Japanese Jawboning Won’t Stop Yen’s “Explosive” Downward Spiral From Testing 150/Dollar

Japanese Prime Minister Fumio Kishida is stepping up the rhetoric against a weaker yen, suggesting that policy makers may be willing to step into the markets yet again. Japan’s “yentervention” is doomed to failure.

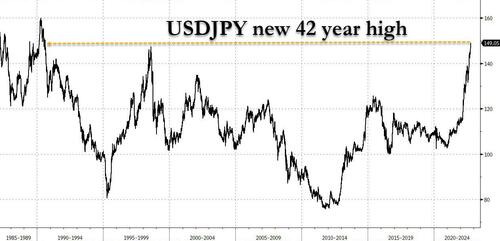

As Bloomberg’s Ven Ram notes, it is important to prepare appropriate action on the yen, Kishida has told parliament, as USD/JPY hovers not too far away from the psychologically significant 150 level. In fact, into the close the USDJPY spiked above 149, a new post-1990 high for the pair.

And while another bout of intervention can’t be ruled out – and may offer some short-term salve to the yen – longer-term support is another matter. After all, the yen is now well below where it was when policy makers intervened last month – meaning traders aren’t respecting the earlier line in the sand.

USDJPY back to pre-intervention levels. 150 next pic.twitter.com/ErjN7Ka00O

— zerohedge (@zerohedge) October 13, 2022

The choices before Japanese policy makers are stark: either relax the yield-curve control framework or be willing to yen the weaken. Until then, as we discussed last month, further interventions are doomed to failure and is why this morning, Japan’s Finance Minister Shunichi Suzuki told reporters he won’t comment, when asked whether the government has conducted any stealth interventions in the foreign exchange market since Sept. 22. Because while there clearly have been interventions, their half-lives are measured in hours if not minutes.

Indeed, as Ram notes, “there is no third choice really at a time when inflationary pressures in the US are likely to compel the Fed to keep going and causing inflation-adjusted yield differentials to move in favor of the dollar against the yen. “

As the Bloomberg strategist concluded:

The yen has declined more than 8% since I noted back in June that the currency is likely to approach 150 per dollar should those differentials widen — which is precisely what has happened.

Which is good… but if we are comparing calls, the yen is down more 23% since we wrote “Yen At Risk Of “Explosive” Downward Spiral With Kuroda Trapped.”

Tyler Durden

Mon, 10/17/2022 – 16:50

via ZeroHedge News https://ift.tt/uclgU2Q Tyler Durden