ECB Terminal Rate Of 2.25% Is A Dream, Because It Won’t Be Real

By Ven Ram, Bloomberg Markets Live reporter and commentator

Staff at the European Central Bank reckon that the monetary authority doesn’t need to raise rates as much as the market expects. The report is probably too optimistic.

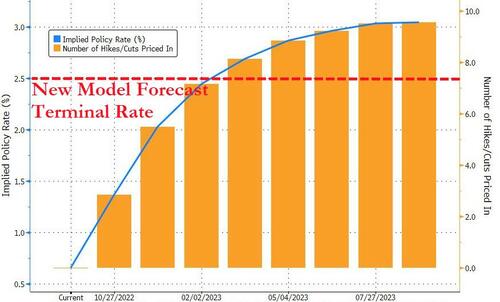

A new internal model seems to suggest the ECB can give up its fight against inflation once its deposit rate reaches, ahem, 2.25% — just 150 basis points away from where we are now. And it contends that the central bank may need to raise even less if it starts shrinking its balance sheet.

Without the benefit of having seen the model, it is difficult to fathom the underlying assumptions, but let’s dig deeper into the current inflation dynamics. At 10%, HICP inflation in the euro area is reaching for stratosphere. While energy is a key contributor to that number, price pressures are now pretty broad-based, so the ECB will be keen to curb second-round effects and to ensure that inflation expectations don’t get unanchored. While the ECB has responded so far this year with jumbo hikes, 5y5y inflation swap rates have actually climbed more than 50 basis points. And the ECB’s own estimate is that inflation will hover around 5.5% next year and still not converge to its 2% target even in 2024.

In other words, any meaningful estimate of the short-term neutral rate will need to take cognizance of those dynamics — suggesting that the current r* could be upward of 2.50%. So if the neutral rate itself is around there, how could the terminal rate — which presumably needs to be a restrictive rate in this backdrop — be pegged at a lower number of 2.25%? It’s a scenario that may be predicated on an extreme tail-risk event, meaning it won’t be anyone’s base case.

The ECB’s internal modeling has unfortunately been overtaken by actual events on the ground (remember its now-infamous model-led inflation forecasts made in 2021 which estimated that inflation this year would be a measly 1.3%?)

We hear the model was presented at a retreat in Cyprus. It may well be that the governing council left all recollection of the presentation right there.

Tyler Durden

Fri, 10/14/2022 – 13:59

via ZeroHedge News https://ift.tt/ToORMgi Tyler Durden