NYC Office Space Glut May Spark $453 Billion In Value Loss, Study Warns

While the Biden administration reinforces the narrative that the economy is robust ahead of the midterm elections, one overlooked sector of the economy could be on the brink of turmoil. That is, commercial real estate.

After more than two years, the virus pandemic upended the world of work, signs of distress in commercial real estate are reemerging. We have pointed this out multiple times this summer, NYC Office Space Glut Made Worse By Remote Work As Older Towers Face High Vacancy and Office Space Market Faces “Economic Downturn” Due To Perfect Storm Of Factors.

Validating our concerns is a new report via Bloomberg, citing a study from the National Bureau of Economic Research that outlines NYC office buildings may experience a massive wipeout in valuation, upwards of $453 billion.

NBER said the value of office buildings plunged 45% in 2020 and is forecasted to remain around 39% below pre-Covid levels due to remote working, companies shrinking corporate workspaces, and some firms gravitating to newer buildings.

Even though Goldman Sachs, Morgan Stanley, and other Wall Street firms have pushed for a return to the office after the Labor Day holiday, NYC’s office-occupancy trends are still below half, according to card-swipe data provided by Kastle Systems.

The problem with NYC is a glut of decades-old office buildings sitting partially empty. This is becoming a multibillion-dollar problem for building owners.

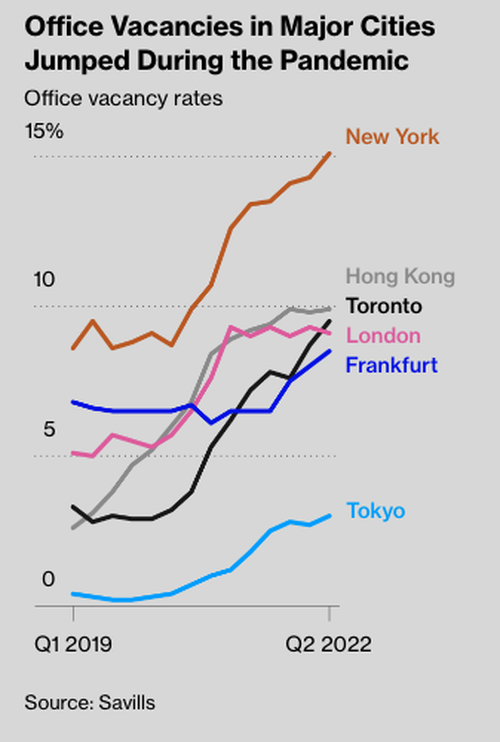

Office vacancy rates in the metro area are some of the highest in the world.

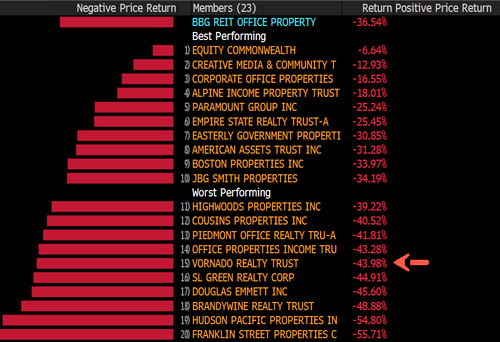

For a deeper dive into the commercial real estate market, Senior REIT Analyst for Bloomberg Intelligence Jeff Langbaum shows office REIT share prices have plunged this year “as fears over long-term tenant demand weigh on landlords. REITs focused in California fared the worst in 3Q, catching up to their New York peers who’ve fallen the most year-to-date even though leasing volume continues to show elevated demand for top-quality space.”

Vornado Realty Trust, a real estate investment trust with massive exposure to the NYC office, is one of the worst performing REITs year-to-date, down about 42%.

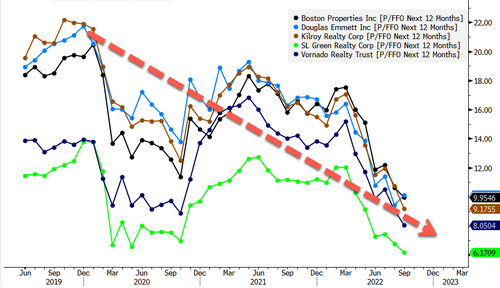

Langbaum pointed out that NYC REITs’ valuations continue to slide as there’s no improvement in the demand picture anytime soon.

Will it only take a recession to trigger a bust in NYC commercial office space?

Tyler Durden

Thu, 10/06/2022 – 06:55

via ZeroHedge News https://ift.tt/HyZWDIR Tyler Durden