Medicore, Tailing 3Y Auction Sees Jump In Dealer Award

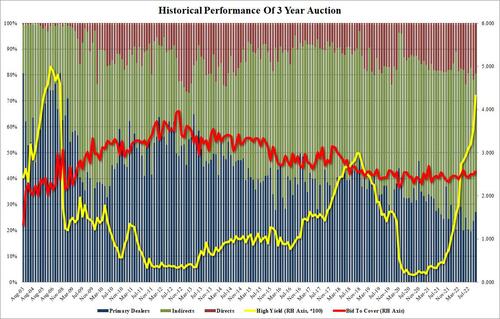

With Treasury prices and yields gyrating like high-beta penny stocks now that liquidity in the world’s “deepest” bond market is practically gone, bond traders were casting nervous eyes at the results of today’s 3Y auction results, the first coupon offering of the week and one month after the ugliest 3Y auction of 2022. Luckily, there were no fireworks this time even if the auction was decidedly of the subpar variety: pricing at a high yield of 4.318%, the highest yield going back to pre-Lehman levels, today’s sale of $40BN in 3Y paper tailed the When Issued 4.310% by 0.8bps, which while hardly good, was better than last month’s 1.4bps tail.

The Bid to Cover of 2.567 was an improvement to last month’s 2.494 and above the six-auction average of 2.492.

The internals were mediocre, with Indirects dipping from 54.5% to 53.4%, the lowest since June and below the recent average of 57.5%; and with Directs taking down 19.6% or right on top of the recent average, Dealers were left holding 27% of the auction, the most since April 2022.

Overall, a very subpar if hardly disastrous 3Y auction, and one which can’t leave bond markets too happy ahead of tomorrow’s 10Y auction.

Tyler Durden

Tue, 10/11/2022 – 13:23

via ZeroHedge News https://ift.tt/utxdVEj Tyler Durden