BofA Soars After Smashing Expectations, Reports Blowout Trading Revenue And Net Interest Income

With the big banks Q3 earnings reports coming to a gradual end after Friday’s barrage, which saw solid results by JPM, medicore earnings by Citi and Wells, and an unexpected miss by Morgan Stanley, this morning we got the latest numbers from Bank of America which were solid, not only beating on the top and bottom line – with both FICC and equity revenue coming above expectations – but also reporting zero trading day losses in 2022. Only Goldman is now left tomorrow.

So what did Morgan Stanley report? Starting at the top, here are the Q3 results:

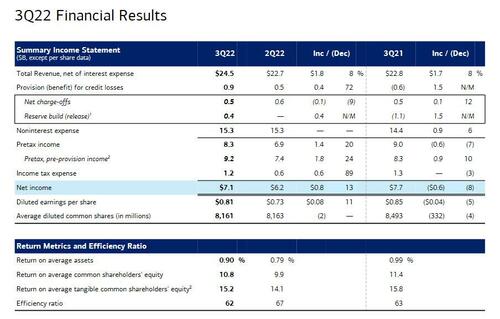

- Revenue net of interest expense $24.50 billion, beating the exp. $23.57 billion

- Net income of $7.1 billion, or 81 cents per share, coming in ahead of analyst expectations of exp. 77c

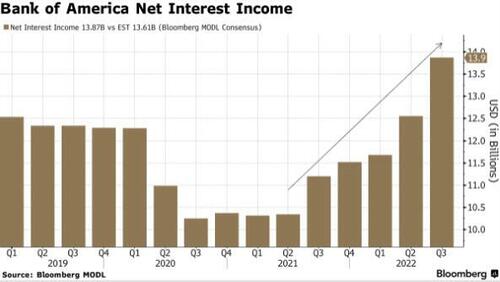

- Highest net interest income in at least a decade as the lender reaps the benefits of the Federal Reserve’s interest-rate hikes, and debt traders beat analysts’ estimates.

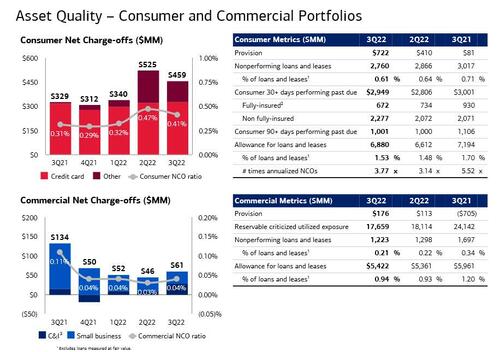

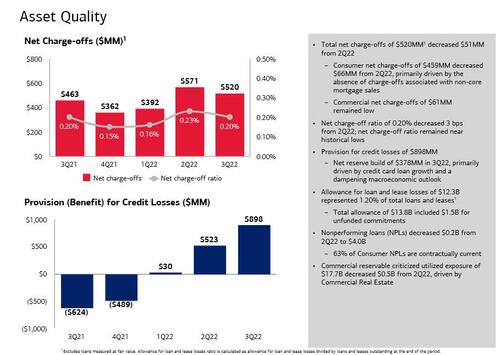

The first thing to note, of course, is that like JPM and all the other banks, BofA took a substantial provision for credit losses, amounting to $898 million, above the $766 million analysts expected and the most since Q3 2020; on the other hand, net charge-offs of $520 million actually declined by $21 million from Q2 2022, and came in below expectations, indicative of still-strong consumers and businesses. Some more details:

- Consumer net charge-offs of $459MM decreased $66MM from 2Q22, primarily driven by the absence of charge-offs associated with non-core mortgage sales

- Commercial net charge-offs of $61MM remained low

- Net charge-off ratio of 0.20% decreased 3 bps from 2Q22; net charge-off ratio remained near historical lows

As for the credit loss provision of $898MM, this was the result of a net reserve build of $378MM in 3Q22, “primarily driven by credit card loan growth and a dampening macroeconomic outlook.”

BofA’s total allowance for loan and lease losses of $12.3BN represented 1.20% of total loans and leases; the total allowance of 13.8BN included $1.5B for unfunded commitments. The silver lining: nonperforming loans (NPLs) decreased $0.2B from 2Q22 to $4.0BN.

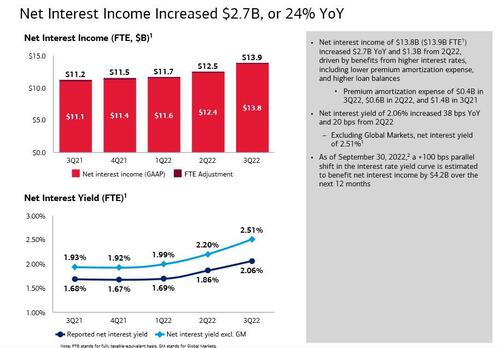

Turning to BofA’s net interest income – a huge source of revenue for the firm – it jumped 24% to $13.87 billion, the bank’s highest net interest income in at least a decade, as the lender reaps the benefits of the Federal Reserve’s interest-rate hikes…

… driven by higher rates and loan growth, CFO Borthwick said. Net interest yield improved 38 basis points from a year earlier, with 20 basis points of that improvement occurring in the third quarter of this year alone. Notably, BofA also expects Q4 NII to rise by “at least” another $1.25 billion more than in the third quarter, or roughly $15.1 billion.

Some context: BofA’s NII growth of 24% versus the third quarter last year might have been less than growth of more than one-third at JPMorgan and Wells Fargo. But the extra $2.7 billion in NII that Bank of America earned more than compensated for the fall in non-interest revenue and the big negative swing in loan loss provisions that all banks reported.

And looking ahead, the bank said on the earnings call that it expects Q4 NII to be at least $1.25BN more than Q3, rising to just over $15BN.

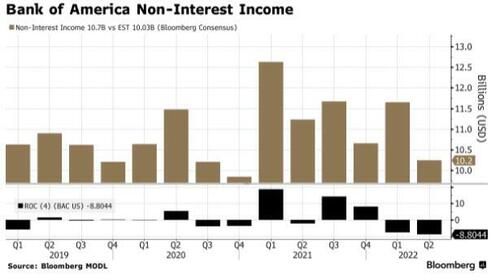

On the other hand, non-interest income fell 8% to $10.7 billion, driven by lower investment-banking and asset-management fees and lower service charges; yet as we note below, it mostly beat expectations across the board.

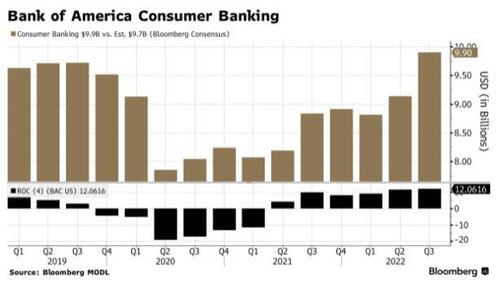

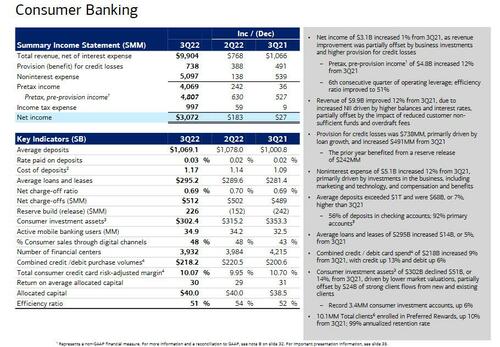

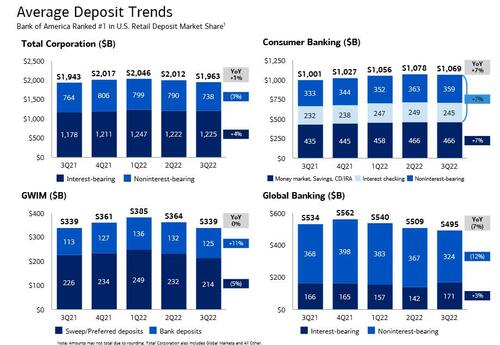

Consumer banking revenues came in at $9.9 billion – a 12% increase from a year ago – which the bank says is mostly due to the jump in net interest income. Revenue was $200 million higher than analysts were anticipating. Deposits were up 7% and exceeded $1 trillion for the fifth straight quarter. And loans were also up a whopping 5%.

It does warn that that was offset by “the impact of reduced customer non-sufficient funds and overdraft fees.”

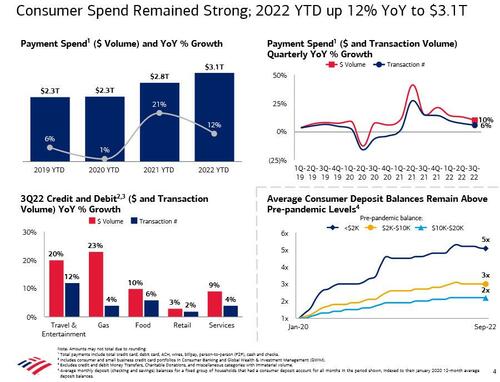

And speaking of “strong consumers”, on the earnings call, CEO Brian Moynihan gave another upbeat summary of the state of the US consumer (by which we assume he means those in the 10% who are still spending as opposed to the 90% who are now maxing out their credit cards to make ends meet): “First, consumers continue to spend at strong levels. Second, customer average deposit levels for September 2022 remain at multiples of the pre-pandemic levels. You can see that in the lower right. Third, there’s plenty of capacity for borrowing.”

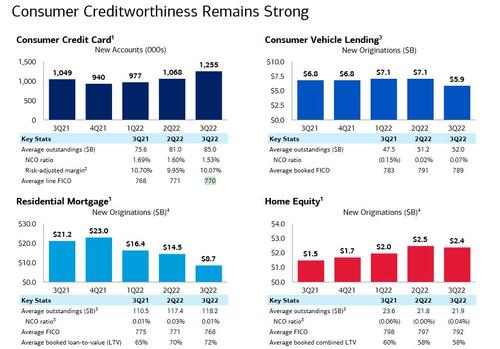

Digging into that credit card business a little more: The firm added 1.25 million new accounts in the quarter, that’s the most of any quarter in at least the last year. But it doesn’t look like they’re widening their credit underwriting standards in any meaningful way here — here are some crazy stats from BofA:

- the average FICO score on consumer credit cards is 770;

- the average FICO score on auto loans is 789.

- the average FICO score on new mortgages is 768.

- the average FICO score on home equity lines is 792!

Bank of America also gives a really interesting metric for cards called “risk-adjusted margin” — that’s basically a measure of profitability that takes into account how much risk you’re taking on for every dollar of revenue. That’s down to 10.07% compared to a year ago (though it’s up slightly from the 9.95% at the end of the second quarter).

The firm’s credit card offerings give some interesting insight into the health of the US consumer right now. As Bloomberg notes, spending on cards soared 13%, and the average outstanding balances were also up 12.4%. For the past few years, banks have complained about higher payment rates on their cards, since customers were flush with cash following trillions of pandemic-induced stimulus packages. It’ll be interesting to hear today if they’re finally starting to see those payment rates come back down.

Bank of America also gives a really interesting metric for cards called “risk-adjusted margin” — that’s basically a measure of profitability that takes into account how much risk you’re taking on for every dollar of revenue. That’s down to 10.07% compared to a year ago (though it’s up slightly from the 9.95% at the end of the second quarter).

BofA also saod that spending on travel and entertainment jumped 20%, so it sounds like the recent high levels of inflation haven’t dampened consumer demand too much. Still, it also looks like spending on gas was up a whopping 23% while food outlays were up 10%.

Here’s another interesting look at the health of the US consumer. BofA says that for those folks who had $2,000 in their bank accounts before the pandemic, they’re still sitting on balances that are five times higher. For folks who had $2,000 to $10,000 in their accounts before the pandemic, they’re now sitting on balances that are three times higher.

All that’s to say, consumers are still pretty flush with cash. That should mean they’re able to handle any downturns in the economy a little more easily than they otherwise would have.

Here are some more observations from Bloomberg:

Banks seem to be having a Goldilocks moment with their credit card portfolios. Spending is up (partly due to inflation and partly due to the fact that consumers are still embracing travel and dining out as the pandemic continues to recede), and that means the fees they collect from merchants each time a customer swipes their cards are also up.

Customers are also finally borrowing again after spending the past few years diligently paying off balances. That comes just as the Fed is raising interest rates, bolstering the net interest income these banks collect. But because folks are still sitting on so much cash, delinquencies remain freakishly low. This is one of banks’ most profitable businesses, so I’m sure this will get lots of attention from investors on today’s call.

Moynihan also made some other optimistic comments: “We continued to see strong organic client growth across our businesses, with increased client activity helping to drive revenue up by 8%. Our US consumer clients remained resilient with strong, although slower growing, spending levels and still maintained elevated deposit amounts. Across the bank, we grew loans by 12% over the last year as we delivered the financial resources to support our clients.”

And indeed, whereas total loans and leases grew by 12% Y/Y…

… the bank’s deposits continue to shrink, down materially Q/Q, and up just 1% Y/Y, after peaking in Q1 2022, driven as usual by the liquidity injections of the Fed. No surprise that as QT has drained the system, that deposits have shrunk and banks have been forced to replace this declining funding with in-house loans and leases.

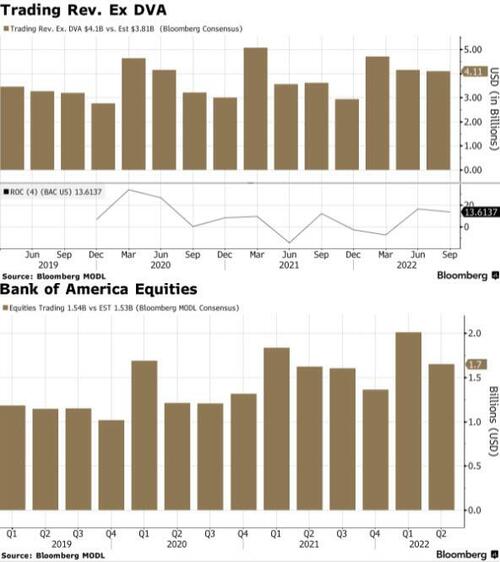

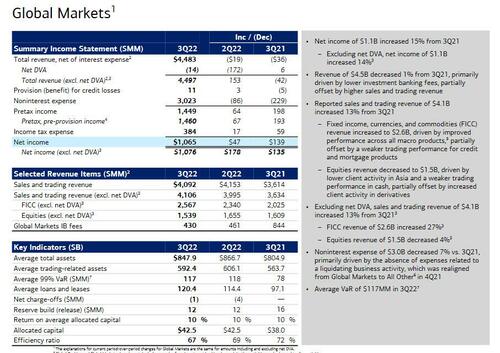

Turning to non-interest income, we find impressive results in the bank’s global markets division where both equity and FICC trading beat expectations (in the case of FICC it even rose materially Y/Y) while investment banking was inline with expectations”

- Trading revenue excluding DVA $4.1 billion, +13% y/y, estimate $3.81 billion

- FICC trading revenue excluding DVA $2.57 billion, +27% y/y, beating the estimate $2.27 billion

- Equities trading revenue excluding DVA $1.54 billion, -4.4% y/y, beating the estimate $1.53 billion

On the fixed income side of the house, here’s what BofA has to say about the much better-than-expected performance. It was “driven by improved performance across all macro products, partially offset by a weaker trading performance for credit and mortgage products.”

Meanwhile, equities, which was down less than expected, was driven by “lower client activity in Asia and a weaker trading performance in cash, partially offset by increased client activity in derivatives.”

And something remarkable: the bank reported that in Q3 it suffered zero trading day losses, an amazin achievement for a quarter where most people could not make any money!

Moving onto investment banking: Advisory fees came in at $432 million, that’s slightly better than the $409 million folks were expecting (though still down a bit from a year ago). There was another beat in the otherwise subdued, debt capital markets revenue was $616 million, which is roughly in line with the $610 million folks were looking for there. Equity underwriting was $156 million, which is also in line with estimates.

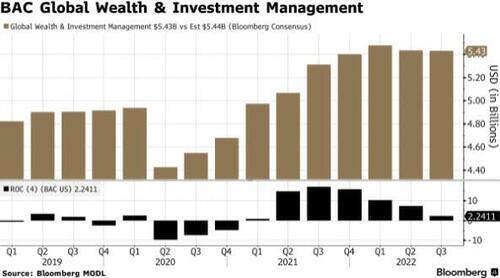

Turning to the global wealth and investment management division saw, revenue climbed 2% to $5.43 billion. This business saw client balances drop 12% in the period because of lower market valuations. Still, the firm added a record number of new bank accounts in the division, so it seems like all the recent markets craziness hasn’t slowed interest in BofA’s offerings here.

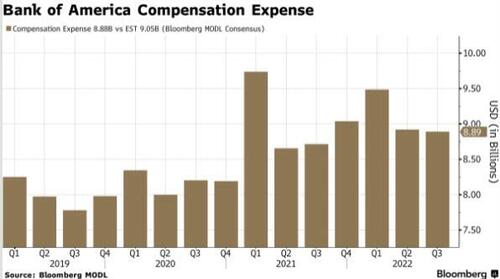

Shifting away from revenue and looking at spending, we find that Bank of America joined rivals in adding to headcount in the quarter. The firm ended the third quarter with 213,270 people on its payrolls after adding about 4,000 staffers during the period. Total comp expenses was little changed from Q2 and modestly higher compared to a year ago.

Overall, this was a blowout quarter by BofA which reported stronger results than most other banks – including JPM – largely thanks to its markets division and soaring net interest income. As such it is no surprise that the bank’s stock is soaring more than 5% this morning as sellside commentators are uniformly supportive of the results.

More in the bank’s full presentation results below (pdf link).

Tyler Durden

Mon, 10/17/2022 – 10:06

via ZeroHedge News https://ift.tt/KWw4hcr Tyler Durden