Lack Of Real Market Stress Seen As Bad Omen For Stocks

By Michael Msika, Bloomberg markets live commentator and reporter

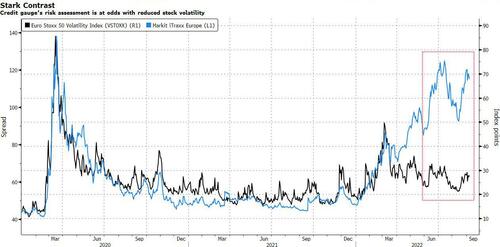

While European stocks have sold off since the middle of August, one thing has been missing: market anxiety in the form of a spike in volatility indicators.

The Euro Stoxx 50 volatility index, also known as the V2X, remains below levels seen earlier this year, and given that bull market rallies typically follow a period of extreme stress, that may be a worrying sign for stock bulls. It’s also a pointer toward hedging opportunities as portfolio protection remains relatively cheap.

According to Bank of America analysts including Riddhi Prasad, there’s value in owning equity volatility given the “disconnect” with credit spreads that have widened to reflect the growing risk of an energy crunch, inflation and rising interest rates driving economies into recession.

In terms of hedging, investors are being drawn toward the DAX Index, given Germany’s high exposure to gas shortages and the benchmark’s 40% weighting in energy-intensive sectors such as industrials, autos and chemicals.

Patrick Bonouvrie, head of European equity index derivatives trading at Optiver, says activity in DAX options indicates there’s brisk demand to hedge against the risk of a prolonged shutdown of Russia’s main gas pipeline to Europe.

“In particular, DAX options one to three months out with strikes around 10% lower than current levels are trading near all-time highs relative to similar options on the Euro Stoxx 50 Index,” Bonouvrie says. Next week’s September options expiry could be eventful after some big index moves in the last quarter, giving traders more to do to rebalance positions and hedges, he says.

Overall sentiment toward European stocks remains weak, especially with plenty of upcoming risk events in September, including Thursday’s ECB rate decision. “This could prove to be the calm before the storm,” says ActivTrades technical analyst Pierre Veyret.

The call is echoed by Zurich Insurance Chief Market Strategist Guy Miller, who says it would be unusual for equities to bottom before the US officially enters recession.

He sees stocks retesting the lows of mid-June, saying that “the most anticipated recession in the US and Europe that we’ve ever had is not totally reflected in markets.”

According to Sam Stovall, chief investment strategist at CFRA Research, markets typically bottom with “a spike in volatility from panic selling,” something that so far has been absent. “It would add more certainty to the conclusion of this bear market if we did get a spike,” he says.

Tyler Durden

Wed, 09/07/2022 – 11:40

via ZeroHedge News https://ift.tt/ry70AwZ Tyler Durden