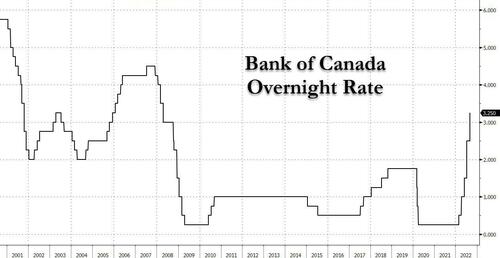

Bank of Canada Hikes 75bps As Expected, Warns Rates “Will Need To Rise Further” Given Inflation

As expected, and ahead of a potential 75bps rate hike by the ECB tomorrow and the Fed later this month, moments ago the Bank of Canada hiked rates by 75bps as expected, lifting the overnight rate to 3.25% – the highest policy rate among major advanced economies – with the fourth consecutive outsized (more than 25bps) rate hike, and warning that “given the outlook for inflation, the Governing Council still judges that the policy interest rate will need to rise further.”

Here are some more highlights from the BOC statement:

RATES:

- Given the outlook for inflation, the Governing Council still judges that the policy interest rate will need to rise further.

- As the effects of tighter monetary policy work through the economy, we will be assessing how much higher interest rates need to go to return inflation to target. The Governing Council remains resolute in its commitment to price stability and will continue to take action as required to achieve the 2% inflation target.

QT:

- Quantitative tightening is complementing increases in the policy rate

INFLATION:

- Surveys suggest that short-term inflation expectations remain high. The longer this continues, the greater the risk that elevated inflation becomes entrenched.

LABOR MARKET:

- Canadian economy continues to operate in excess demand and labour markets remain tight

HOUSING MARKET:

- With higher mortgage rates, the housing market is pulling back as anticipated, following unsustainable growth during the pandemic.

OUTLOOK:

- The global and Canadian economies are evolving broadly in line with the Bank’s July projection

- Continues to expect the economy to moderate in the second half of this year, as global demand weakens and tighter monetary policy here in Canada begins to bring demand more in line with supply.

And the statement redline, courtesy of Newsquawk:

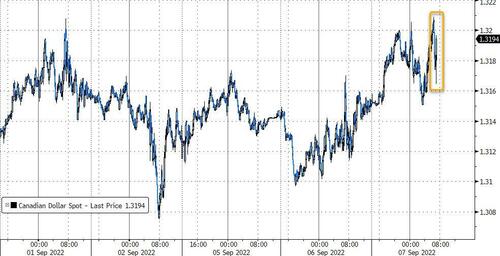

Since the announcement was largely as expected, the market reaction was muted, with little movement in the loonie…

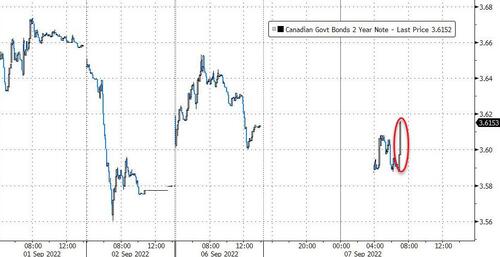

… and a modest rise in yields.

Tyler Durden

Wed, 09/07/2022 – 10:11

via ZeroHedge News https://ift.tt/f1BQEF3 Tyler Durden