WTI Slides Despite US Crude Production Cut, Gasoline Demand Tumbles

Oil prices have extended gains this morning, after last night’s API-reported crude draw and yesterday’s OPEC+ headlines.

“The stakes are very high and will test European resolve for inflicting pain on Russia at the cost of their economy,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Management.

“Buyers of Russian crude are playing the game to get the cheapest crude without drawing the ire of the US and Europe.”

The potential revival of a nuclear deal with Iran, which could lead to a surge in exports from the OPEC producer, had weighed on the market recently. A senior US House Republican demanded that Congress be given a chance to review any agreement as Tehran and Western powers inch toward an accord.

“A nuclear deal with Iran would likely mean only modest increases to global supply — under 200,000 barrels — over the next 12 months. But demand may fall sharply if emerging markets, especially China, face extended economic pressure.”

Will the official data confirm API’s bullish view.

API

-

Crude -5.632mm (-3.2mm exp)

-

Cushing +679k

-

Gasoline +268k

-

Distillates +1.05mm

DOE

-

Crude -3.28mm (-3.2mm exp)

-

Cushing +426k

-

Gasoline -27k

-

Distillates -662k

The official data confirmed API’s crude draw – slightly bigger than expected – but it also showed draws in products (API showed builds). Stocks at the Cushing hub rose for the 8th straight week…

Source: Bloomberg

Last week saw the biggest ever weekly draw from the Strategic Petroleum Reserve, at 8.1 million barrels. Adding that to the headline draw in commercial crude stockpiles, total nationwide crude inventories (including commercial stockpiles and oil held in the SPR) fell by 11.4 million barrels in the week to August 19. That’s the biggest drop in total nationwide crude stockpiles since April.

Source: Bloomberg

US Crude Production slipped lower for the 2nd straight week…

Source: Bloomberg

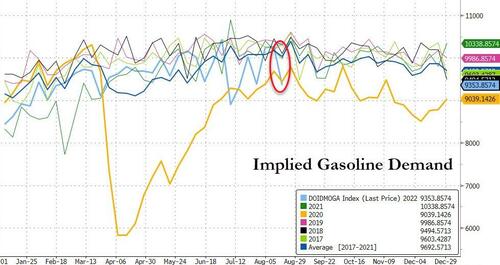

Bloomberg reports that gasoline demand on a weekly basis dropped off sharply, continuing a streak of higher-than-usual volatility. The four-week demand rolling basis fell by 2.24% as well to 8.86m b/d, barely above the same time in 2020.

WTI was hovering just above $94 ahead of the official data and slipped lower…

Bear in mind that the recent rally in natural-gas prices in Europe may encourage more companies to replace gas with diesel, coal and fuel oil in power generation as we approach winter in the Northern Hemisphere. Natural gas now costs about $450 per barrel of oil equivalent, compared to $100 for a barrel of benchmark Brent crude.

Source: Bloomberg

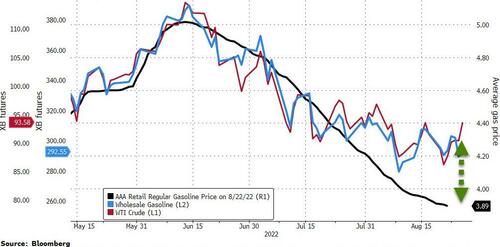

Finally, we note that in the US, gasoline prices are on their longest run of declines since 2015, potentially easing some of the inflationary pressures on the country’s economy. However, that slide may soon come to an end as wholesale gasoline and crude prices have decoupled higher…

Source: Bloomberg

US diesel prices at the pump rose overnight, snapping the longest losing streak (60 days) in two years as farmers stocked up on the fuel used to harvest crops, competing with truckers for a shrinking pool of supplies

Tyler Durden

Wed, 08/24/2022 – 10:34

via ZeroHedge News https://ift.tt/hkHx9UI Tyler Durden