Why The Dollar Rally Is Blowing Itself Out

By Simon White, Bloomberg markets live commentator and reporter

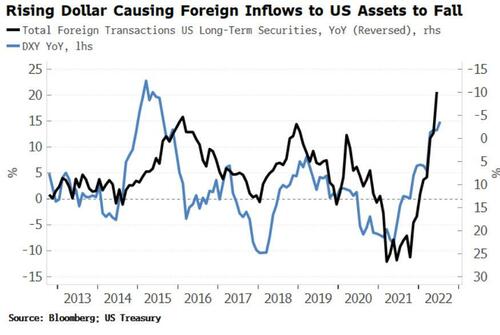

The dollar has been on a tear again recently, but a rising dollar soon causes global trade and therefore demand for dollar-denominated assets to drop, leading to a weaker USD.

As highlighted on Monday, headwinds are growing for the dollar as the real yield curve flattens. Paradoxically, this means a more hawkish Powell at this week’s Jackson Hole would add to headwinds for the US currency, after any initial kneejerk reaction.

While yields and yield curves indicate flow-driven demand for the dollar and USD assets, the level of the dollar has implications for the stock of dollar assets. A higher dollar makes it more expensive for foreign borrowers of USDs to service their debt, generating deleveraging pressure. It also makes the cost of buying new dollar assets more expensive in foreign-currency terms.

But the big driver of global capital flows is trade. Capital flows are the flipside of trade flows, and trade imbalances create capital imbalances which drive capital flows. Global trade today is beginning to falter, which means capital flows are falling.

Virtually all major commodities are traded in USD (apart from a few notable exceptions such as wool, which is traded in AUD), therefore a rising dollar eventually depresses global trade as the price of everything rises in foreign-currency terms. The dollar’s current strength is causing a slowdown in global trade.

Deleveraging pressure driven by the dollar’s strength and a slowdown in primarily USD-denominated global trade are therefore leading to a fall in foreign transactions of US assets.

From last December to June, foreign holdings of long-term US assets (stocks and bonds) has fallen from $27.3 trillion late last year to $23.5 trillion, with the DXY rising almost 13% over the same period.

Jackson Hole may be the buy-the-rumour-sell-the-fact catalyst for the dollar to head lower, especially if Powell leans hawkishly and the real yield curve flattens more. But even if not, the dollar’s baked-in strength soon threatens to be the rally’s undoing.

Tyler Durden

Wed, 08/24/2022 – 20:20

via ZeroHedge News https://ift.tt/Zn3GwL2 Tyler Durden