Food Cost Jump Sparks Hotter Than Expected US Producer Price Inflation

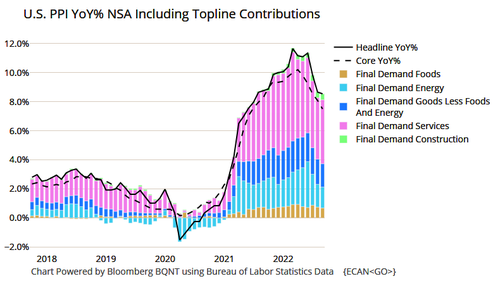

PPI is the under-card ahead of tomorrow’s main event CPI print, but nevertheless will offer some insights into how the inflation picture is evolving in the US and is expected to slow at the headline level but flat at the core level.

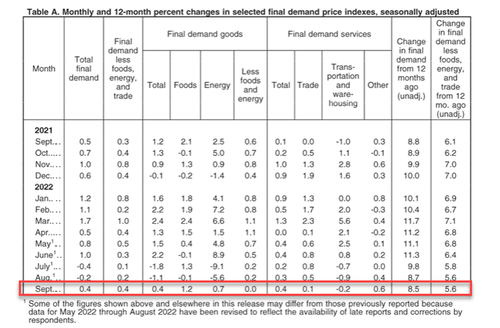

The headline PPI printed +8.5% YoY (which was hotter than the expected +8.4% YoY) but down from August’s 8.7% (jumping 0.4% MoM after 2 straight months lower)…

Source: Bloomberg

Ex-Food, Energy, & Trade, PPI rose 0.4% MoM (double the expected +0.2%).

Both Goods and Services PPI are rising with Food increases dominating…

Over a quarter of the September increase in the index for final demand services can be traced to a 6.4-percent advance in prices for traveler accommodation services…

Sixty percent of the advance in final demand goods is attributable to a 1.2-percent increase in the index for final demand foods. A major factor in the September increase in prices for final demand goods was a 15.7-percent advance in the index for fresh and dry vegetables.

Food cost inflation is still up a stunning 11.90% YoY…

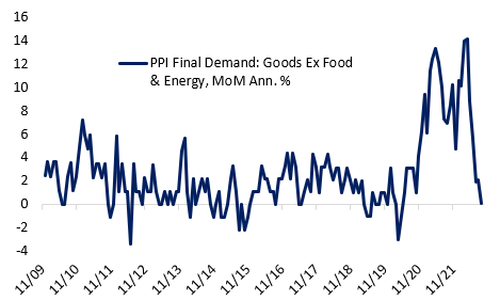

But, there is a silver lining… apart from everything producers need to make their goods and services, inflation is over (cue Biden administration talking point)…

Finally, we note that the pipeline of PPI pain is easing further as intermediate goods inflation eased further…

Source: Bloomberg

There’s nothing here to prompt a pivot from The Fed.

Tyler Durden

Wed, 10/12/2022 – 08:38

via ZeroHedge News https://ift.tt/oiq8egT Tyler Durden