BlackRock Assets Plunge Amid Global Stock And Bond Turmoil

BlackRock, the world’s largest investment manager, reported assets under management (AUM) plunged 16% year-on-year to $7.96 trillion in the third quarter amid global equity and bond market turmoil sparked by central banks aggressively raising interest rates to quell elevated inflation. Reported AUM missed every average analyst estimate, while the Bloomberg consensus was around $8.27 trillion.

New York-based BlackRock reported a smaller-than-expected decline in quarterly profit as demand for exchange-traded funds and other low-risk financial products increased fee income. Most of its money is made from fees charged for investment advisory and administration services.

BlackRock products, known as long-term funds, only attracted $65 billion of net inflows, missing the $104 billion average estimate.

Third-quarter adjusted net income dropped 17% to $1.5 billion, or $9.55 a share, versus the same quarter last year, beating Wall Street’s average estimate of $7.03. Revenue slid 15% to $4.31 billion, almost in line with analysts’ predictions.

Here are some of the highlights on revenue via Bloomberg:

-

Investment advisory performance fees $82 million, estimate $152.9 million

-

Base fees and securities lending revenue $3.53 billion, estimate $3.48 billion

-

Technology services revenue $338 million, estimate $344.2 million

BlackRock said the decline was “primarily driven by the impact of significantly lower markets and dollar appreciation on average AUM and lower performance fees.”

Remember, Fink warned in July 2021 that inflation wasn’t transitory and the Fed would have to react. He called for inflation to be at “3.5% to 4.0%,” though it more than doubled his calculations to 9% in June. Central bankers are aggressively increasing interest rates worldwide and appear predisposed to commit a significant policy error as parts of the world are on the brink of recession.

Central banks have so far caused a collapse in global stock and bond prices.

Meanwhile, the Financial Times reported Monday that BlackRock lost over $1 billion in AUM from Republican states that resisted the firm’s ESG values.

UBS analyst Brennan Hawken downgraded BlackRock to Neutral from Buy on Tuesday with a new price target of $585 from $700. In a note, Hawken said that bond market turmoil is one of the most significant headwinds for BlackRock, as 61% of its active AUM is fixed income.

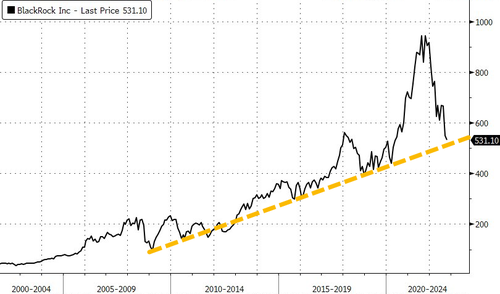

BlackRock shares have tumbled 42% year-to-date.

CEO Larry Fink stated that “the power of our diversified platform is most evident in times of uncertainty, and clients are turning to us more than ever for our comprehensive and integrated solutions.”

Tyler Durden

Thu, 10/13/2022 – 13:25

via ZeroHedge News https://ift.tt/zVX57Rj Tyler Durden