Deflation, Depression, & Trader Of The Year Awards

Authored by Peter Tchir via AcademySecurities.com,

Maybe it was because the Emmy Awards were presented last week (did you know that Academy’s President, Phil McConkey, in addition to having a Super Bowl ring, has awards for his TV broadcasting?). Or maybe I just couldn’t bear writing about the same arguments as we head into this week’s FOMC meeting. Instead, I decided that we could give out some “Trader of the Year” Awards.

First, the Fed

Here is my latest take on markets, the economy, and the upcoming FOMC meeting:

-

The economy is fragile and we could see a deep (nominal) recession this year. Key drivers would be the inventory build, housing, autos, and wealth destruction as described in more detail in Wake Me Up When September Ends.

-

By the end of this year, deflation will be as big of a concern as inflation.

Nothing in the data (CPI) that came out this week changed my core view. If anything, some of the data and the comments from the FedEx CEO make me more convinced that we are in a precarious situation.

I don’t envy the Fed’s job as the Economy is Complex, but before getting to the awards, I feel obligated to give my opinion on the Fed Meeting:

-

75 bps is almost certain. 100 bps could be done in a “shock and awe” type of moment, but that seems unlikely. Maybe the Fed will realize that they’ve pushed too hard already and go with 50 bps, but that also seems unlikely (so, we are left with 75 bps). In any event, the size of the hike is the least interesting part of the meeting.

-

Some “nod” to wait and see. Whether he will be hammering home data dependence, answering questions about the lag effects of policy, or addressing more concerns from people about the state of the economy, we could see Powell back down from the tough talk he and the rest of the Fed and central bankers across the globe have been giving us. It cannot be easy to tell an entire nation that you are prepared to sacrifice their jobs in the name of “inflation fighting” when many believe that inflation has peaked. Maybe not a pivot, but a little relief for the stock market bulls.

-

Reshaping Quantitative Tightening. The mortgage market is in disarray (yields keep moving higher as Treasury yields go higher and spreads widen). The Fed does not have enough runoff in their mortgage portfolio to accomplish their stated QT goals and selling bonds into the open market seems problematic. So maybe we could see total QT remain the same, but the emphasis will be shifted to achieving this goal by using Treasuries that are maturing rather than mortgages. It seems like they’ve hinted at some issues and this would be a rational resolution as it would bring the balance sheet down with the least amount of impact to markets. This could be good for mortgages and maybe even for stocks, at least briefly.

Anyways, let’s get to the fun stuff and hand out some hardware.

Top Tick Award – Railway Workers

The railway unions may have top ticked this market beautifully. Shipping costs are going down. There are parts of the freight business experiencing some weakness as companies deal with overbuilt inventories and slowing consumer demand (I believe that retail sales are relatively weak considering last month’s revisions, the ex-auto numbers, and the control group). Did these “insiders” see the writing on the wall and decide that now was a good time to negotiate?

They also managed to capture the moment when people still believe that supply chains are in serious disarray (despite that clearing up).

Finally, the government seemed to be involved in many aspects of this (incumbents don’t like national strikes ahead of elections) and the government seems happy to spend taxpayer money like it isn’t their own (because, I guess, it isn’t).

While many pointed to this deal as a sign of raging inflation, they managed to top tick the market and deserve praise for their savvy trading!

Ounce of Prevention Award – Investment Grade Bond Issuers

According to the Bloomberg league tables, IG bond issuance is 11% below last year’s pace.

I made a quick attempt to scrub the data and it seems that the percentage of bonds issued with maturities longer than 5 years dropped significantly this year compared to last year.

It is almost like corporate America decided to lock in low rates for a long time so they wouldn’t be buffeted by rising rates!

Bravo! A well done and impressive accomplishment, though those of us on the underwriting side (Academy, based on my settings in the Bloomberg league tables for all banks, shows up as #28 in IG) will have our work cut out for us for the rest of this year and next!

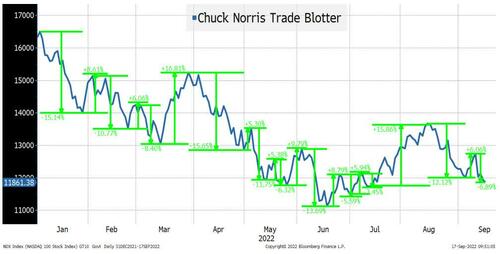

Dos Equis Award – Chuck Norris

The Dos Equis “Most Interesting Man in the World Award” goes to Chuck Norris, because presumably he has timed this market perfectly! While many of us have found this market difficult, Chuck Norris captured every major turn to generate 187% YTD returns, with an almost infinite Sharpe ratio.

The number of 5% moves in the Nasdaq 100 seems almost insane. The rapid shifts back and forth have become exhausting. I don’t know how Chuck Norris does it, but there was a lot of money to be made by those (especially those on Twitter) who claimed to get every move right.

Look for more of the same extreme volatility as we head into year end and some try to protect their years, others try to slay it, and some just try to figure out a way to stay alive and do it again next year.

Rocky Balboa Award – Stagflation

Stagflation seems like such a weird state. High inflation but no growth. It is easy to see how it could happen to a small country (i.e., one that isn’t the reserve currency), one that isn’t (in theory) energy independent, or one that doesn’t have much influence. It seems so theoretical, but just like Rocky, this concept won’t go down and stay down.

I do not believe in stagflation (I think that we will see inflation fall off a cliff, along with economic growth), but I cannot discount it. Certainly, this week it felt like stagflation was coming out of its corner, ready to battle away in round 12 with renewed energy.

Oscar the Grouch Award – Most Economic Data

I wanted to give myself this award, but that might have raised some eyebrows on the validity of the awards, so I will give the garbage in, garbage out award to “most of the economic data we currently get.” I find it interesting that ADP, which should have some solid real-time data, revamped its methodology (which could be a step in the right direction). I also included CPI, which I’ve already discussed ad nauseum in previous reports (ditto for jobs data). We live in a world where there is so much real time/accurate data at our fingertips, yet so much of the data that we base business and investment decisions on is of mediocre quality. I think that the entities collecting this data do as good of a job as they can with the resources they are given. However, I’d like to see more changes because we are still trying to keep the data continuous and have the apparent need to seasonally adjust everything so the neophytes don’t panic. Too often the data doesn’t reflect what we “know,” yet we are stuck dealing with the data as presented (at least until it is revised).

I will never forget how part of the Great Financial Crisis felt like a recession, but we were only told by the powers that be 3 months or so after it felt like we were in a recession that we’d actually been in a recession for 3 months. Déjà vu for this year?

The Trinity Award – Stop Loss, Gamma, and Beta

There was a stage in my life when this would have been Jim, Jack, and Johnny. But now, love ‘em or hate ‘em, stop loss and gamma are a powerful combination. With liquidity being low in so many things (from small cap stocks to individual bonds), more investors are turning to beta products (indices, futures, ETFs, portfolio trades, etc.) to manage their risk – giving gamma and stop loss even more power. Without stop loss and gamma, the meme stock thing wouldn’t exist, but it has gone so far beyond that and all we can do is try to be small and nimble because if (when) you get caught in the jaws of stop loss, gamma, and beta, it doesn’t end without some pain.

Only a Flesh Wound Award – Cryptocurrency

You can really admire the Monty Python, “it’s only a flesh wound” attitude of many of the biggest crypto pumpers. We’ve gone from FOMO, HODL, Diamond Hands, Have Fun Staying Poor, etc., to an entirely new level of denial. The latest I’ve seen is “well, this is the Nth time bitcoin has dropped X% and it always comes back much higher!” Say what? I’ve had some silly and even stupid investment theories but that seems like an insane thing to say about an investment. Though I do have to give crypto pumpers credit for creating the non-permanent loss accounting technique. See, if you own crypto and are second guessing the HODL philosophy by questioning which side of the trade will leave you “poor” and aren’t worried as much about being vilified as having “lettuce hands”, you must remember that only “selling” creates a permanent loss (this is true, but possibly too clever).

And yes, many of the more professional crypto players have moved on from crypto to blockchain and NFTs (tokenizing the world), which may well be the wave of the future, but I don’t think that we’ve seen the lows in crypto yet. I’ve heard that crypto yields are now less than T-bills, which figures, because I just finally understood yield farming.

Worst Performance of the Year Award – COVID

The competition for this award was staggering. Putin for his vicious behavior (and for his miserable performance acting out his vicious behavior) is a leading candidate. Terra/Luna, an $80 billion “stable” coin that went poof would also be a contender, but I don’t like piling on. German wind farms are up there (though they have a shot at redemption this winter). COP 22 gets an honorable mention, not just for the irony of how many private jets were used by guests to attend, but more for the fact that some believed the main takeaway was that COP 22 was just a forum for China to tell us what we can do with our greenhouse gases! TSLAQ had another miserable year (that is the hashtag for Tesla haters on social media), but they’ve had so many awful years in a row that they really should be left out of the discussion. The 20-year Treasury managed to outshine every other bond in terms of performance unbecoming an officer. Yes, it has been a bad year for bonds, but the U.S. Treasury 20-year sticks out like a sore thumb on any global chart of yield curves. Finally, central bankers across the globe buying bonds, injecting liquidity, keeping rates low, and repeating the word “transitory” over and over probably deserve a mention, though in hindsight, they were 2021 winners and not this year’s issue (though if they’ve tightened too much, they could be back in contention next year).

I could keep listing more contenders, but let’s get to this year’s winner – COVID (ex-China). Covid had a bad year, much to everyone’s happiness! While China still suffers from lockdowns and COVID continues to infect people across the globe, most of the world has been able to move beyond COVID. Between vaccinations, treatments, awareness, common sense, and more, we have been able to turn COVID from a nightmare into “just” a concern. Giving the worst performance of the year to COVID might be one of the happier things I’ve been able to do!

Bottom Line

Brace for more volatility and be nimble and adapt to information as it comes in.

We know that the start of this week will focus on the FOMC meeting, but we also know that by Friday the market will have identified two or three new things as the “must watch” market and economic indicators.

Thanks again for all your support and let’s plow through the rest of this year and next year (and beyond) together!

Tyler Durden

Mon, 09/19/2022 – 07:20

via ZeroHedge News https://ift.tt/1Sl2Qmz Tyler Durden