Futures Flat Ahead Of ECB, Powell Doubleheader

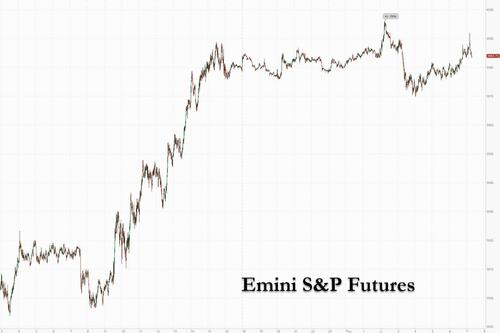

US stock futures traded flat, erasing modest earlier gains and losses in the overnight session as investors remained cautious while watching for signs of a softening in the Federal Reserve’s policy. Nasdaq 100 futures were little changed by 7:15 a.m. in New York after earlier gaining as much as 0.6%. S&P 500 contracts were up less than 0.1%, at 3,983.75 after hitting 3,996 overnight and following small gains in Estoxx50. The underlying index notched its biggest gain in a month on Wednesday which was sparked by yet another short squeeze, and is attempting to rebound following three straight weeks of declines that were fueled by fading bets on a Fed policy pivot and as investors braced for the impact of a potential economic contraction. Crude oil futures managed a feeble, +0.5% bounce after falling 5.7% Wednesday. The dollar reversed earlier gains helping lift the badly beaten EUR and JPY higher.

Among notable movers in premarket trading, American Eagle Outfitters slumped as much 16% after the retailer reported results for a quarter that Citigroup analysts described as “rough,” while also pausing its quarterly cash dividend. GameStop jumped as much as 12% in US premarket trading after the announcement of a partnership with cryptocurrency exchange FTX US, though the gaming company reported net sales for the second quarter that missed estimates. Here are some other notable premarket movers:

- Asana gains 18% in premarket trading after the software company boosted its revenue guidance for the full year. Separately, the company said CEO Dustin Moskovitz bought $350 million of shares in a private placement.

- Moderna (MRNA US) gains 2.2% in premarket trading after Deutsche Bank upgraded the stock to buy from hold after its “solid” second quarter earnings beat and the “welcome” late- July news of additional fall 2022 orders from the US.

- Apple (AAPL US) shares were steady in premarket trading as analysts say the biggest takeaway from the company’s product event was its pricing strategy, with the iPhone maker opting not to raise average prices for its latest smartphone and watch models.

- Keep an eye on Intel (INTC US) as the stock is started with a hold rating and $32 price target at Stifel, which cites uncertainty over the chipmaker’s turnaround strategy. Stifel also started Nvidia (NVDA US) with a hold recommendation and AMD (AMD US) with a buy rating.

- Chipmakers may also be in focus after TSMC, the world’s largest supplier of made-to-order chips, said sales rose 59% in August from a year earlier. In the US, watch equipment stocks such as Applied Materials (AMAT US), KLA (KLAC US), Lam Research (LRCX US), Entegris (ENTG US), Teradyne (TER US), and MKS Instruments (MKSI US)

Sentiment improved on Wednesday after Fed Vice Chair Lael Brainard warned that “two-sided” risks will eventually emerge from tightening monetary policy — remarks that were considered to have a more dovish tone than some other recent Fed comments. Focus on Thursday will be on a speech by Chair Jerome Powell, who is scheduled to speak just after a monetary policy decision by the European Central Bank.

Still, strategists warn that risks to a sustained rally are growing. “Sentiment is very depressed and markets are oversold,” Frederique Carrier, head of investment strategy at RBC Wealth Management, said on Bloomberg TV. “It’s possible that there is a rally, but as long as the Fed is increasing interest rates, it’s very difficult for the upside to be very strong.”

As central banks are walking a tightrope, moving sharply to tackle price pressures while remaining leery of sparking a damaging economic contraction in the process, today we get a central bank doubleheader with the ECB expected to hike rates by 75bps at 8:15am, while Jerome Powell speaks at a monetary conference at 9:10am ET. The Euro is holding around parity against the dollar ahead of the ECB, where money markets price in around 65bp of rate hikes for the meeting, with most economists expecting a 75bp rate hike. The focal point of US session after ECB is Powell participation in moderated discussion at a monetary policy conference.

“What we are seeing in Europe is very, very concerning, what is happening there is the worst energy crisis we have seen since the oil embargo in 70s,” Ryan Lemand, Securrency Capital advisor to the board, said on Bloomberg Television. “Europe will face a recession, one of the worst recessions it will have faced and I don’t think risky assets are pricing this in correctly.”

Fed officials reiterated their determination to get inflation under control. Vice Chair Lael Brainard said interest rates will need to rise to restrictive levels, while cautioning risks would become more two-sided in the future. The Fed’s Beige Book report said US economic expansion prospects were weak, while adding that price growth showed signs of decelerating.

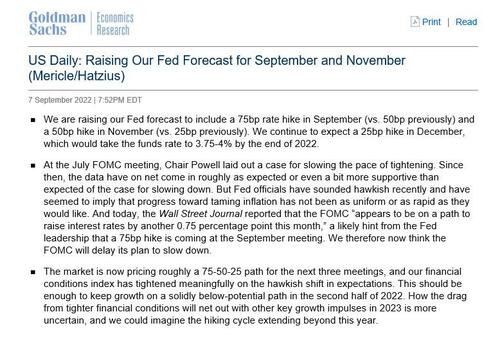

Goldman economists lifted their forecast for the pace of Fed interest rate increases, expecting the Fed to hike by 75 basis points this month and 50 basis points in November, up from previous forecasts of 50 basis points and 25 basis points respectively. They are tipping a 25 basis points move in December.

Deutsche Bank AG strategists also said that elevated “late-cycle earnings,” higher valuations and the risk of a recession limit the fundamental case for a sustained rally in US stocks. In their worst case scenario, they see the S&P 500 slumping to 3,000 points in the event of a recession — almost 25% below its latest close. However, their base case still calls for equities to rise by year end.

In Europe, the Stoxx 50 rose 0.1%, surrendering most of an initial 0.6% advance as retailers slumped after a profit warning from Primark-owner Associated British Foods Plc. The FTSE 100 outperformed peers, adding 0.4%, IBEX lags, dropping 0.2%. Insurance, banks and miners are the strongest-performing sectors. Here are the biggest European movers:

- Genus shares jump as much as 16%, the most since May 2019, after Peel Hunt upgraded the firm to buy, saying its business was “back on the front foot” after publishing FY earnings

- SBB shares jumped as much as 11% during early trading in Stockholm after signing a letter of intent to sell SEK9 billion worth of properties to an unidentified institutional investor

- European semiconductor stocks rise on Thursday, after chipmaking bellwether TSMC reported an acceleration in sales in August and Apple launched a new lineup of devices

- Ocado shares advance as much as 4.4% after being upgraded to equal-weight from underweight at Barclays, which says the risks are now “more evenly balanced” for the online grocer

- Alleima gains as much as 6.1% after Danske Bank initiated coverage of the shares with a buy recommendation, where it sees “plenty of value,” also expecting it to benefit from a cyclical recovery

- Munters shares rise as much as 7.6% after Nordea upgraded the Swedish climate and cooling manufacturer to buy on “surging order intake,” raising adjusted Ebita estimates for 2023 and 2024

- Energean shares rise as much as 15% after it increased medium-term financial targets in its 1H report and a quarterly dividend helped by what Peel Hunt called “robust operational performance”

- Atos shares tumble to the lowest level since 1993 after Goldman Sachs downgrades the French tech firm to sell from neutral, citing low visibility and a long path to recovery

- Darktrace shares plunge as much as 35%, the most on record, after M&A talks with Thoma Bravo collapsed, with the suitor not intending to make an offer for the UK cybersecurity company

- AB Foods shares drop as much as 8.6% after the Primark owner said it expects FY23 adjusted operating profit and adjusted earnings per share to be lower than this financial year

- Somfy fell as much as 13% after the French maker of windows and doors warned of a possible pullback in consumer spending after its 1H results were hurt by a slowdown in growth

Earlier in the session, Asian stocks rebounded from their lowest level in more than two years as oil prices eased and the region’s suppliers to Apple Inc. climbed after the US company unveiled new lineups for its iPhones and watches. The MSCI Asia Pacific Index rose as much as 1.3%, snapping a five-day slump, as technology and industrial shares advanced. Japan gained along with Australia and Taiwan, while China dropped as Chengdu extended a week-long lockdown in most downtown areas after Covid-19 cases increased. Asian stocks regained some footing amid a rout that still has the market on course for its fourth-straight week of losses. A two-day retreat in long-term US Treasury yields and Wednesday’s plunge in oil prices helped lift sentiment that had been hurt by concerns over a hawkish Federal Reserve.

“Markets have started to price in a less aggressive Fed, while falling oil and other commodity prices have also helped to ease profit-margin pressures for Asian companies,” Soo Hai Lim, head of Asia ex-China equities at Barings, wrote in a note. “In the longer term, we believe the performance of individual Asian markets will be driven by country-specific growth factors.” Asian stocks are down more than 4% this month amid an outflow of funds from the region. Still, some investors believe that attractive valuations will lure money back and spur a rebound. Read: ‘Massive Discount’ Has Robeco Eyeing 2003-Like Asia Stock Bounce

Japanese stocks gained, with the Topix climbing the most since July 20, after a rally in US shares and a weak yen boosted exporters. The Topix rose 2.2% to 1,957.62 at the 3pm close in Tokyo, while the Nikkei 225 advanced 2.3% to 28,065.28. Toyota Motor contributed the most to the Topix’s gain, increasing 2.3%. Out of 2,169 stocks in the index, 1,947 rose and 161 fell, while 61 were unchanged. Shares also climbed after Japanese GDP data showed the economy grew at a faster pace last quarter than earlier estimates. “Japanese stocks look attractive to dollar-denominated investors in the short term,” said Tetsuo Seshimo, portfolio manager at Saison Asset Management. “It makes it easier to buy when there’s a bit of a risk-on mood.”

Australian stocks gained most in ten weeks on RBA Lowe’s comments. The S&P/ASX 200 index rose 1.8% to close at 6,848.70, staging an afternoon rally after the RBA’s chief signaled a potential end to outsized interest rate hikes. Mining and banking shares provided the biggest boost to the benchmark. Reserve Bank Governor Philip Lowe said the case for a slower pace of tightening becomes stronger as the cash rate moves higher. The central bank delivered a fourth straight half-point hike this week to take the cash rate to 2.35%. Energy shares declined as oil fell to a near eight-month low before steadying, with investors assessing the outlook for demand as China pushes on with its Covid Zero policy and central banks tighten monetary policy. In New Zealand, the S&P/NZX 50 index rose 1.1% to 11,677.93

Indian stocks rose, snapping two sessions of declines, as a drop in crude oil prices below $90 per barrel raised optimism of lower import costs and softer consumer prices. The S&P BSE Sensex gained 1.1% to 59,688, its highest level in three weeks, while the NSE Nifty 50 Index advanced 1%. ICICI Bank contributed the most to the Sensex, which had 24 of 30 member shares ending higher. Fourteen of 19 sectoral sub-indexes compiled by BSE Ltd. advanced, led by a gauge of banks. Price of Brent crude, a major import for India, hovered around $88 per barrel, their lowest level since early February

In FX, the pound pared a decline as UK Prime Minister Liz Truss outlined plans to provide relief on rising energy costs to British households and businesses, which she said is expected to curb inflation. There has been widespread speculation that the government’s aid proposals will require further debt sales to fund it that could drive up bond yields. Short-end gilts steadied after rallying Wednesday on bets the plan would calm inflation. Other notable movers:

- A dollar gauge was steady as traders assessed comments from Federal Reserve officials on their commitment to fighting inflation.

- The euro was little changed against the dollar. On European bond markets, two-year German yields rose by around 5 basis points, while the Italian two-year yield fell by one basis point. Market pricing for the following ECB meetings picked up slightly. Just one jumbo rate hike from the European Central Bank may not cut it for euro bulls looking for a sustainable move above parity with the dollar

- The yen gave up an earlier modest advance to trade below 144 per dollar after senior Japanese officials met for the first time since June to discuss markets but said their stance remained the same

- The Australian dollar slumped and Australian sovereign bonds jumped after Reserve Bank Governor Philip Lowe signaled a potential end to outsized interest-rate increases. Australian dollar underperformed all its Group-of-10 peers

In rates, Treasuries steadied after rallying as Australia’s central bank chief signaled a potential end to outsized policy moves; they were slightly richer from belly out to the long-end of the curve with price action light ahead of ECB policy rate decision at 8:15am ET. US yields were richer by up to 2bp across belly of the curve with 2s5s, 2s10s spreads both flatter by around 2bp on the day as front-end underperforms; 10-year yields around 3.25% with bunds and gilts lagging by 3bp and 2bp in the sector after an earlier rally spurred by RBA signaling a potential end to outsized interest-rate increases, making it an outlier in G-10. Bunds yield curve bear-flattens with 2-year yield up 3.6bps to around 1.12%, underperforming USTs and gilts. Both 10-year and 2-year gilts yields trade around 3% as traders gear for details of the new economic package from Truss. Futures gained during Asia session after RBA’s dovish policy pivot, following Aussie bonds higher before fading slightly over London morning. IG dollar issuance slate includes Mitsubishi HC $500m 5Y; six borrowers priced $10b on Wednesday, follows Tuesday’s massive $33b over 44 tranches. Three-month dollar Libor +4.17bp to 3.23571%.

In commodities, oil trimmed a sharp slide this week sparked by demand risks from monetary tightening and China’s Covid travails — the megacity of Chengdu extended a weeklong lockdown in most downtown areas. Gold added $1 to ~$1,719. Most base metals trade in the green; LME aluminum rises 1.4%, outperforming peers. LME nickel lags, dropping 1.3%.

Bitcoin trades relatively flat just above USD 19,000 whilst Ethereum remains north of USD 1,600.

To the day ahead now, and the ECB policy decision will be the main highlight, along with President Lagarde’s press conference. Otherwise, we’ll also hear from Fed Chair Powell and the Fed’s Evans and Kashkari. Finally, data releases include the weekly initial jobless claims from the US.

Market Snapshot

- S&P 500 futures down 0.1% to 3,975.00

- STOXX Europe 600 little changed at 412.42

- MXAP up 1.0% to 152.06

- MXAPJ up 0.3% to 498.31

- Nikkei up 2.3% to 28,065.28

- Topix up 2.2% to 1,957.62

- Hang Seng Index down 1.0% to 18,854.62

- Shanghai Composite down 0.3% to 3,235.59

- Sensex up 0.8% to 59,518.06

- Australia S&P/ASX 200 up 1.8% to 6,848.67

- Kospi up 0.3% to 2,384.28

- German 10Y yield little changed at 1.59%

- Euro down 0.2% to $0.9984

- Gold spot down 0.1% to $1,717.37

- U.S. Dollar Index little changed at 109.81

Top Overnight News from Bloomberg

- With the greenback supercharged by expectations of higher-for- longer US interest rates, traders are struggling to pick the bottom for Asian currencies

- The European Union may need additional stimulus measures if the economic downturn worsens, according to the bloc’s economy chief, who warned that the coming winter could be “one of the worst in history”

- Investors are bracing for details of UK Prime Minister Liz Truss’s new economic package, with some warning that a new wave of debt issuance to fund the spending risks roiling debt markets and pressuring the battered pound

- Inflation in Hungary accelerated to the highest level since 1998 in August as food prices increased by almost a third, according to stats office data. Consumer prices rose an annual 15.6% in August after 13.7% growth in July

- Russian Deputy Finance Minister Timur Maksimov said the government plans to resume sales of its bonds, known as OFZs, as early as this month, Interfax reports

A more detailed look at global markets

Asia-Pacific stocks were mostly positive after the relief rally on Wall St where a lower yield environment and declines in oil prices underpinned risk appetite, although Chinese markets underperformed on COVID woes. ASX 200 was positive with tech and gold miners leading the advances across nearly all sectors aside from energy after the recent fall in oil. Nikkei 225 surged towards the 28,000 level with sentiment lifted following the larger-than-expected upward revisions to Q2 GDP. Hang Seng and Shanghai Comp underperformed their regional peers after the megacity of Chengdu extended its lockdown in most areas and Shenzhen also temporarily lowered its entry quota for Hong Kong travellers amid a resource squeeze from the ongoing outbreak.

Top Asian News

- China Health Authority encourages people to stay put during China National Day holidays (Oct 1st-7th), and to avoid travel outside their cities, via Reuters. China Transport Ministry Official said daily average travel for mid-Autumn festival expected to drop 32% Y/Y.

- RBA Governor Lowe said further rate rises will be required but they are not on a preset path and said the case for a slower pace of rate hikes becomes stronger as the level of the Cash Rate increases. Lowe also commented that demand has to grow more slowly to bring it back in line with supply and there is a significant demand element to higher inflation, while he added it is very possible that wage growth does not pick up much further and said quantitative tightening is not on the agenda.

- Japanese top currency diplomat Kanda said MoF, BoJ, and FSA meeting produced no statement this time as basic understanding on FX remains unchanged from the prior meeting. Japanese top currency diplomat Kanda agreed at the meeting on the need to watch markets with a strong sense of urgency, will not rule out any step, and are ready to take action in the FX market; BoJ and Govt are extremely worried about the recent JPY moves.

- Japan Deputy Chief Cabinet Secretary said it is watching FX moves with high sense of urgency, ready to take necessary steps if recent FX moves continue. When asked about potential intervention, said he would not comment on specific market views. Will make decisions at the appropriate time regarding both economic sentiment and inflation when asked about supplementary budget

European bourses trade with a directionless bias on ECB day after waning off best levels, and following a mixed APAC handover. European sectors are now mixed (vs mostly firmer at the open), with defensives making their way up the ranks. Stateside, US equity futures are portraying a similar tentativeness as their European counterparts, with the main contracts trading on either side of the flat mark but holding onto yesterday’s gains.

Top European News

- Primark Drags Down AB Foods Outlook as Energy Costs Rise

- Commerzbank Says Profit Target Remains Despite Energy Crisis

- Euro Holding Parity Needs Uber-Hawkish Meet: ECB Cheat Sheet

- Sampo Plans Dual Listing in Stockholm to Boost Liquidity

- Zurich Cuts Swimming Pool Temperatures to Save Energy

FX

- DXY pulled back further from Wednesday’s new y-t-d and multi-year peak before finding support just under 109.500.

- The EUR briefly popped over parity and the JPY pared more losses from its worst levels in around 24 years vs the USD.

- The Kiwi and Aussie both have cause to underperform given a deceleration in NZ manufacturing sales, bleak Australian trade data and remarks from RBA Governor Lowe.

Fixed Income

- Bunds and Gilts sit far from best levels between 145.82-144.71 and 106.84-105.75 parameters.

- Conversely, US Treasuries are treading water ahead of jobless claims and Fed chair Powell, albeit also off overnight peaks

Commodities

- WTI and Brent front-month futures trade volatile with two-way action seen in the European morning.

- JPMorgan believes OPEC+ will need to cut another 1mln BPD to stabilise the market.

- Spot gold holds onto yesterday’s gains north of USD 1,700/oz, but under the USD 1,726.79/oz high set on Tuesday

- Base metals are mostly firmer but the upside is capped by China’s COVID woes, nonetheless, 3M LME copper is supported by reports that Workers at Chile’s Escondida copper mine voted to strike over safety concerns.

- Russian Finance Minister considers it reasonable to build reserves in gold and Yuan, according to Tass.

US Event Calendar

- 08:30: Aug. Continuing Claims, est. 1.44m, prior 1.44m

- 08:30: Sept. Initial Jobless Claims, est. 235,000, prior 232,000

- 15:00: July Consumer Credit, est. $32b, prior $40.2b

Central Banks

- 09:10: Powell Speaks at Monetary Policy Conference

- 12:00: Fed’s Evans speaks on economy, policy at DuPage forum

- 14:20: Fed’s Kashkari Makes Introductory Remarks at Labor Market…

DB’s Jim Reid concludes the overnight wrap

Readers could be forgiven for losing track of the various themes in markets right now, after a volatile 24 hours that’s seen oil prices crash to their lowest level in months, the dollar reach another multi-decade high, a WSJ article that cemented expectations for another 75bps Fed hike this month, but an S&P 500 that relentlessly marched higher all day to close +1.83%. Indeed even as the likelihood rose that we could see a more rapid pace of near-term hikes, both equities and sovereign bonds rallied yesterday, since the commodity declines raised hopes that central banks could afford to slow up on rate hikes when we get to 2023. Today could put that narrative under pressure however, as there’s a decent chance we’ll see the largest ECB hike in their history, and we’re also set to hear from Fed Chair Powell in his last appearance before the next FOMC meeting.

Running through those specific moves, oil prices took a significant tumble yesterday as concerns about the strength of global demand continued to fester. Indeed, Brent crude (-5.55%) closed beneath $90/bbl for the first time since early February, before Russia’s invasion of Ukraine began, whilst WTI fell -5.69% to $81.85/bbl. Brent futures are back up c.+1% this morning in Asia. One factor behind the declines has been the continued pursuit of the zero-Covid strategy in China, and we got confirmation yesterday that Chengdu (population 21 million) would be extending its lockdown in most of the city. Even European Gas (-10.82%) fell and is now down -28.47% from the intra-day peak on Monday as the market digested the latest NS1 closure announced after the close on Friday. Since then we’re actually down -14.78%. How much of this is a demand destruction story this week and how much is a “we now have peak bad news on European gas supplies” is one to debate.

On the commodities topic, at 12:00 London time today I’ll be speaking on a client call on the outlook for commodities, China and inflation. It’s hosted by DB’s metals and mining team, and I’ll be joined by their head Liam Fitzpatrick, our chief China economist Yi Xiong, and our head of Asian property equity research, Lucia Kwong. Industrial commodities have come under heavy pressure in recent months since peaking earlier this year, so is this the end of the bullish mining and commodities trade, or a cyclical blip within a larger structural uptrend? For further details on the call and how to register, click here.

The continued decline in oil prices has been welcome news from an inflation perspective, and US gasoline prices are now down by nearly a quarter since their peak in mid-June. And in turn, the prospect that central banks don’t need to hike rates as aggressively if inflation is subdued (rightly or wrong) helped both equities and bonds to stage a strong rally over yesterday’s session. For instance, the S&P 500 (+1.84% yesterday) is now on track to end a run of three consecutive weekly declines, where only the Energy (-1.15%) sector ended in the red and every other sector gained at least +1%, a broad-based gain. Germany’s DAX (+0.35%) also recovered from its initial losses of more than -1% to move higher on the day. In the meantime, yields on 10yr Treasuries (-8.6bps), bunds (-6.1bps), OATs (-7.7bps) and BTPs (-11.4bps) all declined, which makes a change from the awful run that sovereign bonds have been on over recent weeks. As we go to print, we are another -3.6bps lower on the 10yr USTs but less than a basis point lower for 2yrs.

Indeed, when it comes to the next couple of weeks, it looks as though the series of bumper rate hikes is set to continue. There was a noticeable reaction in Fed funds futures yesterday after the WSJ’s Nick Timiraos published an article saying that Chair Powell’s pledge to tackle inflation “appears to have put the central bank on a path” to a 75bps hike. Remember it was Timiraos’ article back in June that was seen as setting the stage for the first 75bps hike of this cycle (rather than 50bps as previously expected), so his articles do carry weight in markets. That was apparent in futures, which are now pricing in +69.5bps worth of hikes for the September meeting, which is the most hawkish markets have been on September since the last meeting in July. Fed speakers continued to weigh in yesterday. Notably, Fed Vice Chair Brainard noted the Fed’s commitment to bring inflation under order, and the risks of inflation expectations moving higher, while at the same time paying heed to the two-sided risks of over-doing tightening. In short, her remarks didn’t do anything to discourage markets from pricing a larger hike in September and from pricing in lower yields out the curve. As noted, Fed Chair Powell will follow up at a conference later this morning.

Speaking of rate hikes, the focus today will be on the ECB’s latest decision, where the consensus among both market pricing and economists is that they’ll follow the Fed’s moves in June and July and similarly hike by a bumper 75bps. Our own economists at DB are also expecting a 75bps move, and if realised this would be the largest ECB hike since the formation of the single currency, so a historic move. In our economists’ view, the factors tipping the balance towards a larger hike are the upside inflation surprises (hitting a record +9.1% in August), along with the significant minority of Governing Council members publicly calling for 75bps to be on the table. You can see their full preview here.

Staying on this theme, overnight, the Reserve Bank of Australia (RBA) Governor Philip Lowe reiterated that further rate rises are required to cool inflation while signalling that the hikes could be smaller in the coming months. Comments from the Governor indicated that he is hopeful that the central bank can navigate the narrow path to a soft landing despite badly misreading the growing inflation crisis. Aussie yields are around -15bps lower across the curve with two-thirds of the move coming after Lowe’s speech. So a big reaction.

Another focus today will be the UK once again, as new PM Truss is set to announce the government’s plan on energy bills in the House of Commons. According to media reports, that will involve bills being frozen around their current levels, rather than rising in October in line with the increase in the energy price cap. However, there was a tough market backdrop yesterday, as sterling fell to its weakest intraday level against the US Dollar since 1985, hitting $1.1406 at one point before recovering to end the day at $1.1533. To be fair, a good chunk of sterling’s recent weakness has been down to dollar strength, with the dollar index currently up by +14.72% YTD, leaving it on track for its biggest annual gain since 1981, when it strengthened +15.8%. But when it came to yesterday, it was certainly a story of sterling weakness, as it fell -0.89% against the Euro too.

Asian equity markets are mixed this morning following Wall Street’s solid rebound overnight. As I type, the Nikkei (+2.05%) is leading gains across the region with the Kospi (+0.55%) also trading in positive territory. Over in mainland China, stocks are slightly down with the Shanghai Composite (-0.08%) and CSI (-0.04%) both struggling for direction on the extension of a lockdown in the city of Chengdu while the Hang Seng (-0.53%) is slipping in early trade. US stock futures are little changed with contracts on the S&P 500 (+0.06%) and NASDAQ 100 (+0.09%) marginally higher after yesterday’s rally.

Early this morning, the final estimate of Japan’s GDP showed that the economy expanded an annualised +3.5% in the second quarter (+2.9% expected) up from the initial reading of +2.2% growth as the removal of local Covid-19 restrictions boosted consumer and business spending. Separately, Australia recorded a record drop in its trade surplus, narrowing to A$8.7 bn in July from A$17.7 bn a month before mainly due to declining iron ore and coal exports. At the same time, exports in July declined -10.0% (-8.0% expected) from the month before while imports rose +5%.

Back to yesterday and the theme of hawkish central banks continued (notwithstanding the Aussie news this morning), as the Bank of Canada hiked by 75bps, whilst outlining their view that “the policy interest rate will need to rise further.” Meanwhile on the data side, we heard that the Euro Area economy grew faster than previously thought in Q2, with a +0.8% expansion (vs. +0.6% previous estimate). Finally, German industrial production in July contracted by a smaller-than-expected -0.3% (vs. -0.6% expected).

To the day ahead now, and the ECB policy decision will be the main highlight, along with President Lagarde’s press conference. Otherwise, we’ll also hear from Fed Chair Powell and the Fed’s Evans and Kashkari. Finally, data releases include the weekly initial jobless claims from the US.

Tyler Durden

Thu, 09/08/2022 – 08:01

via ZeroHedge News https://ift.tt/jngweqc Tyler Durden