Key Events This Week: Fed, BOJ, BOE

An event-packed week, with a barrage of central bank announcements on deck, will kick off with a quiet, solemn, start, as the UK is closed for the Queen’s funeral. Japan is also out on holiday. Looking forward, however, DB’s Tim Wessel reminds us that the postponed BoE meeting will nudge its way into an already packed central bank meeting schedule which includes the BoJ, SNB, Riksbank, Norgesbank, and of course, the Fed. Needless to say, monetary policy will be in focus this week.

On the Fed, market pricing is now largely a consensus that the Fed will deliver a 75bp hike on Wednesday, having decayed from last week’s peaks after the stronger than expected CPI data (Nomura remains the lone outlier with a 100bps forecast). Much closer to consensus PPI and University of Michigan inflation expectations data helped bring pricing back from the peaks, let alone no press reports seemingly confirming pricing one way or another (finishing the week at 79.8bps priced). Regardless, some premium of a 100bp move will probably stay priced in for Wednesday, either on the off chance of some late blackout-period guidance.

Beyond the rate move itself, the Fed’s new Summary of Economic Projections should show unemployment ticking higher, moving farther from a soft-landing forecast; with some expecting to see unemployment rising to 4.5%. The September FOMC also adds another year to the SEP, so we will get figures for 2025, showing how steep a hiking cycle, how deep any recession, and how quick the subsequent recovery policymakers are expecting if their preferred policy path is realized.

On the BoE, economists expect the MPC to vote for a second consecutive 50bp hike, albeit along divisive lines, with dissents favouring both a 25bp and a 75bp move likely surfacing. On the balance sheet, the MPC should confirm the start of gilt sales from later on this month, totaling GBP 10bn per quarter. Economists also expect the BoE’s terminal rate to be 4%, reached in May of next year.

The Bank of Japan also meets, and DB economists expect the BoJ to remain the DM outlier by maintaining an easy policy stance, while agreeing to end their special pandemic funds-supplying operation as scheduled at the end of the month. The policy divergence will continue to weigh on a yen which is around its weakest levels versus the dollar since the early 90s, but DB’s economists do not expect that augurs intervention, as fundamentals are driving the weakening and reduce the chance any intervention is effective.

Geopolitical risks will also remain in focus, where the Ukraine war is most front-and-center. Elsewhere, a few conflagrations have broken out in former USSR states which individually may not be macro moving events, but are something to keep an eye on if symptomatic of something broader. Finally, an ever-looming potential issue, President Biden said in an interview with 60 minutes that the US would defend Taiwan if invaded, even as he downplayed the claim as not official US policy.

Here is a detailed weekly summary courtesy of DB:

Monday September 19

- Data: US September NAHB housing market index, Eurozone July construction output, Canada August industrial product and raw materials prices

- Central banks: ECB’s Guindos and Villeroy speak

Tuesday September 20

- Data: US August housing starts, building permits, Japan August national CPI, Germany August PPI, Italy July current account balance, July ECB current account, Canada August CPI

- Central banks: ECB’s Muller speaks

Wednesday September 21

- Data: US August existing home sales, UK August public finances

- Central banks: Fed’s decision, ECB’s Guindos speaks

- Earnings: General Mills, Lennar

Thursday September 22

- Data: US September Kansas City Fed manufacturing activity, August leading index, Q2 current account balance, initial jobless claims, Japan August nationwide department store sales, France September business and manufacturing confidence, Eurozone September consumer confidence

- Central banks: BoE and BoJ decision, ECB’s Economic Bulletin

- Earnings: Costco

Friday September 23

- Data: US, UK, Germany, France and the Eurozone flash September PMIs, UK September GfK consumer confidence, Canada July retail sales

- Central banks: Fed’s Powell, ECB’s Kazaks and Nagel speak

* * *

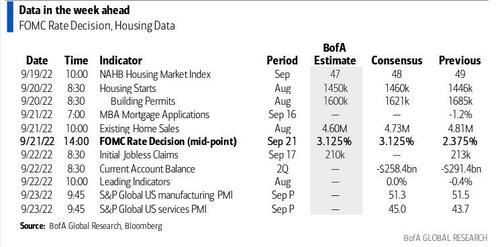

Finally, looking at just the US, Goldman writes that the key event this week is the September FOMC meeting on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM.

Monday, September 19

- 10:00 AM NAHB housing market index, August (consensus 47, last 49)

Tuesday, September 20

- 08:30 AM Housing starts, August (GS +0.6%, consensus +0.3%, last -9.6%); Building permits, August (consensus -4.5%, last -1.3%): We estimate housing starts edged up by 0.6% in August.

Wednesday, September 21

- 10:00 AM Existing home sales, August (GS -3.0%, consensus -2.3%, last -5.9%); We estimate that existing home sales declined 3.0% in August.

- 02:00 PM FOMC statement, September 20-21 meeting: We expect the FOMC to deliver a third 75bp rate hike at its September meeting, taking the funds rate to 3-3.25%. We expect 50bp hikes in November and December, taking the funds rate to 4-4.25% at yearend. Services inflation will likely remain high, but we expect the FOMC to slow the pace of rate hikes because the funds rate will be at a higher level, concern about overtightening will eventually rise, and the drop in consumer inflation expectations should reduce concern about unanchoring. The FOMC’s new economic projections are likely to show GDP growth more materially below potential this year and next than in June, a slightly larger increase in the unemployment rate in the years ahead, and a bit more inflation this year and next. We expect the median dot to show the funds rate at 4-4.25% at end-2022, an additional hike to a peak of 4.25-4.5% in 2023, one cut in 2024 and two more in 2025, and an unchanged longer-run rate of 2.5%.

Thursday, September 22

- 08:30 AM Initial jobless claims, week ended September 17 (GS 215k, consensus 218k, last 213k); Continuing jobless claims, week ended September 10 (consensus 1,395k, last 1,403k): We estimate initial jobless claims edged up to 215k in the week ended September 17.

- 08:30 AM Current account balance, Q2 (consensus -$259.0bn, last -$291.4bn)

- 11:00 AM Kansas City Fed manufacturing index, September (consensus +5, last +3)

Friday, September 23

- 09:45 AM S&P Global US manufacturing PMI, September preliminary (consensus 51.3, last 51.5); S&P Global US services PMI, September preliminary (consensus 45.5, last 43.7)

- 02:00 PM Fed Chair Powell, Fed Vice Chair Brainard, and Fed Governor Bowman speak: Chair Jerome Powell will make opening remarks at a Fed Listens event in Washington and Vice Chair Lael Brainard and Governor Michelle Bowman will moderate conversations from community and business leaders on how the pandemic has reshaped the economy. On September 7th, Vice Chair Brainard noted that while “it will be necessary to see several months of low monthly inflation readings to be confident that inflation is moving back down to 2 percent,” nevertheless “a variety of indicators are showing signs of improvement on delivery times and supplies of some goods,” labor force participation “showed a welcome increase” in August, and “reductions in markups could also make an important contribution to reduced pricing pressures.” On August 6th, Governor Bowman noted that “similarly-sized increases” in the federal funds rate to the FOMC’s 75bp hikes in June and July “should be on the table until we see inflation declining in a consistent, meaningful, and lasting way.”

Source: DB, Goldman, BofA

Tyler Durden

Mon, 09/19/2022 – 09:16

via ZeroHedge News https://ift.tt/yUnqT4o Tyler Durden