US Gas Producers Struggle To Meet Demand: Kemp

By John Kemp, senior market analyst at Reuters,

U.S. shale drillers are struggling to meet strong demand for gas from domestic generators as well as customers in Europe and Asia scrambling for replacement supplies following Russia’s invasion of Ukraine.

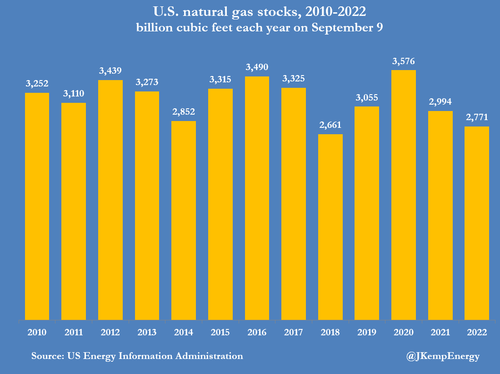

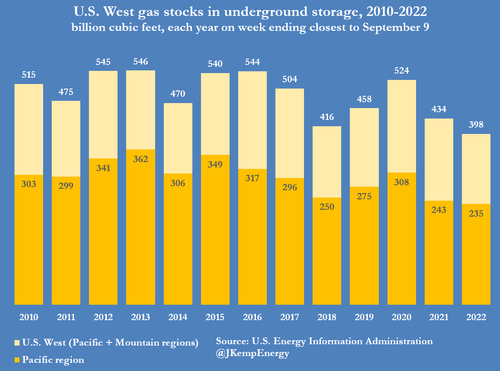

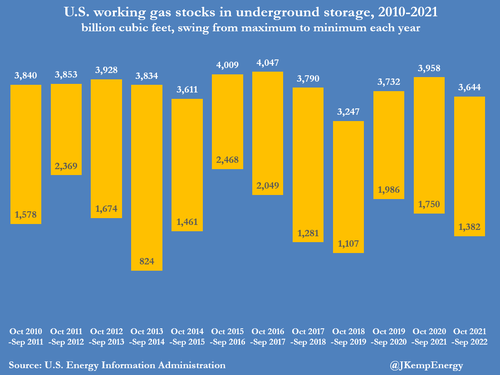

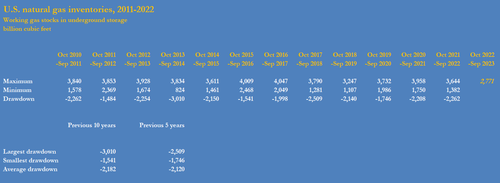

Working inventories in underground storage amounted to 2,771 billion cubic feet on Sept. 9, the second-lowest for the time of year since 2010, according to data from U.S. Energy Information Administration (EIA).

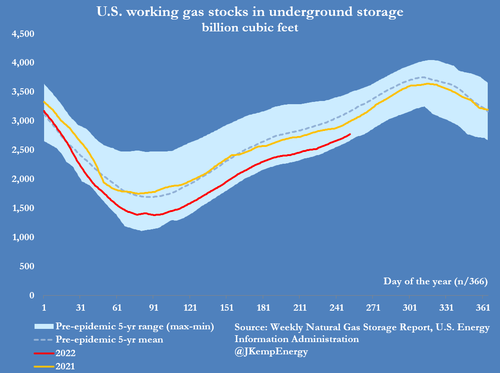

Storage has been below the pre-pandemic five-year average continuously since late January and the deficit has shown no sign of closing despite prices well above long-term averages.

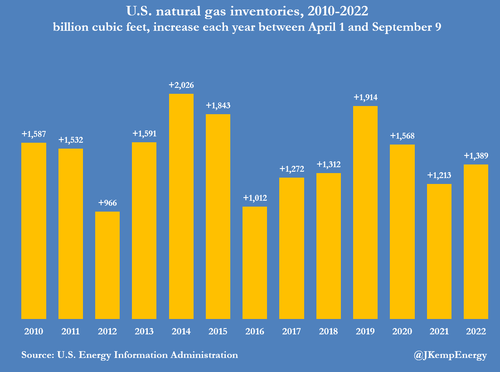

Inventories are currently 398 billion cubic feet below the pre-pandemic average, compared with a deficit of 316 bcf at the start of the injection season on April 1 (“Weekly natural gas storage report”, EIA, Sept. 15).

Electricity generation is on track for a record this year as a result of the economy’s recovery from the pandemic and slightly above-average temperatures this summer.

U.S. generators are burning record volumes of gas because coal-fired units have been retired and drought has limited hydroelectric output in the western states.

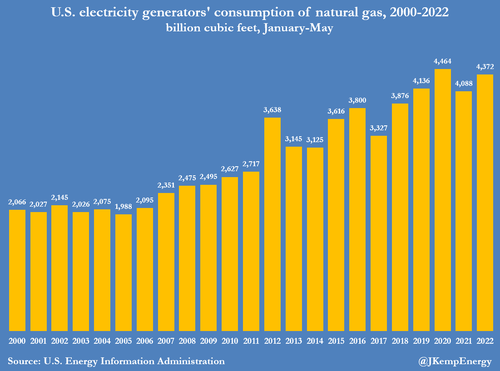

Generators consumed 4,372 bcf in the first five months of 2022, the second-highest on record after January-May 2020 (“Monthly energy review”, EIA, Aug. 25).

Power producers’ gas combustion has been even stronger over the summer months, setting a new daily record in July (“Daily U.S. electricity generation from natural gas hit a record in mid-July”, EIA, Aug. 23).

At the same time, exports are running at record rates as new LNG liquefaction terminals meet soaring demand from importers in Europe and Asia.

APPROACHING WINTER

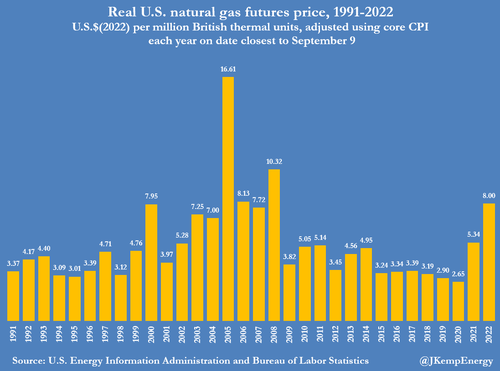

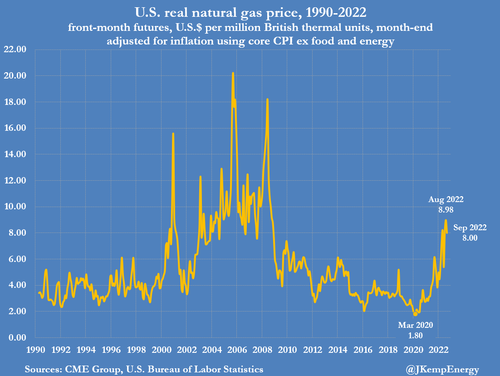

Persistent scarcity has forced front-month futures prices up to more than $8 per million British thermal units, more than double the seasonal average for 2011-2020…

…and the highest after adjusting for inflation since 2008.

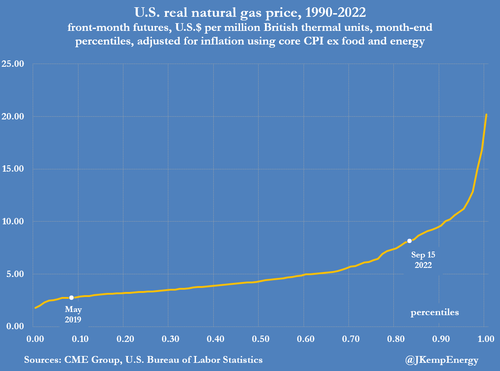

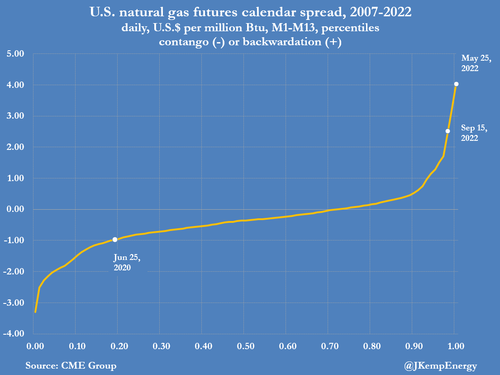

In real terms, prices have been trading for most of the time since late May in the 80-85th percentiles for all months since 1990, signalling a shortage of stocks and providing a strong incentive for more production.

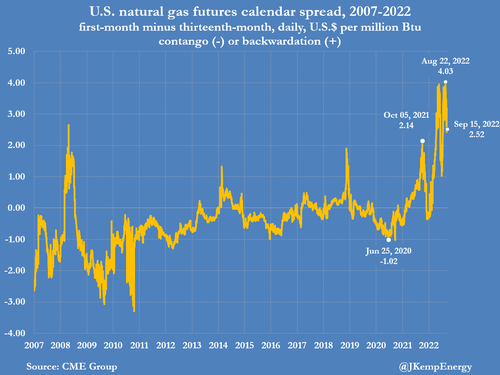

The one-year calendar spread has been trading in an extreme backwardation of $2.50-$4.00 per million Btus…

…(99th-100th percentiles for all trading days since 2007) underscoring the shortage of inventories.

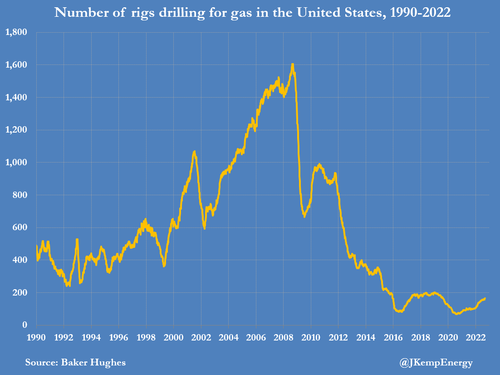

The number of rigs drilling for gas has risen to 166, from 106 at the start of the year and a low of just 68 during the pandemic’s first wave in 2020.

Oil rigs (likely to produce some associated gas) have climbed to 591, from a pandemic low of 172, according to field services company Baker Hughes.

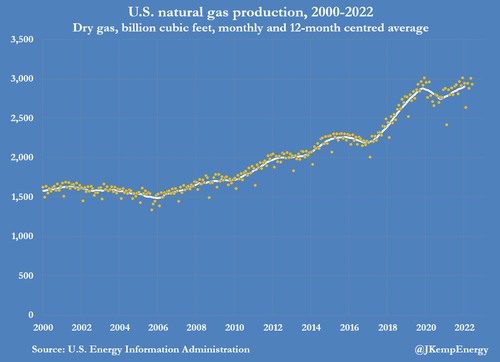

As a result, gas production was up by around 4% in the second quarter of 2022 compared with the same period in 2021 but it was not enough to meet strong domestic and foreign demand and rebuild depleted inventories.

As a result, stocks are vulnerable in the event of a late-season hurricane in the Gulf of Mexico, a colder than normal winter, or an ice storm in the key producing areas of Texas.

In the last 10 years, the average winter drawdown has been around 2,182 bcf with a range from 1,541 to 3,010 bcf, compared with stocks of just 2,771 at present, with roughly two months’ more injections to go.

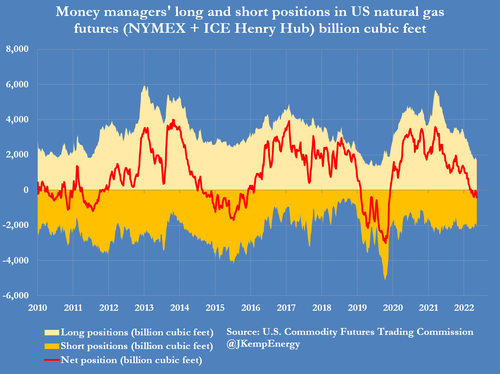

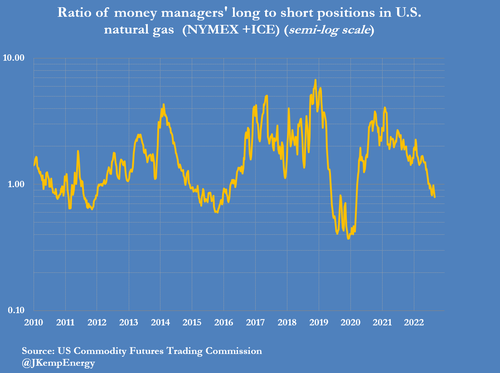

Even so, hedge funds and other money managers have become progressively less bullish and even slightly bearish on gas prices since April.

The combined position in the two major contracts on NYMEX and ICE is equivalent to a net short position of 435 billion cubic feet, a major reversal from a net long of 1,394 bcf in early April.

With prices already well above the long-term average, many portfolio managers are betting there is scope for them to retreat if winter temperatures are close to normal and there are no major output disruptions.

But the low level of inventories means there are few shock absorbers; the system will quickly come under pressure if this winter’s drawdown is towards the top end of the historic range or exceeds it.

Tyler Durden

Mon, 09/19/2022 – 14:05

via ZeroHedge News https://ift.tt/lYscxTV Tyler Durden