“Good News Is Bad News” Dynamic Won’t Last Much Longer

By Simon White, Bloomberg Markets Live commentator and reporter

Recent better-than-expected US data has been bad for stocks and bonds as a less accommodative Fed leads to higher yields and lower stock prices. But that dynamic might soon reverse, as leading indicators point to a significant deterioration in growth through the rest of the year.

This week jobless claims, the headline ISM and the Conference Board’s consumer confidence have all exceeded expectations. Today we will also get the latest update for employment, with last month’s data delivering a big upside surprise.

The market is treating good news as bad news, as positive economic data is leading to higher shorter and longer-term yields, and thus causing stocks to drop.

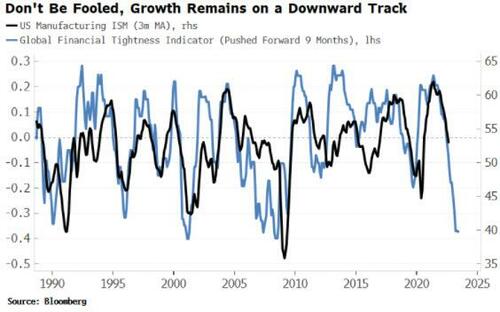

But don’t expect this to persist for much longer. Global financial conditions remain very restrictive. The Global Financial Tightness Indicator is very low, which anticipates the downward trend in the manufacturing ISM — a proxy for growth overall — will continue apace.

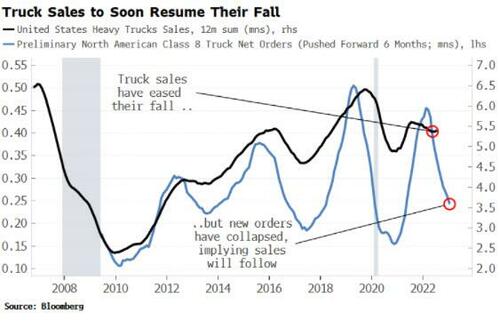

Truck sales are an excellent leading barometer of economic activity. Almost two-thirds of the dollar value of North American freight is moved by trucks. The fall in truck sales has been leveling off, but is likely to resume given the slump in truck new orders. This presages weaker economic activity ahead in the US.

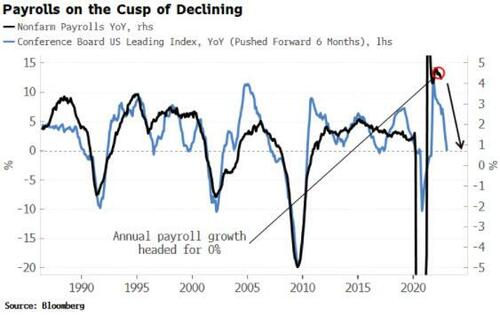

Payrolls is out later today, with last month’s data showing a huge upside surprise. But the same goes here: data should soon resume a downward track. The Conference Board’s Leading Index anticipates the y/y payroll growth will be flat by early next year, from over 4% currently.

Any recent let-up in economic data should be seen as a pause rather than a reprieve. The interim move lower in yields should soon re-assert itself, taking some pressure off equities.

However, the bigger picture is that bonds face more risk to the downside than the upside as it becomes apparent inflation is entrenched. Further, while liquidity remains poor and global financial conditions tight, stocks remain mired in a bear market, meaning a sustainable rally is off the cards, steep sell-offs are an ongoing risk, and the VIX should stay elevated.

Tyler Durden

Fri, 09/02/2022 – 07:40

via ZeroHedge News https://ift.tt/6YNIqFW Tyler Durden