Peter Schiff: Somebody Has To Pay For Student Loan Forgiveness

President Biden is expected to announce student loan forgiveness on Wednesday (Aug. 24). The plan will reportedly cancel $10,000 in student loan debt for anybody making less than $125,000 per year.

A lot of people think this is like waving a magic wand — poof — the debt is gone. But somebody has to pay and that somebody is the American taxpayer.

Nothing the government does is free. Ultimately, student loan debt forgiveness will add to the already massive budget deficit. That means Uncle Sam will have to borrow more money that taxpayers will have to repay, either in higher taxes or the inflation tax.

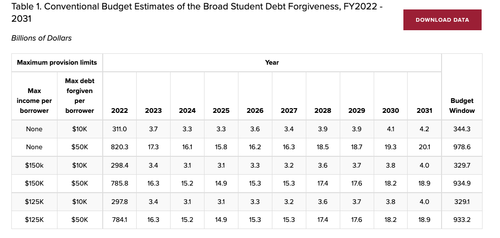

According to the budgetary model created by the Wharton Business School at the University of Pennsylvania, student loan forgiveness will cost between $300 billion and $980 billion over the 10-year budget window, depending on the amount forgiven and the income caps included in the plan.

If the Biden plan includes that $125,000 income cap, the budget model estimates that a one-time maximum debt forgiveness of $10,000 per borrower will cost around $300 billion. Increasing the maximum amount forgiven to $50,000 per borrower would increase the total cost to as much as $980 billion.

The Biden administration has already canceled about $32 billion in student loan debt for more than 1.6 million Americans through programs targeting public service workers, disabled borrowers, and students who were “defrauded” by specific schools.

Student loan debt in the US totaled $1.59 trillion at the end of the second quarter. Around 43 million Americans hold student loan debt. Less than a third of those owe less than $10,000.

The Biden administration will also reportedly extend the current pause on student loan payments through the end of the year. The Trump administration put student loan payments on pause early in the pandemic. The pause has been extended multiple times and was set to end on Aug. 31

When the US government stopped defaults and allowed borrowers to pause payments due to the COVID-19 pandemic, 11.1% of student loans were 90 days or more delinquent or were in default. This didn’t include the people who were in various deferment programs and were not counted as delinquent.

Student loan forgiveness does nothing to address the underlying problem – the high cost of tuition. In fact, forgiveness will likely make the problem worse.

The widespread availability of student loans drove up college tuition in the first place. Studies have shown the influx of government-backed student loan money into the university system is directly linked to the surging cost of a college education.

As Peter Schiff pointed out in a podcast earlier this year, loan forgiveness would be like Christmas for colleges and universities. College administrators will figure, “Now we can really raise tuition because our students know they can borrow the money and they won’t ever have to pay it back.”

Schiff said it won’t likely be a one-time thing. This will create a moral hazard.

If they do it once, they’re going to do it again. Everyone is going to expect it… The moral hazard there is nobody is going to pay for college. Nobody is going to work to try to avoid going into debt because you’re an idiot. Take on the debt! It’s going to be forgiven.”

Tyler Durden

Wed, 08/24/2022 – 14:53

via ZeroHedge News https://ift.tt/r8QdlLu Tyler Durden