Blain: Forget The ‘Dead Cat Bounce’, It’s All About Inflation & The Dollar

Authored by Bill Blain via MorningPorridge.com,

“It’s either the devil or the deep blue sea?”

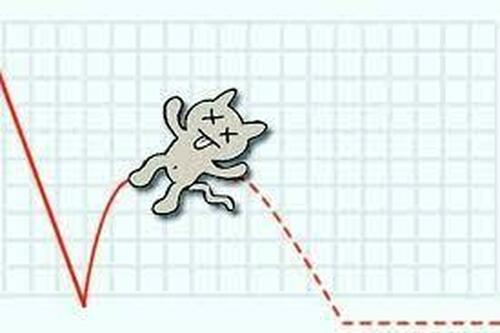

There is nothing like a dead cat bounce to cheer up the already doomed, but the real issues are inflation and dollar strength. Both can be addressed, and the treatment will hurt. Smile and get used to it.

So much to unpack about markets this morning – so apologies its late and it’s going to be short as lots of stuff going on!

There is nothing like a good old fashioned dead cat bounce – like yesterday’s green stock market! The shorts were squeezed, and half-a-dozen market talking heads declared – it’s time to buy again! It’s probably not… One swallow less does not an autumn make.

Even the ECB is on the shock and awe interest rate rising path – so the fight against inflation is very real. Unfortunately, there is the law of consequences – higher rates will go down like a kick in the head across struggling European economies, stirring up political unrest, getting populists elected and reopening the prospect of a full-blooded Euro-sovereign crisis – again. (Got some ideas on that – and it could be a great opportunity to be a contrarian!)

Interest rates are rising, yet the market is still – foolishly – taking the perspective global central banks are probably close to done. I would like a quarter of whatever they’ve been smoking – when inflation was last in double digits like today, during the 1970s, the Fed (under Arthur Burns) thought it could address inflation with gradual interest rate hikes – achieving nothing. It wasn’t till Paul Volker applied a dramatic series of big hikes – 1000 basis points in matter of months – that inflation got the message and finally abated.

Yesterday morning I had a cup of coffee with a political chum close to the Mother of Parliaments. She was trying to persuade me to give Liz Truss some slack, time to settle into her new job – and even give her some credit for the coming energy bailout package. My chum suggested its not sterling weakness, but dollar strength I should be blaming for the apparent unravel going on across all Western Economies. It’s not just sterling that’s crashing. Yen and the Euro are in a similar spot.

The “inflation problem” is this global inflation pandemic has not been triggered by money supply, wages outpacing supply, or any of the other monetarist reasons conventionally unpinning inflation.

It was triggered by an exogenous energy shock and war.

The dollar problem is… different. Its strong on the back of the growing sense of global crisis and uncertainty. At some point the Fed will realise that’s not a good thing. (Dollar strength is contributing to the expectation interest rate rises will be muted, to keep dollar strength down.)

Although inflation was triggered by the war, the fact all the endogenous inflationary firewood to blevy into a price-stability conflagration was lying around ready to spontaneously ignite is important: the money printing done by central banks through the decade of monetary experimentation (via NIRP and QE) didn’t find its way into the real economy because it was immediately invested in financial assets (stocks and bonds.) Inflation is now apparent as more and more of that money in financial assets now seeps into the real economy via real assets like property.

That’s why this inflation pandemic still has damage to do – everyone is talking wages, social unrest and a housing shock in the west, but it’s not happened yet. We are still seeing buyers clambering onto the market, thinking houses are an inflation hedge, and rates wont go much higher. The same is true against depreciating assets like car and boat loans – boat dealers tell me order books are buoyant because folk believe these bad times will be short-lived.

Reality takes time to establish itself. How can we have a consumer cost-of-living crisis, yet consumers taking out more debt – unless they believe rates are set to revert lower? And that wont happen till inflation is licked, and energy prices stabilise. And currencies stabilise – a major source of imported inflation.

The crisis in Europe is made worse because of imported dollar strength driving inflation. It’s even more damaging for the UK as we’re no longer part of the single trading block – and sterling now looks the weakest link. UK Prices are going to remain more volatile – no matter what government tells us about UK energy security. On its own, sterling is vulnerable. Euro is stronger because it’s a pack economy.

The current market is all about inflation. The Fed has given enough clues about how much more its prepared to raise rates. The problem for the Fed is they need to aggressively hike rates to stem inflation, but that will only make the dollar stronger. The ECB and BOE have little choice to follow – if they don’t the currencies weaken further. If they do, their economies weaken further. My political chum accepted that is something of a conundrum.

The ever excellent John Authers on Bloomberg addresses the question of dollar strength this morning: Nothing Will Stop the Dollar from Getting Stronger.

Apples and Apples…

Among the many stocks to prosper yesterday was Apple – showing off a new iPhone 14 and new watch. Fantastic. Tremendous..

Not sure I need this years must-have Apple gimmick: a Satellite SOS System – already got a host of stuff that does that on the boat. Not sure I need information on whether I am ovulating at my age (and gender) either…

My Apple watch stopped working months ago, and Apple shrugged their shoulders and told me it was out of warranty. My iPhone 12 is working fine. I am trying to save some money to help my kids. I am being shouted at by Mrs Blain to switch off lights and save energy. I am not going to rush out and buy one – especially since they are priced at a sub-dollar parity in the UK – it costs more pounds than dollars: £1199 vs $1099! Why? Sounds like a FROAD to UK consumers.

Since my iWatch doesn’t work, I am looking for a health wearable to replace it. Any suggestions?

And that should terrify Apple executives.

If Bill Blain, a self-confessed Apple-holic is about to shake his addiction to New Bright Shinny Things – then how many others are thinking the same? I will have mild Cold Turkey that my Air-pods aren’t the latest version, and my phone is 2 years and 1 day old. But my company provided home computer system is as good as my iMac, and my company laptop does everything my IMac Pro did.

I have sold my Apple position – months ago. It was my largest holding at one point. Big companies stay big – for a while, till the next thing comes along. It’s just a brand.

Tyler Durden

Thu, 09/08/2022 – 11:15

via ZeroHedge News https://ift.tt/Eiuq4As Tyler Durden