Futures, Bitcoin Crater As Yields And Dollar Surge

After a dismal week for risk assets, which saw equities drop the most since June 17, global markets and US equity futures are tumbling in another extremely illiquid session (Japan and UK are both closed, the latter for the state funeral of QE2) as the realization sparked by Fedex that the world is in a global recession, is starting to finally seep through. Add to that Wednesday’s 75bps rate hike by the Fed (which however is more than priced in by now) as well as the previously discussed start of the buyback blackout period, and CTAs and pensions becoming forced sellers with investor sentiment that can at best be described as pervasive record doom and gloom, and it becomes clear why this week could be an even bigger bloodbath for stocks.

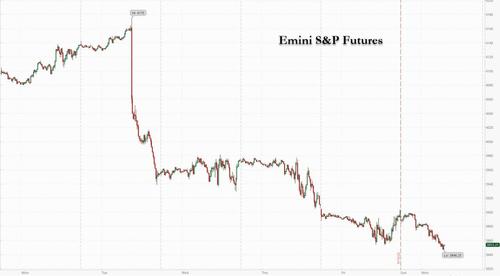

And sure enough, Nasdaq contracts have tumbled 1.2% as S&P futures are down 1.0%…

…the dollar is back into record territory, with rumors of a new imminent plaza accord growing louder by the day…

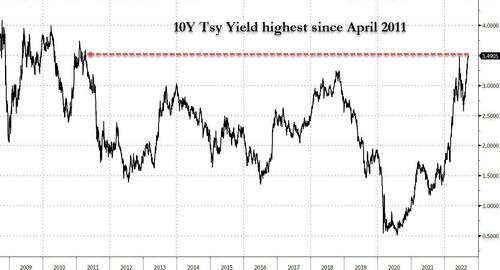

… 10Y yields are just shy of 3.50%, hitting a new post-2011 high this morning…

… which in turn is hammering European and Asian markets, as oil plunges in response to the fresh highs in the dollar.

In permarket trading, tech shares are lower and poised to extend last week’s decline, as investors expect the Fed to deliver a 75bps rate hike when it meets on Wednesday, putting pressure on pricier growth stocks. Tesla (TSLA US) -1.4%, Google (GOOGL US) -1.2%. Here are some other notable premarket movers:

- Marathon Digital (MARA US) plunged as much as 8.4% in premarket trading on Monday alongside other cryptocurrency- related stocks, after Bitcoin dropped toward the lowest level since 2020 on monetary tightening concerns.

- US-listed Chinese stocks edged lower in premarket trading Monday after Chinese stocks listed in Hong Kong dropped, putting them on track to enter bear-market territory. Alibaba (BABA US) -1.5%, Nio (NIO US) -1.6%.

- FOXO Technologies (FOXO US) surges in premarket trading after tumbling 52% on its debut on Friday via its combination with special purpose acquisition company Delwinds Insurance Acquisition Corp.

- Take-Two Interactive Software Inc. (TTWO US) falls 6.5% in US premarket trading Monday after a hacker published pre-release footage from development of Grand Theft Auto VI, its most anticipated video game.

In addition to the startling FedEx warning which sent the stock crashing by the most on record, investors also face potential volatility from policy decisions this week by the Bank of England, the Bank of Japan and a host of other central banks. The British pound sank to its weakest level against the dollar since 1985 on Friday and the yen remains under pressure, though it has backed off from just below the key 145 level versus the dollar.

“The aggressive tightening of policy in the coming 4-6 months, not just in the US but globally, increases the risk of a recession next year,” said Maria Landeborn, a senior strategist at Danske Bank A/S. “We expect uncertainty will remain high surrounding inflation, rates and the overall economy, which is negative for market sentiment and risk assets.”

With the Fed poised to hike 75bps (and perhaps even 100bps) and keep rising until it hits 4.50%, top Wall Street strategists see mounting risks for US earnings and equity valuations. Both Morgan Stanley’s Michael J. Wilson and Goldman Sachs Group Inc.’s David J. Kostin said headwinds to profitability are building, highlighting tighter monetary policy and pressure on company margins.

In Europe, the Stoxx 50 fell 0.9% with Spain’ IBEX outperforming, dropping just 0.3%, CAC 40 lags, dropping 1.1%. Energy, financial services and real estate are the worst performing sectors. Rate-sensitive European real estate shares are among the worst-performing in Europe in Monday trading, with the region’s equity market dropping further after seeing the biggest weekly decline in three months, as investors await a Federal Reserve monetary policy meeting this week. Here are some of the biggest European movers today:

- Porsche Automobil Holding advances; Volkswagen AG said it’s looking to raise as much as EU9.4 billion from the IPO of its sports-car maker in what could be Europe’s largest listing in more than a decade

- European energy stocks fall, making them the worst-performing sector in Europe on Monday, as oil prices dipped, erasing earlier gains, with the Stoxx 600 Energy index declining 1.8%

- European real estate shares are among the worst- performing in Europe in Monday trading, with the region’s equity market dropping as investors await a Federal Reserve monetary policy meeting this week

- TF1 and M6 slumped after the French TV companies called off a planned combination because of objections from the country’s antitrust regulator; also today, Oddo cut TF1 to neutral

- Valneva falls as much as 16% after the French vaccines maker said it will terminate a Covid-19 vaccine collaboration with IDT Biologika, agreeing to pay as much as EU36.2 million in cash.

Earlier in the session, Asian equities fell, poised for a fifth session of decline, as the dollar strengthened ahead of the Federal Reserve’s meeting this week. The MSCI Asia Pacific ex-Japan index erased early gains and fell as much as 0.8%, dragged by consumer discretionary and tech shares. Benchmarks in Hong Kong and South Korea were among the worst performers in the region. Japan’s market was shut for a holiday. The dollar’s gains put pressure on regional currencies, and stocks tumbled in the Philippines, Malaysia and Vietnam. Traders are watching the Federal Open Market Committee’s interest-rate decision on Wednesday for signals on further policy tightening, pricing in a 75-basis-point hike. The Hang Seng China Enterprises Index fell more than 1%, taking its losses from a June 28 peak to just short of 20%, which will mark the start of a bear market. Mainland China stocks traded little changed Monday as megacity Chengdu exited a lockdown.

MSCI’s broadest Asia Pacific stock gauge has clocked five consecutive weeks of losses as investors factor in higher US interest rates and a strong dollar. Optimism over any easing of China’s Covid-Zero stance after the party congress in October is also waning. “Unless the Fed is done with rate hikes, the US dollar bull market is not over yet,” Lim Say Boon, chief investment strategist at CGS-CIMB Securities wrote in a note.

In Australia, The t&P/ASX 200 index fell 0.3% to close at 6,719.90, the lowest since July 19, dragged by losses in health care and energy shares. In New Zealand, the S&P/NZX 50 index fell 0.4% to 11,531.99. The nation’s economic outlook is sound, despite increasing domestic and international turbulence, S&P said in a statement

Stocks in India snapped three days of declines, helped by a rally in consumer and auto firms on expectations of a boost in demand during the upcoming festive season. The S&P BSE Sensex rose 0.5% to 59,141.23 in Mumbai, while the NSE Nifty 50 Index also gained by a similar magnitude. Out of 30 shares in the Sensex index, 20 rose and 10 fell. A gauge of fast-moving consumer-goods makers was the best performer among 19 sectoral sub-indexes compiled by BSE Ltd. Most stocks across Asia declined ahead of key rate decisions by various central banks, including the US Federal Reserve. A higher-than-expected inflation in the US has raised expectations of another 75-basis-point hike when Fed policymakers meet on Wednesday. Housing Development Finance Corp contributed the most to the Sensex’s gains, increasing 1.5%.

In rates, Treasuries re-opened with yields cheaper by up to 5.5bp across front end of the curve in a bear flattening move. Into the weakness 10-year yields top at 3.506% and cheapest levels since June 2011. Cash market was closed overnight as UK observes a day of mourning for Queen Elizabeth II and Japan is out on holiday. Treasury yields 3.5bp to 5.5bp cheaper across the curve with long end outperforming slightly, flattening 2s10s, 5s30s spreads by 0.5bp and 1bp on the day. IG dollar issuance slate empty so far; up to $20b expected for the week with Monday and Tuesday potentially busy ahead of Wednesday FOMC. Latest CFTC positioning data shows hedge fund net short in two-year note futures, biggest since June 2021. Bund yields climb some 3bps across the curve. Australia’s bonds rose for the first time in four days. Yields fell 3-5bps across the curve.

In FX, the dollar strengthens against all FX majors; euro trades below parity while cable trades at around 1.13/USD and the yen slides near 143.43/USD. UK observes a day of mourning for Queen Elizabeth II. Some more details:

- The Bloomberg Dollar Spot Index advanced 0.3% as the greenback strengthened against all Group-of-10 peers. Risk-sensitive Scandinavian and Antipodean currencies were the worst performers. Treasury futures eased, sending yields a few basis points higher

- The euro gave up an Asia session gain to drop for the first time in four days, yet momentum in options is less bearish across all tenors compared to a week ago. German bonds inched lower, with yields rising 3-4 bps, ahead of ECB speakers today

- The Swiss franc and the yen held up best against wide dollar gains. Hedge funds ramped up bearish yen bets to a three-month high on expectations Japan would languish in a world where developed market peers are racing to hike interest rates

- The yuan fell even as the People’s Bank of China fixed the currency at 6.9396 per dollar, 647 pips stronger than the average estimate in a Bloomberg survey of analysts and traders, the widest difference on record since Bloomberg started the survey in 2018

In commodities, WTI drifts 1.3% lower to trade near $83.98. Oil futures have resumed the sell-off, in part amid the cautious risk tone/firmer Dollar. Nord Stream AG says it cannot confirm nominations for the Nord Stream 1 gas pipeline on Monday. Kuwait produces more than 2.8mln bpd and has plans to increase oil output whenever the market needs it, while Kuwait currently produces 650mln cubic feet of gas per day and plans to raise it to 1bln cubic feet, according to Kuwaiti Petroleum Corporation’s CEO, cited by Reuters. Spot gold falls roughly $10 to trade near $1,665/oz. European natural gas futures fall again to their lowest level in almost two months. Bitcoin extends decline to $18k-level as broad crypto selloff continues.

Bitcoin remained under pressure sub-USD 18,500. Ethereum extended on losses under USD 1,300.

It’s a busy week on the macro front, but Monday will be quiet with just the September NAHB housing market index on deck in the US. We also get the Eurozone July construction output, Canada August industrial product and raw materials prices.

Market Snapshot

- S&P 500 futures down 0.8% to 3,861.00

- STOXX Europe 600 down 0.7%

- MXAP down 0.5% to 149.48

- MXAPJ down 0.6% to 487.97

- Nikkei down 1.1% to 27,567.65

- Topix down 0.6% to 1,938.56

- Hang Seng Index down 1.0% to 18,565.97

- Shanghai Composite down 0.3% to 3,115.60

- Sensex up 0.6% to 59,203.12

- Australia S&P/ASX 200 down 0.3% to 6,719.92

- Kospi down 1.1% to 2,355.66

- German 10Y yield up 3 bps to 1.78%

- Euro down 0.4% to $0.9978

- Brent futures down 0.9% to $90.53/bbl

- Gold spot down 0.7% to $1,663.72

- U.S. Dollar Index up 0.3% to 110.05

Top Overnight News from Bloomberg

- Federal Reserve officials are on track to raise interest rates by 75 basis points for the third consecutive meeting this week and signal they’re heading above 4% and will then go on hold

- Investors bracing for another jumbo Federal Reserve interest-rate hike are focused on a few key trades: betting on deeper inversion in the US yield curve, further losses in stocks and a stronger dollar

- The risk of a euro-area recession has reached its highest level since July 2020 as concerns grow that a winter energy squeeze will cause a slump in economic activity. Economists polled by Bloomberg now put the probability of two straight quarters of contraction at 80% in the next 12 months, up from 60% in a previous survey

- European Central Bank interest rates will need to rise a lot more to get inflation under control, Bundesbank President Joachim Nagel said over the weekend

- The Chinese megacity of Chengdu exited its lockdown on Monday, with 21 million people allowed to leave their homes and resume most aspects of normal life for the first time since Sept. 1, provided they’re tested regularly for Covid-19

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued with the region lacking firm direction amid holiday-quietened conditions and with participants cautious ahead of this week’s slew of central bank policy decisions including from the FOMC, BoE and BoJ. ASX 200 was indecisive after gains in the mining industry were offset by underperformance in tech and defensives, with risk appetite also contained amid further calls for the RBA to hike by 50bps next month. Nikkei 225 was closed due to a domestic holiday. Hang Seng and Shanghai Comp declined with the Hong Kong benchmark pressured by losses in tech and pharmaceuticals, while the mainland was also subdued despite the cities of Chengdu and Dalian lifting lockdowns and the PBoC conducting 14-day reverse repos for the first time since January at a lower rate. Nonetheless, the injection was likely due to the upcoming National Day holidays and the rate cut was not much of a surprise after a similar cut in the 7-day reverse repo rate last month, while geopolitical concerns also lingered following comments from US President Biden that US forces would defend Taiwan in the event of a Chinese invasion.

Top Asian News

- China’s Chengdu lifted the lockdown for the entire city and Dalian will also lift the citywide lockdown effective this Monday, according to Bloomberg.

- China NDRC is seeking to promote an acceleration of the recovery in domestic consumption and speed up the injection of funds to start project construction ASAP. NDRC said the foundation of the economic recovery is still weak despite positive changes in main economic indicators and that external environment for utilising foreign capital is increasingly complex and severe, while it added there remains some factors affecting foreign investment confidence.

- UBS cut its China 2022 GDP growth forecast to 2.7% from 3.0% due to a weak Q3 recovery, according to Bloomberg.

- China’s Global Times stated that economists urged US regulators to serve market fairness and not let their work be trained with political factors as they are about to begin reviewing audit files of Chinese companies.

- US tsunami warning system issued a tsunami threat in Taiwan on Sunday morning following a magnitude 7.2 earthquake.

- Japan’s weather agency issued a special typhoon warning for the Kagoshima prefecture in southern Japan on Saturday, according to Reuters. It was later reported that the typhoon made landfall and millions were told to evacuate homes, according to FT.

The subdued tone seen across a holiday-thinned APAC session reverberated into Europe, with UK markets closed due to the funeral of Queen Elizabeth II. European cash bourses are lower across the board but off worst levels. European sectors are mostly lower with no overarching theme. US equity futures are softer in tandem with their European counterparts with relatively broad-based losses seen across the main December contracts.

Top European News

- UK PM Truss will conduct a bilateral meeting with US President Biden at the UN General Assembly on Wednesday instead of meeting in Downing Street on Sunday, according to a statement cited by Reuters.

- UK PM Truss agreed with Irish PM Martin that an opportunity exists for the UK and the EU for a negotiated Brexit resolution to the Northern Ireland protocol, according to RTE.

- UK PM Truss’s chief of staff Fullbrook said he is cooperating with the FBI regarding an investigation into a Conservative Party donor charged with illegally providing campaign donations to a former Puerto Rico governor, although Fullbrook denied any wrongdoing, according to FT.

- ECB’s Lane said there will probably be several more rate hikes this year and early next year, while he noted signs that inflation will come down but not just yet and said that a recession cannot be ruled out, according to Reuters.

- ECB’s Nagel said the ECB are ‘a good way off’ from where rates should be and rates will need to rise a lot more to get inflation under control, although is confident that inflation rates will fall after a tough winter, according to Bloomberg.

- EU is set to withhold EUR 7.5bln of funding from Hungary due to rule of law violations regarding corruption in awarding public contracts, according to FT.

- EU may ask companies to expand or repurpose production lines, according to European Commission emergency powers to avert supply crisis

Geopolitics

- US President Biden warned Russian President Putin against changing the face of the war by using tactical nuclear or chemical weapons in Ukraine, while he also stated that Ukraine is not losing the war and is making progress in some areas, according to an interview on CBS’s 60 Minutes. Furthermore, President Biden said he warned Chinese President Xi of an investment chill and that it would be a gigantic mistake if China violates sanctions on Russia but noted that there has been no indication that Beijing has provided weapons to Moscow for its invasion of Ukraine.

- US Joint Chief of Staff chairman General Milley said during a visit to a military base in Poland that it is still unclear how Russia will react to the battlefield setbacks in Ukraine and now is the time for increased vigilance and preparedness, according to Reuters.

- IAEA said one of the Zaporizhzhia nuclear power plant’s regular external power lines has been repaired and the plant is receiving electricity directly from the national grid, while it added that although there has not been any recent shelling at or near the plant, it continues to occur in the wider area, according to Reuters.

- Russia and China have agreed on further cooperating on defence with a focus on joint exercises, according to Interfax cited Russian Security Council.

- US President Biden said US forces would defend Taiwan in the event of a Chinese invasion, according to Reuters.

- Taiwan said China continued its military activities around the island and that it detected 20 Chinese aircraft and 5 Chinese ships operating around Taiwan on Saturday, according to Reuters.

FX

- The Dollar regrouped and regained a bid on a combination of technical and positional factors; DXY topped 110.00 but remains shy of Friday’s best.

- EUR/USD retreated back under parity, GBP/USD under 1.1400 from a 1.1442 peak.

- USD/JPY grinds upwards and briefly topped 143.50, whilst antipodeans are the G10 laggards.

Fixed Income

- Bonds have extended to the downside after waning from best levels earlier or overnight.

- Bunds are off a deeper 142.43 Eurex trough and the US 10-year T-note is nearer the base of its 114-12+/114-25+ range.

Commodities

- WTI and Brent futures have resumed the sell-off, in part amid the cautious risk tone/firmer Dollar.

- Nord Stream AG says it cannot confirm nominations for the Nord Stream 1 gas pipeline on Monday.

- Kuwait produces more than 2.8mln bpd and has plans to increase oil output whenever the market needs it, while Kuwait currently produces 650mln cubic feet of gas per day and plans to raise it to 1bln cubic feet, according to Kuwaiti Petroleum Corporation’s CEO, cited by Reuters.

- Spot gold has been under pressure as the Dollar gained traction, whilst CME copper is softer amid the risk tone

- Chinese copper tycoon He Jinbi’s Maike Metals International is reportedly suffering a liquidity crisis that threatens his empire which handles one of every four tons of copper imported into China, according to Bloomberg.

US Event Calendar

- 10:00: Sept. NAHB Housing Market Index, est. 47, prior 49

DB’s Jim Reid concludes the overnight wrap

A packed week will kick off with a quiet, solemn, start, as the UK is closed for the Queen’s funeral. Japan is also out on holiday. Looking forward, the postponed BoE meeting will nudge its way into an already packed central bank meeting schedule which includes the BoJ, SNB, Riksbank, Norgesbank, and of course, the Fed. Suffice to say, monetary policy will be in focus this week.

On the Fed, market pricing glided toward Matt Luzzetti’s expectations (full FOMC preview here) that the Fed will deliver a 75bp hike next week, having decayed from last week’s peaks after the stronger than expected CPI data. Much closer to consensus PPI and University of Michigan inflation expectations data helped bring pricing back from the peaks, let alone no press reports seemingly confirming pricing one way or another (finishing the week at 79.8bps priced). Regardless, some premium of a 100bp move will probably stay priced in for Wednesday, either on the off chance of some late blackout-period guidance.

Beyond the rate move itself, the new SEP should show unemployment ticking higher, moving farther from a soft-landing forecast. Luzzetti and co. expect the dots will show unemployment ratcheting to 4.5%. The September FOMC also adds another year to the SEP, so we will get figures for 2025, showing how steep a hiking cycle, how deep any recession, and how quick the subsequent recovery policymakers are expecting if their preferred policy path is realized.

On the BoE, our economists expect (full preview here) the MPC to vote for a second consecutive 50bp hike, albeit along divisive lines, with dissents favouring both a 25bp and a 75bp move likely surfacing. On the balance sheet, the MPC should confirm the start of gilt sales from later on this month, totaling GBP 10bn per quarter. Our economists expect the BoE’s terminal rate will be 4%, reached in May of next year, which is a 150bp upgrade over their old forecast.

The Bank of Japan also meets, where our economist expects (full preview here) the BoJ to remain the DM outlier by maintaining an easy policy stance, while agreeing to end their special pandemic funds-supplying operation as scheduled at the end of the month. The policy divergence will continue to weigh on a yen which is around its weakest levels versus the dollar since the early 90s, but our economists do not expect that augurs intervention, as fundamentals are driving the weakening and reduce the chance any intervention is effective.

Geopolitical risks will remain in focus, where the Ukraine war is most front-and-center. Elsewhere, a few conflagrations have broken out in former USSR states which individually may not be macro moving events, but are something to keep an eye on if symptomatic of something broader. Finally, an ever-looming potential issue, President Biden said in an interview with 60 minutes that the US would defend Taiwan if invaded, even as he downplayed the claim as not official US policy.

Overnight in Asia equity markets are trading in negative territory at the start of the week after the US equities ended in the red on Friday. The Kospi (-0.98%) is the largest underperformer across the region followed by the Hang Seng (-0.88%). Over in mainland China, the Shanghai Composite (-0.22%) is trading lower while the CSI (-0.11%) is swinging between gains and losses. Elsewhere, as mentioned, markets in Japan are closed for a holiday with no trading in Treasuries until the US session. In overnight trading, US stock futures are pointing to further losses with contracts on the S&P 500 (-0.27%) and NASDAQ 100 (-0.50%) both edging lower.

A quick recap of last week, which was a reliable microcosm of the major macro stories over the year, namely the war in Ukraine and the central bank battle over inflation.

Ukraine’s successful counter-offensive stoked some optimism early in the week, optimism which faded from risk assets (along with the tightening in global policy paths, more below) as the pathway to peace and an end to the war were not any clearer. That was ossified on Friday with President Putin giving a press conference where he warned about escalating the conflict in so many words. Global equity indices retreated over the week, with the STOXX 600 down -2.89% (-1.58% Friday), the DAX -2.65% lower (-1.66% Friday), and the CAC down -2.17% (-1.31% Friday). Banks proved one bright spot in European equities given the rate selloff, with the Euro Banks index gaining +2.90% despite pulling back -1.88% on Friday. US equities underperformed given the salience of steeper Fed policy post CPI, with the S&P 500 pulling back -4.77% (-0.72% Friday) and the NASDAQ down -5.48% (-0.90% Friday), the worst weekly return for both since mid-June.

The EU’s unveiling of measures to curtail energy price pressures, combined with some national-level efforts, drove European natural gas futures -9.82% lower to close the week at EUR 186.75, the first time they’ve ended a week below EUR 200 since the end of July.

For rates, the main event was the above-consensus US CPI data, which saw a repricing of global policy paths steeper, with 2yr Treasuries gaining +31.1bps (+0.3bps Friday) and 2yr Bunds +20.6bps higher (-0.7bps Friday). Curves flattened in both jurisdictions given the harder-landing implications of such a steep policy path, with 10yr Treasuries up +14.0bps (flat Friday) and Bunds up +5.8bps (-1.4bps Friday). It also coincided with terminal rates pricing higher, where the market is expecting fed funds rates to get up just shy of 4.4% in the spring of next year, albeit below our revised in-house call of terminal closer to 5%.

Tyler Durden

Mon, 09/19/2022 – 07:32

via ZeroHedge News https://ift.tt/E6rwqoU Tyler Durden