US Durable Goods Orders Disappointedly Flat In July As Defense Spending Slumps

After surging in June, US durable goods order growth was expected to slow in July (preliminary data) but it notably disappointed with no change from June (vs +0.8% MoM expected), which was revised up from +2.0% MoM to +2.2% MoM. That is the weakest print for durable goods orders since February and YoY growth slowed to just 9.4%

Source: Bloomberg

Ex-Transports, durable goods orders rose 0.3% MoM (better than the +0.2% expected)

The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, rose 0.4% after an upwardly revised 0.9% advance.

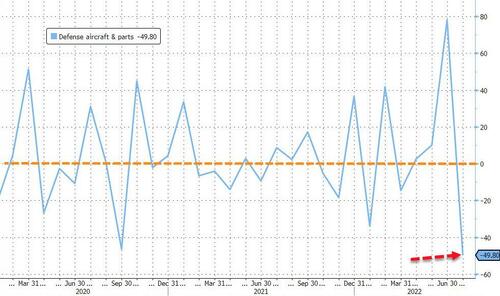

Bookings for defense aircraft and parts plunged nearly 50% – dragging down the overall durable goods measure – the biggest drop since Nov 2019…

Source: Bloomberg

Capital Goods New Orders Nondefense Ex Aircraft & Parts – a proxy for capital expenditure – was up solidly in the early July data (+0.4% MoM vs +0.3% MoM expected)

Of course, all of this data is nominal – not adjusted for inflation – so adjust your euphoria at the ‘economic’ strength accordingly.

Tyler Durden

Wed, 08/24/2022 – 08:36

via ZeroHedge News https://ift.tt/SuC3gJj Tyler Durden