Soaring CPI & Extreme Pre-Positioning Sparks Massive Swings Across Markets

CPI (soaring food and shelter costs) slammed the markets hard…but pre-positioning sparked a massive reversal everywhere…

Source: Bloomberg

Sheesh, that escalated quickly…

The day started off well with a series of headlines from the UK that Truss and Kwarteng would fold on tax cuts. Gilt and Linker yields tumbled as BoE accepted offers rose to top $5bn…

Source: Bloomberg

Cable also soared (though no confirmation of the budget plans was forthcoming yet)…

Source: Bloomberg

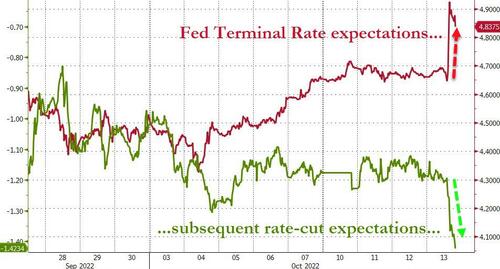

Hotter than expected CPI sent rate-hike expectations soaring to a new high above 4.90% (terminal rate in March 2023) and at the same time, the expectations for rate-cuts dovishly surged also…

Source: Bloomberg

The odds of a 100bps hike in November also shot up…

Source: Bloomberg

Around 1400ET, JPM CEO Jamie Dimon warned that he “doesn’t think there will be a soft landing,” adding that his “gut tells him the Fed rate will be higher than 4-4.5%”

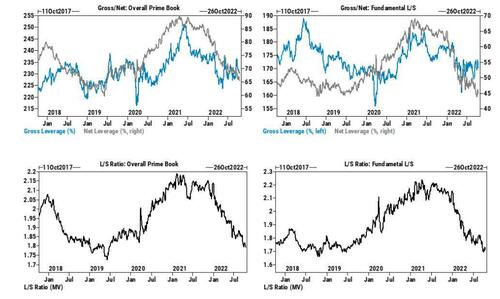

As a reminder, net hedge fund positioning into CPI was the lowest in 5 years…

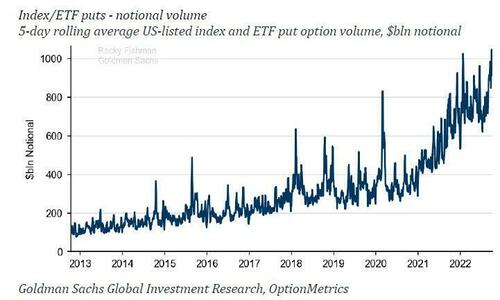

Separately, we also know that the 5-day rolling average notional of index puts is $1 Trillion, per day, every day, that according to Goldman, is a new record!

And sure enough saw a massive short-squeeze off the dismal can market open…

Source: Bloomberg

“sentiment has completely bombed out – yes the CPI may come in hot, and will likely lead to more selling, at least initially, but everyone is already positioned for this.”

So the 3.5-4% plunge in stocks on the CPI was reversed at the US cash open, ripping back 5-6% higher…

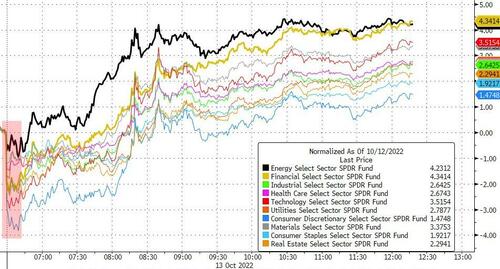

Energy and Financial stocks were the day’s best performers (as the latter kick off earnings season tomorrow). Notably, financials were up almost 7% from the opening lows…

Source: Bloomberg

The S&P bounced off its 200-week moving-average…

Source: Bloomberg

The S&P bounced perfectly off its 50% retrace of the post-COVID rip…

Source: Bloomberg

“We bounced off of this support level and that becomes self-fulfilling,” said Ellen Hazen, chief market strategist and portfolio manager at F.L.Putnam Investment Management.

“There’s so much uncertainty in the market and so many data points are conflicting that the market responds to whatever is the most recent.”

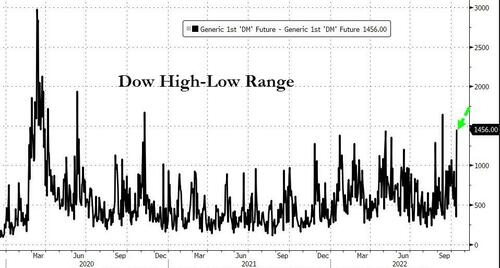

Dow rallied over 1500 points off the CPI plunge lows…

…one of the biggest ranges on record…

Source: Bloomberg

In $SPY‘s history, it has only opened down 2%+ and closed up 2%+ four times. Today would make it 5, but a lot of day left. Prior days on the chart below: pic.twitter.com/HLOgFVKiiD

— Bespoke (@bespokeinvest) October 13, 2022

Treasuries were just as chaotic as stocks today with a massive spike in yields on the CPI print (+15-25bps) then a complete reversal in all but 2Y. By the close most yields were marginally higher with 2Y underpeforming dramatically…

Source: Bloomberg

30Y yields briefly topped 4.00% for the first time since August 2011 but then caught an aggressive bid back down…

Source: Bloomberg

The yield curve inverted/flattened significantly more after CPI with 2s10s trading below -51bps…

Source: Bloomberg

The dollar spiked higher on the CPI print then spent the rest of the day getting monkeyhammered lower (now lower on the week)…

Source: Bloomberg

Bitcoin followed a similar path to stocks with a major puke on CPI followed by a buying panic back above $19000…

Source: Bloomberg

Gold ended the day lower (despite USD weakness), puking hard on the CPI before bouncing back somewhat…

Oil prices ended significantly higher after getting slammed on the CPI…

Finally, we fear today’s rip could be the start of the next major pain trade as seasonality swings strongly in bulls’ favor…

Source: Bloomberg

And with positioning so extreme going in… who knows. Just one thing though, if we rip like we did in June… The Fed will come thundering ‘over the top’ to ensure financial conditions don’t ease too much… so be careful what you wish for.

Tyler Durden

Thu, 10/13/2022 – 16:01

via ZeroHedge News https://ift.tt/ED7bIMW Tyler Durden