Volkswagen Seeks To Raise Up To $9.4 Billion From Porsche IPO

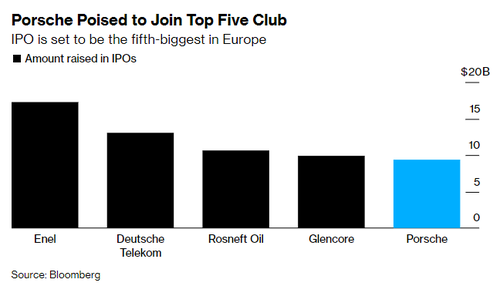

Volkwagen is looking to raise up to $9.4 billion from its forthcoming IPO of Porsche, a new report from Bloomberg says. That would make it Europe’s largest listing “in more than a decade”, the report says.

The company said this weekend that, despite havoc in both European capital markets and European auto markets, it was seeking out a valuation of 70 billion to 75 billion euros for its listing, down from an 85 billion figure that was being tossed around prior.

As the report notes, other forthcoming IPOs – like Intel’s planned IPO for Mobileye – have also scaled back expectations due to market volatility.

However, for Porsche, Qatar Investment Authority, Norway’s sovereign wealth fund, T. Rowe Price and ADQ have all signed on to subscribe to preferred shares totaling as much as 3.7 billion euros.

VW’s Chief Financial Officer Arno Antlitz told Bloomberg: “We are now in the home stretch with the IPO plans for Porsche and welcome the commitment of our cornerstone investors.”

VW has been pitching the investment opportunity as a way to combine the best of companies like Ferrari and Louis Vuitton.

The valuation puts Porsche at 10.2x EBITDA, the report says, well below Ferrari’s valuation of 23.1x EBITDA.

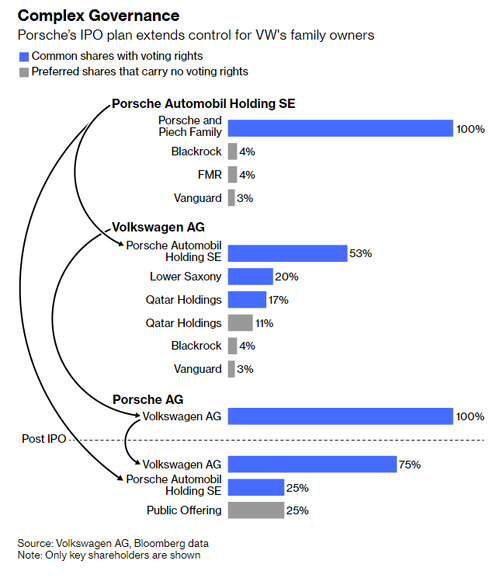

Porsche’s target for the year is for 39 billion euros in revenue. The IPO will also hand over decision-making to the Porsche-Piech family, who lost control of the company more than 10 years ago during a battle with VW, the report says.

Investors are going to be allowed to subscribe to 25% of Porsche preferred shares, which have no voting rights. The Porsche-Piech family will buy 25%+ of the company’s common shares with voting rights and has agreed to pay a 7.5% premium on top of the price range.

Despite the spin-off, however, some have raised questions about its future independence, since Oliver Blume, Porsche’s chief executive, is being appointed to head VW.

Tyler Durden

Mon, 09/19/2022 – 09:45

via ZeroHedge News https://ift.tt/gEt1Zp5 Tyler Durden