Yields Surge To Session High After Treasury Unexpectedly Projects It Will Issue An Additional $150BN In Q4 Debt

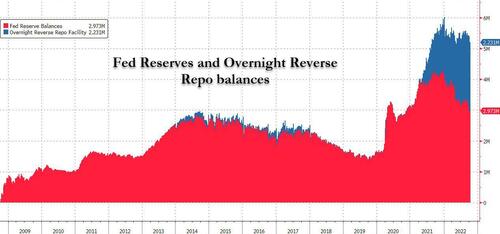

At a time when QT is rapidly shrinking the amount of total reserves, if barely denting the outstanding reverse repos…

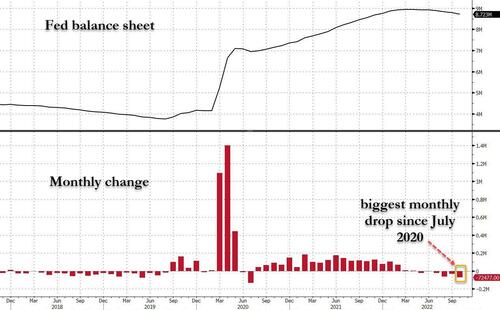

… as the Fed’s balance sheet just shrank by $72BN in the past month, its biggest decline since the early days of the covid crisis…

… many have asked just where will the demand come from to purchase all those trillions in debt that have to be sold over the next two years during which time the Fed’s balance sheet will (supposedly) continue to shrink, and just when will the Treasury commit to TSY buybacks since the Fed won’t do more QE for at least a few more months (until the BLS admits just how ugly US payrolls truly are, a few weeks after the midterms) as the Treasury market continues to fracture and break with every week that nothing happens.

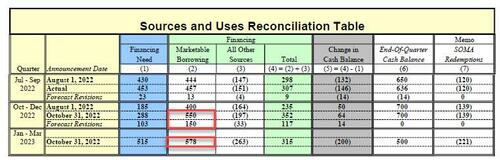

Well, moments ago the Treasury just added fuel to that particularly fiery question when in its latest Marketable Borrowing Estimate it uneviled that in the current October – December 2022 quarter, the US Treasury now expects to borrow $550 billion in marketable debt, assuming an end-of-December cash balance of $700 billion. The borrowing estimate is $150 billion higher than announced in August 2022, and is due primarily due to changes to projections of fiscal activity, greater than projected discount on marketable securities, and lower non-marketable financing.

It doesn’t end there of course, and in its first estimate for borrowing during the January – March 2023 quarter, the Treasury expects to borrow $578 billion in new debt, assuming an end-of-March cash balance of $500 billion. Said otherwise, another $1.1 trillion in debt issuance in the next six months.

As for the historical, July – September 2022 quarter, the Treasury borrowed a relatively modest $457 billion in marketable debt and ended the quarter with a cash balance of $636 billion. In August 2022, Treasury estimated borrowing of $444 billion and assumed an end-of-September cash balance of $650 billion. The $13 billion difference in privately-held net market borrowing resulted primarily from lower net fiscal flows, somewhat offset by the lower end-of-quarter cash balance.

As usual, the Treasury will announce additional financing details relating to Treasury’s Quarterly Refunding this Wednesday at 8:30 a.m. on Wednesday, November 2, 2022, just hours before the FOMC announcement.

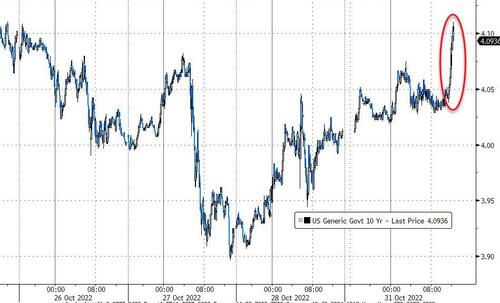

The news that the Treasury will need to issue an additional $150BN was disappointed the market, and sent yields to session highs, while stocks and other risk assets briefly tumbled.

Tyler Durden

Mon, 10/31/2022 – 15:36

via ZeroHedge News https://ift.tt/ab2kVgu Tyler Durden