Memo To Wall Street: The Monetary Cavalry Ain’t Coming

For the past 25 years, markets have depended on central banks to bail them out because of the delusion that “inflation had been vanquished to the dustbin of history.”

Even after the Jay Powell smackdown, we still hear talk of a “pivot,” “close to neutral,” “imminent recession,” “the lows are in,” blah, blah, blah.

It is getting close to bonus conversation time, ya’ know.

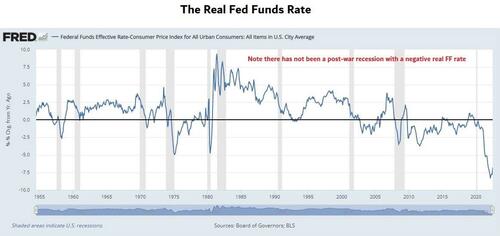

Inflation is still and will continue to run several laps ahead of the Fed for some time.

There is way too much money – loosely undefined – in the global monetary system.

We are still not confident the Fed has the backbone to back up its tough talk, and may God help the ECB.

Steven Roach gets it.

The real Fed Funds rate needs to move “10 percent higher from its lows,” which would be through a combination of lower inflation and higher nominal rates.

Go to 1:50 into the video to get the upshot.

Tyler Durden

Thu, 09/01/2022 – 12:05

via ZeroHedge News https://ift.tt/iXym7Y1 Tyler Durden