). Tether has seen their market cap drop from $82 billion to $67 billion, and part of that could be that some investors, given what has gone on this year, have shied away from it.

USD Coin or USDC (again, notice how much it tries to sound like the dollar) has a market cap of $52 billion. Its market cap only peaked at $55 billion, so it has gained at the expense of USDT. Circle, which is the company behind USDC, makes a big deal out of being transparent and regulated in the U.S. I’ve had brief conversations with people involved in the company and the pitch makes sense to me (though I have not yet gone through the effort of figuring out how granular that transparency is – that’s a project for another day). But they are clearly marketing themselves on the transparency issue and have surged relative to Tether over the past year or so.

Binance USD (BUSD) weighs in at $18 billion and is a distant third and seems relatively tied to the Binance ecosystem.

Vegan hotdogs. When I see all these names trying so hard to associate themselves with the dollar despite being part of an ecosystem designed to avoid the dollar, I can’t help thinking about vegan hotdogs and why vegans try to replicate an already weird food, when vegan food in its own right can be awesome! But I digress.

My view is that stablecoins and their market caps are a function of the overall utility of cryptocurrencies. If crypto crashes, we should see a decline in the market cap of stablecoins.

Two things could occur:

- Those backed by assets will have to sell the assets to meet redemptions. If it is a few billion and they are back by T-bills, then no sweat. Markets would digest that easily and no one would be impacted. But if the size is bigger (10s of billions) and the assets are less liquid (non-standard commercial paper programs for example) then we could see some friction in markets. Again, if we knew exactly what they held we could be more or less prepared. What they hold and the size of the selling would impact the knock-on effects of any unwind (Terra/Luna held nothing, so that didn’t spread to the greater financial system, but this could).

- If the stablecoins don’t truly hold sufficient assets or the assets are of low quality (there are all sorts of conspiracy theories out there on what it might be invested in that isn’t worth me repeating here, even if they intrigue me) then we could see what looks like a “bank run” occur not just in stablecoins, but ultimately in the assets they hold and asset classes that compete with what they hold. Let’s just pretend, for the moment, that they have money market lending that is off the radar screen, and presumably paid a lot, as it wasn’t standard. If they have to sell, that could cause prices to plummet, possibly to a level that more traditional players sell what they have to buy this stuff, creating that first domino effect.

There is a circularity between crypto and stablecoins. They can bring each other down.

While crypto losses themselves will be largely isolated to the holders (we still have to dig into that), the unravelling of stablecoins is likely to influence other markets, possibly quite negatively.

Direct Losses

The direct losses are relatively easy to figure out.

- Crypto losses. Let’s say $500 billion could be wiped out of crypto. While some evidence points to there being a small subset of “whales” that would bear the brunt of that loss, I think there is a broad enough swath of the population that would take a serious hit and it would affect spending in the near-term.

- Stablecoin losses. Stablecoins in theory should have an orderly unwind. If, and that remains a question, there is a disorderly unwind of one or more stablecoins, the losses would be in the 10’s of billions (which isn’t so bad). The problem is that unlike crypto losses, where investors presumably treated this as a risky portion of their portfolio, stablecoins are viewed as cash equivalents. Losing cash is always more problematic than losing risky investments. Something to watch.

- Public Company Losses. There are at least a couple of public companies that are linked to crypto. Then there are the miners, mostly listed on foreign exchanges. HIVE for example went from almost $2 billion to just over $400 million (higher than the recent lows of $237 million). Not a huge market cap loss, but only one of many miners out there. This would add up to more losses, some of which would hit mainstream funds. The bigger losses would likely be felt in the private domain as many of the companies in the space have not yet made the leap from private equity to public equity. The losses shouldn’t be material to the broader market, but would likely be concentrated enough to leave a mark disproportionate to the size of the losses. On the private equity side (even more than the public side) the losses will hit employees the hardest and that will hit spending.

- Jobs.

- If you consider day trading crypto and waiting for NFT drops to be a job, then there will be job losses.

- The companies I’ve mentioned, both the public and private ones, will be forced to let go of employees (that already will have lost significant paper wealth). These are skilled employees, so in theory, could find other jobs, but that could be more difficult to do in an environment where crypto losses cause investors (including private equity) to be more conservative across the fintech space.

- Domino or knock-on effects. Assuming the stablecoins hold liquid assets, that unwind should be handled easily (there is a risk that isn’t the case, at least for some stablecoins) but I won’t harp on it. There is not a lot of direct debt tied to crypto (though there are some bonds out there, but they are too small to have any material impact). I don’t see crypto being used as a major source of collateral. If bitcoin holdings, for example, were being used to leverage up stock investments, then I’d be very scared. I think some individuals may manage their personal wealth along those lines, but I don’t see it as a widespread issue (unlike housing in 2008, for example).

- Spending. How much spending is coming from this sector and what does that mean for us?

Spurious Correlation or Real Threat

You can take any two data series and potentially see a correlation. They may have nothing to do with each other, so we can stare at the “correlation” chart as long as we want, but it isn’t going to help us because there is no causation. Complicating matters further, we should be looking at correlations between the rate of change rather than correlations between asset classes themselves (I vaguely remember the reasons for this, but I will ignore that technicality for today).

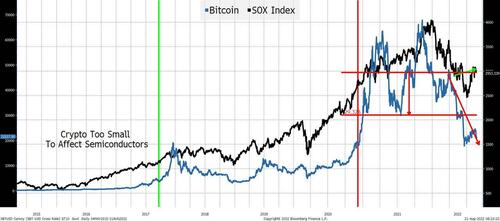

Here is the SOX (Philadelphia Semiconductor Index) versus bitcoin. I chose to use this index because it is more likely to be spurious and highlights how much more correlated some individual semi-conductor stocks are.

Spurious correlation. The argument for “spurious correlation” is strong.

- It seems impossible that a small segment of the market, like crypto, could have a large effect on such a big diversified market.

- Many of the things that drove crypto were also driving other industries that placed huge demands on the chip industry (video conferencing, autonomous driving, big data, etc.). So crypto was just one of many things driving those industries and those industries should not be impacted by a crash in crypto.

- I could go on, but I can see heads nodding here, so I won’t spend any more time arguing what is a consensus (and probably correct) view.

What if it is correlated?

- The wealth being generated by those in crypto was large. From the miners to the “exchanges,” there was a race to capture revenue and there was plenty of revenue to capture. The spending on chips (rigs to mine, servers to provide customer service, etc.) was large. Chip companies presumably saw this demand and knew that they could charge a premium to an industry where speed and timeliness meant everything. Were chips designed specifically for the crypto industry? Was production of generics shifted to higher profit margin lines? Not only were the companies (that succeeded) spending money, but many failed business ideas (or those just not yet successful) had money to spend as well.

- What if crypto spending went to web services (seems like it would). What if it went to advertising? (It did). What if that spending caused those companies to spend more? Maybe they needed to add systems, components, and people to keep up with the demand from the crypto industry. Did that spending then create more spending and make it very difficult (if not impossible) to figure out where crypto spending ended and where “regular” spending went?

- How much money was crypto spending on energy? At one time I saw stories that in terms of energy usage, crypto, if treated as a nation, would have been the 10th largest country in terms of energy use. Commodity prices are always affected by the marginal 5% or 10% of demand. Is it possible that part of energy inflation was due to crypto? Does that mean policy makers are responding to a problem (high inflation) while ignoring one of the causes (because it isn’t on their radar screen, except in China, which has been clamping down on mining in that country?)

The case for crypto being a bigger driver than previously thought may seem weak, but I cannot help but believe that it is a risk we should be discussing more than I think we are.

What if the correlation was a driver for exciting new technologies where enormous wealth seemed possible (to such an extent) that current spending or success was irrelevant? What if crypto’s decline and potential collapse may not be causal, but is correlated to some broader move in markets and the economy? Then in that case, it might be spurious, but is still dangerous.

Impossible Things, Black Swans, and Thinking Out of the Box

I do not think a crypto collapse is impossible. It isn’t my base case, but there is a real possibility that it occurs.

Black swans are things that people didn’t think were possible (and turned out to be possible). We can get a pass on missing black swans, but not if we are looking at a grey swan and choose to ignore it.

I’m not lying awake at night thinking about a crypto collapse because:

- It “probably” won’t happen.

- If it does happen, the damage to the economy “could” or maybe even “should” be minimal.

But I am thinking more and more about it because if there is a correlation between crypto and the broader economy (and markets) or because crypto, the broader markets, and the economy are moving to the same theme, there is serious risk to the downside. Some of this risk may not be getting priced in based on some simple charts of crypto versus other asset classes. On this broader correlation theme, check out ARKK shares outstanding because something seems to have shifted in terms of the investor mentality there.

For those who celebrate, enjoy bitcoin infinity day! It really seems weird that not only is that a thing, but on 8/21/21 the CEO of a public company enjoyed tweeting it out. I’m possibly too old and jaded, but stuff like that seems silly rather than compelling.

Tyler Durden

Sun, 08/21/2022 – 21:30

via ZeroHedge News https://ift.tt/QHYb2y0 Tyler Durden