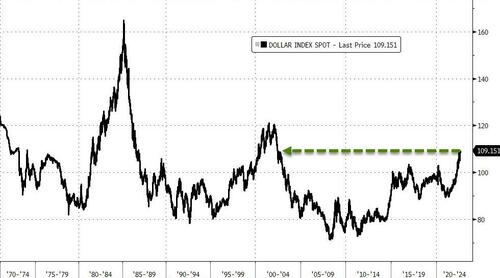

Dollar Index Surges Above COVID-Panic Highs, Gold Back Below $1700

The DXY Dollar Index has spiked to its strongest against a small basket of fiat peers since June 2002…

Source: Bloomberg

But the broader-based Bloomberg Dollar Index has now spiked above the safe-haven panic-bid highs from March 2020’s COVID lockdown crisis to hit a new record high…

Source: Bloomberg

This, combined with surging real rates, has sent gold reeling with spot now trading back below $1700…

Source: Bloomberg

Crypto and the precious metals are tracking real rates…

Source: Bloomberg

As we noted earlier, this surge comes amid the rumble of crisis in emerging markets facing dollar margin calls on their debt.

Critically, this dollar rally is a time-bomb for global markets and we humbly suggest that if this trend continues, the Powell Pivot will come not from “inflation targets hit”, but from pressure to stall devastation across the rest of the world.

But, as Ruchir Sharma recently warned, “don’t be fooled” by the recent dollar strength. The currency may look strong but its weaknesses are mounting…

Today, as in the dotcom era, the dollar appears to be benefiting from its safe-haven status, with most of the world’s markets selling off. But investors are not rushing to buy US assets. They are reducing their risk everywhere and holding the resulting cash in dollars.

This is not a vote of confidence in the US economy, and it is worth recalling that bullish analysts offered the same reason for buying tech stocks at their recent peak valuations: there is no alternative. That ended badly. Tina is never a viable investment strategy, especially not when the fundamentals are deteriorating.

So don’t be fooled by the strong dollar. The post-dollar world is coming.

And nowhere is that post-dollar world more evident that in news this morning that Russia is considering a plan to buy as much as $70 billion in yuan and other “friendly” currencies this year to slow the ruble’s surge.

Tyler Durden

Thu, 09/01/2022 – 08:58

via ZeroHedge News https://ift.tt/tZGoyxz Tyler Durden