Lagging Demand Won’t Keep Gas Prices From Soaring Again

Authored by Alex Kimani via OilPrice.com,

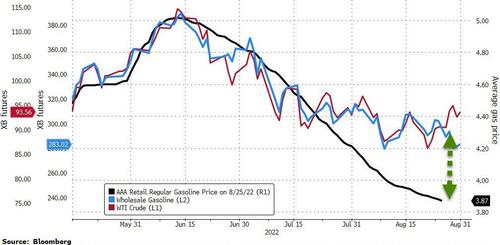

After peaking in early-May at $5.02 per gallon, U.S. national average gas prices have declined for 70 straight days to trade at $3.88 per gallon on Wednesday, marking the second-longest losing streak in two decades.

But experts are now warning that consumers should not be lulled into a false sense of confidence thinking the cuts will last. In an interview with Yahoo Finance Live, Rebecca Babin, senior energy trader at CIBC Private Wealth, has warned that two factors could put upward pressure on gas prices: reserves and sanctions.

“Even if demand dips [for gasoline], supply will dip with it, and I don’t see a significant pullback. If anything, I think that gasoline prices on the national average will probably rise from here,” Babin has said.

Babin notes the giant SPR release of oil reserves by the Biden administration is set to end in November while Europe is due to implement sanctions on Russia in December.

She argues that both factors could cut oil supply, pushing prices higher and rippling through to gasoline.

Compounding matters is the fact that this will coincide with the heating oil season in North America, meaning refiners will be more inclined to make crude into heating oil instead of gasoline.

Since the beginning of the week, crude oil prices have been paring back earlier losses after Saudi Oil Minister Prince Abdulaziz bin Salman said the current bear market may require OPEC+ to tighten production because futures prices do not reflect underlying fundamentals of supply and demand.

“Extreme volatility and lack of liquidity in the futures market are moving prices in ways that do not conform to normal supply and demand factors, which may spark OPEC+ to take action,’’ the Saudi oil chief warned.

Bloomberg Opinion columnist Javier Blas says $100 oil just got a lot more likely following bin Salman’s comments: “Call it a price floor, the return of the OPEC+ put or, simply, a line in the sand. Whatever its name, Riyadh’s intervention indicates a preference to keep oil near $100.”

Tyler Durden

Fri, 08/26/2022 – 11:41

via ZeroHedge News https://ift.tt/5IktL30 Tyler Durden