Wave Of European Ammonia Plant Closures To Exacerbate Food Crisis

A wave of European ammonia-plant shutdowns due to soaring natural gas prices has resulted in a devastating fertilizer crunch, worsening by the week, with as much as 70% of production offline.

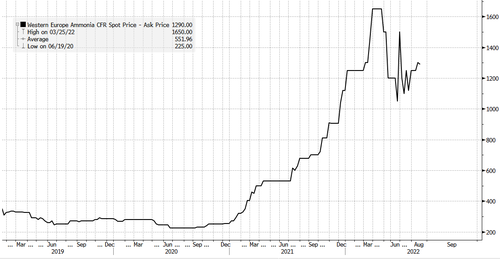

“Ammonia prices, though volatile, rose 15% in 3Q and could climb higher as Europe’s record gas prices curtail output and send ammonia producers to the global market in search of replacement supplies to run upgrade facilities — with winter still around the corner,” Bloomberg Intelligence’s Alexis Maxwell wrote in a note.

As of Friday, 70% of capacity is offline across the continent, according to Fertilizers Europe, representing top regional producers.

“The current crisis begs for a swift and decisive action from EU and national policymakers for both energy and fertilizer market,” Jacob Hansen, director general of Fertilizers Europe, said in a statement.

Producers from Norway’s Yara International ASA to CF Industries to Borealis AG recently reduced or halted production because European NatGas prices hit a record high of 343 euros per megawatt hour, making it uneconomical to operate.

“We confirm we are reducing and stopping production of some fertilizer plants in the different EU sites and this for economic reasons,” a spokesperson for Borealis AG said.

Europe’s benchmark NatGas price soared nearly a third this week as Russian supplies to Europe via Nord Stream 1 pipeline have been reduced to 20% over the summer and face a temporary halt on Aug. 31 for three days.

The region’s fertilizer industry association warned the energy crisis is rippling across many industries and could heavily impact the food industry.

“We are extremely concerned that as prices of natural gas keep increasing, more plants in Europe will be forced to close.

“This will switch the EU from being a key exporter to an importer, putting more pressure on fertilizer prices and consequently affecting the next planting season,” said Maximo Torero, chief economist at the United Nations Food and Agriculture Organization.

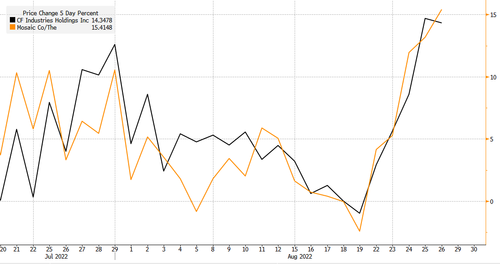

The closure of fertilizer producers across Europe lifted Mosaic and CF Industries as some of the top advancers in the S&P 500 Index on Friday, rising 16% and 15%, respectively, on the week.

Bloomberg Intelligence’s Maxwell said “cascading supply-side shocks” could keep fertilizer prices elevated well into 1H23 and may pressure farmers in the upcoming growing season, adding to even more food inflation as less fertilizer equals smaller harvests.

Remember, the world’s largest fertilizer company warned supply disruptions could extend into 2023.

The picture is becoming more apparent that Europe’s energy crisis and much of its fertilizer capacity offline will have severe consequences for the food industry in the growing season ahead — leaving some to believe a global food crisis is only just materializing.

Tyler Durden

Sun, 08/28/2022 – 08:45

via ZeroHedge News https://ift.tt/tlcS0dP Tyler Durden