‘Pain Is Coming’: Pro-Powell-Pivot Positioning Pummeled As Hawks Hammer Markets

“Don’t Fight The Fed!”

Powell said he’s prepared to cause some pain to bring down inflation:

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.“

Ian Shepherdson, chief economist, Pantheon Macroeconomics:

“Chair Powell’s speech forcefully reiterated the Fed’s intention to tighten policy enough to bring inflation down to target and then keep it here, acknowledging that this likely means ‘…some pain to households and businesses.’ The Fed appears frustrated by market expectations — which we have never shared — of easing next year.

Here’s why Powell was pissed off – thanks to the rip higher in stocks, financial conditions are now easier than when The Fed started tightening!!

Source: Bloomberg

However, Americans face an opposing force:

-

Powell: pain is coming; we are going to crush demand.

-

Biden: midterms are coming, we are going to boost demand, discharge debt and come up with stimmies and new definitions

Short-Term Interest-Rates (STIRs) never bought the ‘pivot’ bullshit and both rate-hike expectations and rate-cut expectations have been pushing hawkishly for two weeks…

Source: Bloomberg

September rate-hike odds shifted hawkishly from pre-Powell levels to around a 66% chance of 75bps, 33% of 50bps…

Source: Bloomberg

So the sudden realization among Wall Street’s best and brightest that there is no ‘Powell Pivot’ and never was, sparked mayhem across markets.

Stocks were clubbed like a baby seal today. Nasdaq suffered the biggest drop -4% since early-June (thanks in part to an ugly day from AAPL on anti-trust headlines). The S&P was down 3%…

On the week, Nasdaq was the ugliest horse in the glue factory, dropping almost 5% (worst week since June)…

Today’s hammering sent The Dow, S&P and almost the Nasdaq down to their 100DMAs…

The Dow dropped 1000 points intraday today, back below 33k…

“Most Shorted” stocks were hammered today, erasing all the week’s gains…

Source: Bloomberg

Energy was the only sector to end the week green while Tech was wrecked…

Source: Bloomberg

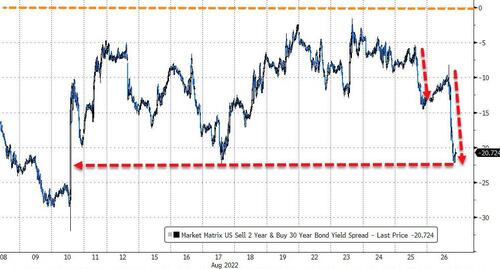

Treasuries were very mixed on the week with the long-end dramatically outperforming (2Y +16bps, 30Y u-1bp)…

Source: Bloomberg

Which sparked dramatic flattening (further inversion) in the yield curve…

Source: Bloomberg

The Dollar ripped higher on Powell’s hawkishness today, back into the green for the week…

Source: Bloomberg

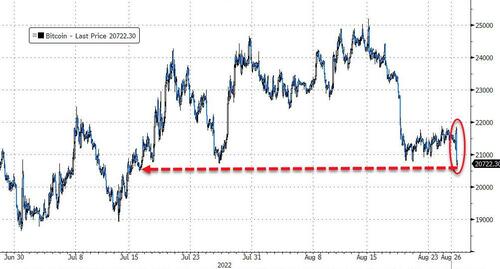

Cryptos were slammed after Powell’s hawkish comments with Bitcoin tanking back below $21,000 to its lowest in six weeks…

Source: Bloomberg

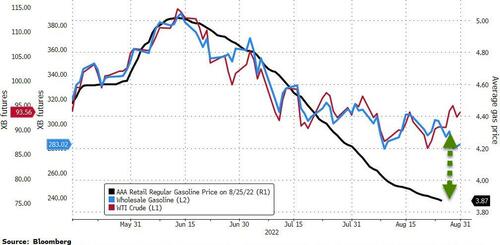

Oil prices ended the week higher amid OPEC headlines on supply cuts which dominated any recessionary demand threats…

The rise in crude (and wholesale gasoline) suggest the charge lower in pump prices could be set to stall very soon…

Source: Bloomberg

Gold ended the week lower, back around $1750, after being monkeyhammered lower today on Powell’s hawkishness…

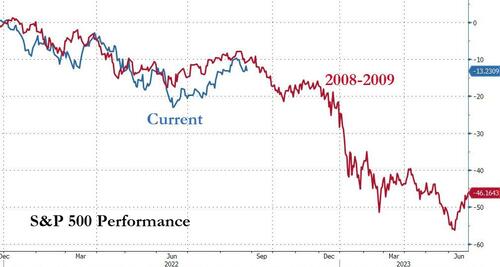

Finally, in case you were wondering where this ends. Short-term, the ‘Powell-Pivot’ rally will go (notice that STIRs never fell for the pivot bullshit)…

Source: Bloomberg

And then this?

Source: Bloomberg

Wondering what the catalyst could be? There is $155BN ($36BN in S&P) of CTA selling over the coming month in a down tape..

Will that be enough “pain” for Powell to pivot?

Tyler Durden

Fri, 08/26/2022 – 16:00

via ZeroHedge News https://ift.tt/QFvGc6I Tyler Durden