Real US Retail Sales Tumble (Again) In September

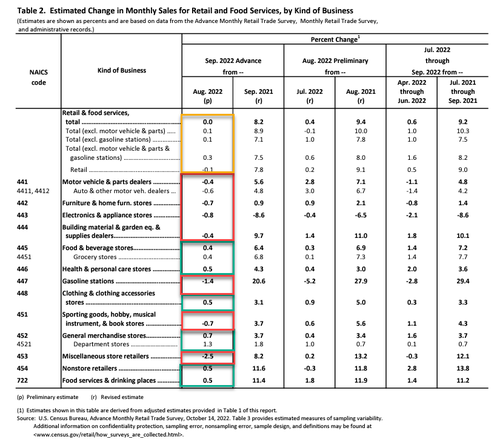

US retail sales were expected to rise 0.2% MoM in September but instead were disappointedly unchanged. On a year-over-year basis, retail sales (nominal) rose 8.2%, the weakest since April

Source: Bloomberg

Ex-Autos and Ex-Autos and Gas both rose more than expected (+0.1% vs -0.1% exp and +0.3% vs +0.2% exp respectively). On a YoY basis, core retail sales rose 6.6%., exactly in line with Core CPI’s 6.6% YoY rise…

The control group – which feeds directly into GDP – rose 0.4% MoM (above the +0.3% expectation).

Under the hood, motor vehicles sales were down, food & beverage up, gas stations down, and miscellaneous store retailers down hard…

Store Retailers saw sales tumble 2.5% MoM – the biggest monthly drop since May 2021…

Source: Bloomberg

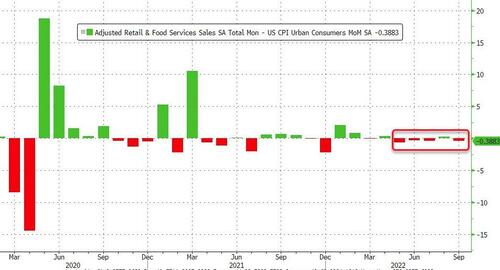

And finally, we remind readers that retail sales data is nominal – i.e. not adjusted for inflation. While we know very well that adjusting headline retail sales by headline CPI is not apples to apples, it is a good rough guide to what is really going on…

Source: Bloomberg

This means the ‘real’ retail sales in September fell for the 4th month of the last 5… “strong consumer”?

Tyler Durden

Fri, 10/14/2022 – 08:37

via ZeroHedge News https://ift.tt/eoPgL6K Tyler Durden