Stocks Rise As Recession Odds Hit 100% For “Strong As Hell” Economy”

Over the weekend, President Biden declared the US economy “is strong as hell”…

Joe Biden saying, “Our economy is strong as hell,” while eating an ice cream cone is so tone deaf and out of touch to what Americans actually see in their lives that it feels like the Democrats are intentionally tanking the election. pic.twitter.com/blkc4omdhd

— Clay Travis (@ClayTravis) October 16, 2022

Then, White House press secretary Karine Jean-Pierre then doubled-down on that narrative in today’s briefing, suggesting: “Economic indicators are not pointing to a recession…”

Peter Doocy: “How is it that we can be barrelling towards a recession, and the economy is as the President says ‘strong as hell’?”

Karine Jean-Pierre: “We are seeing an economy that is going into a transition with more stable growth…” pic.twitter.com/SY8fLMS0tA

— The Post Millennial (@TPostMillennial) October 18, 2022

There’s just one thing… THEY ARE pointing to a recession.

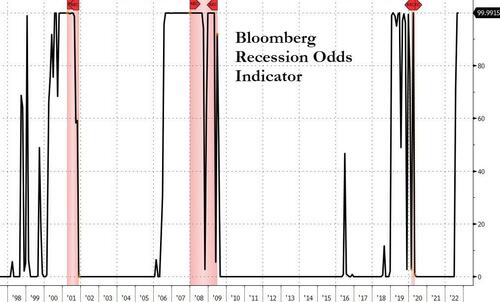

As Bloomberg reports, The latest recession probability models by Bloomberg economists Anna Wong and Eliza Winger forecast a higher recession probability across all timeframes, with the 12-month estimate of a downturn by October 2023 hitting 100%, up from 65% for the comparable period in the previous update.

Source: Bloomberg

The Bloomberg Economics model uses 13 macroeconomic and financial indicators to predict the chance of a downturn at horizons of one month to two years.

JPMorgan Chase CEO Jamie Dimon recently warned that the United States is likely going to fall into a recession in the next six to nine months, adding that the Fed “waited too long and did too little” and is now “clearly catching up.”

For all of Biden’s optimistic remarks on the economy, the president did recently acknowledge that there is a chance that the United States would fall into a recession, though he added that it’s “very slight.”

Economist Nouriel Roubini, dubbed Dr. Doom for his accurate prediction of the market crash during the 2008–09 financial crisis, said in a recent op-ed in TIME that the view that the recession will be mild and short-lived is “dangerously naive.”

“There is ample reason to believe the next recession will be marked by a severe stagflationary debt crisis,” Roubini wrote.

So, with all that said, the market’s expectations for The Fed’s rate-hike trajectory continue to trend hawkishly (with a cycle end in March 2023 at around 4.90%), but stocks (this week) remain decoupled from that reality (for now)…

Source: Bloomberg

Overnight futures ramped ever higher on the negative delta squeeze but the US cash open saw selling appear quickly… and another leg down into the European close amid headlines and UK property fund liquidations (and a really ugly collapse in US homebuilder confidence). Stocks bounced after that but were then monkeyhammered back into the red by AAPL production cut headlines. However, a green close would not be denied and the S&P and Dow closed above 1% on the day…

AAPL dumped into the red on the headlines today…

The open saw the short-squeeze continue but immediately run out of ammo…

Source: Bloomberg

US equities are up over 6% from Thursday’s spike lows…

Treasuries were choppy on the day but ended lower in yield, down 1-2bps almost uniformly across the curve. On the week, the 30Y yield is the only one higher (+2.5bps) while 2Y yields are the leaders (-6.5bps)…

Source: Bloomberg

The 10Y yield burst back above 4.00% again today but by the close it was back below it…

Source: Bloomberg

The dollar chopped around all day but ended practically unchanged…

Source: Bloomberg

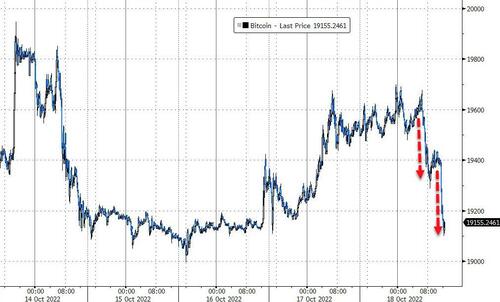

Bitcoin puked back down towards $19,000 (legging on the AAPL news)

Source: Bloomberg

Gold closed marginally lower on the day…

Oil prices puked today with WTI back to a $81 handle ahead of tonight’s API inventory data…

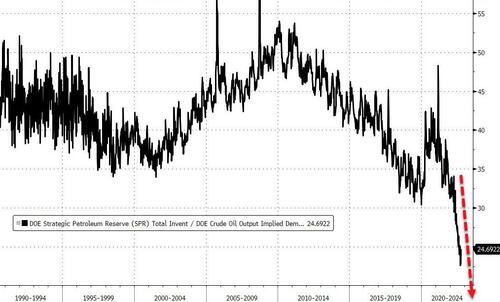

The Biden administration is preparing to announce more SPR releases tomorrow to rescue gas prices from their recent rebound. That will push the SPR even deeper into record lows in the context of days of supply…

Source: Bloomberg

Let’s just hope we really don’t suffer an emergency…

So, Biden does control the price of oil? *confused*

— Nunzio Alioto 🇺🇸 (@nalioto) October 18, 2022

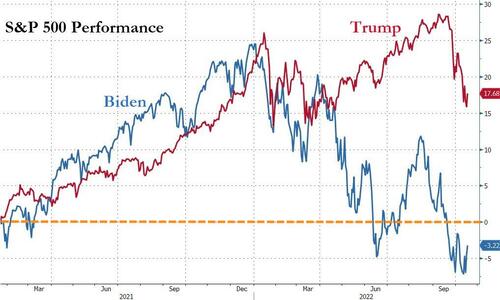

Finally, we note that the S&P 500 is back in the red since Biden took office…

Source: Bloomberg

But the market is not the economy, right…?

Tyler Durden

Tue, 10/18/2022 – 16:01

via ZeroHedge News https://ift.tt/xuMiVWF Tyler Durden