Signs Are Pointing Toward Equities Capitulation

By Michael Msika, Bloomberg Markets Live commentator and reporter

The extreme stress showing in credit and currency markets has yet to be fully reflected in equities, though this moment may not be far away.

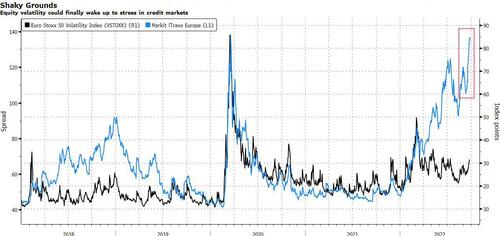

The selloff in stock markets has so far been an orderly one: volatility is nowhere near where it was in the early part of the year, while the Stoxx 600 is still well above pandemic lows.

Contrast that with the blowout in credit markets, where the Markit iTraxx Europe Index of investment-grade credit default swaps has surged to its highest level in 10 years, exceeding Covid highs.

It’s a similar story for foreign exchange and government bonds, with the Bank of England having to provide support in the face of sharp declines, a complete turn in the monetary tightening narrative. The intervention was enough to calm financial markets on Wednesday, but more could be needed in the near future.

For Barclays strategists led by Emmanuel Cau, capitulation in equities may have “a final leg” amid the twin “shock” of a recession and monetary tightening. They expect more equity selling if earnings fundamentals deteriorate and central banks don’t come to the rescue.

Signs are emerging that panic selling in many asset classes may soon spill over into stocks. The Stoxx 600 just hit its lowest level since November 2020 before bouncing yesterday, and is in oversold territory, all of that on heavy volume.

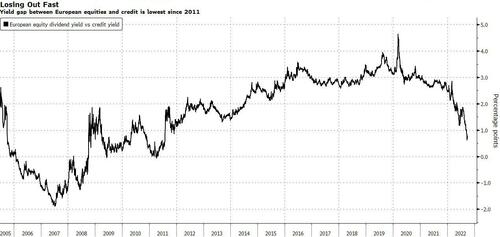

Among the wall of headwinds for equities right now is that they have almost lost their edge to bonds. Corporate investment grades are close to yielding more than stocks, with the difference between them at its lowest level since August 2011. The picture is similar when comparing shares with government 10-year bonds.

Meanwhile, European markets are falling into bear territory one after the other. Spain’s IBEX just became the latest to do so, despite outperforming this year on demand for value stocks. The FTSE 100 is now the only major European index to have dodged the bear tag thanks to the pound’s extreme weakness, though in dollar terms it’s down 30% from its peak.

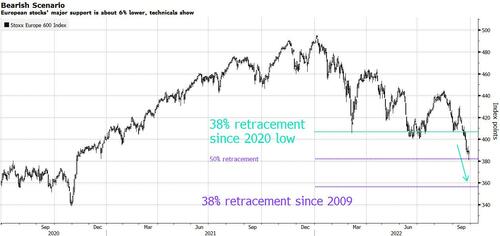

Technically, things don’t look much better. The Stoxx 600 has now clearly broken major resistance between 414 and 408, and as long as it remains below those levels, further downside is likely, according to DayByDay analyst Valerie Gastaldy.

The European benchmark has “clearly broken below” a 38% retracement from its 2020 low, and could now fall to a level representing a drop of that extent from its 2009 trough “without any particular timing,” she says.

Tyler Durden

Thu, 09/29/2022 – 10:54

via ZeroHedge News https://ift.tt/r5XYzMV Tyler Durden