Yield Curve Inversions Guarantee Recessions… Or Do They?

Authored by Charles Hugh Smith via OfTwoMinds blog,

What’s different now? Quite a few fundamentals are consequentially different.

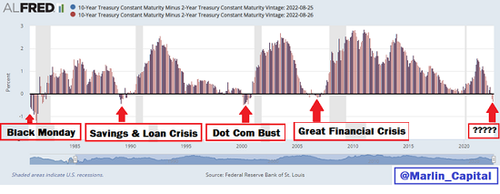

The closest thing to a guarantee in finance is the truism that recessions always follow Treasury bond yield inversions, where short-term bond yields exceed longer-duration bond yields.

Does history alone guarantee the same result this time? The consensus is “yes,” but as grizzled market observers have noted, when everyone is sure the market is going to do one thing, it does something else.

The better approach would be to say all else being equal to previous conditions, recessions follow yield inversions as night follows day. But are conditions the same now? It can be argued that conditions are fundamentally different, and so the guarantee of recession might be flawed.

What’s different now?

Quite a few fundamentals are consequentially different.

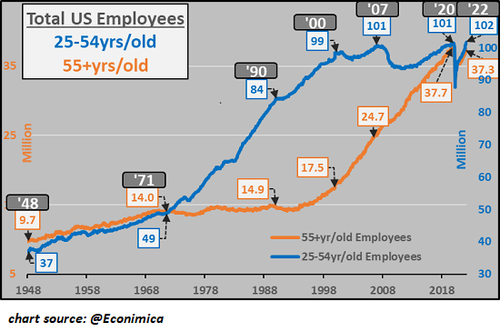

1. The labor force is no longer expanding, and may be shrinking. As the chart below illustrates (courtesy of Econimica), the number of employees 25-54 has been stagnant for 20 years. The only growth in the employed are in the 55 and older cohort, which added 20 million employed in those 20 years.

As the population ages and the birthrate declines, the workforce ages and then shrinks as older workers retire. This puts a floor under employment that didn’t exist in previous eras. Wages are finally rising after 45 years of stagnation. This trend will only accelerate as the workforce contracts.

Social and health changes are exacerbating this contraction in those willing to work. Laying flat and Let It Rot are Chinese terms for younger generations opting out of the rat-race, but they apply to American workers as well. Quiet quitting is only one manifestation of a larger social movement of take this job and shove it.

Long COVID is not being tracked all that well, but anecdotal evidence suggests it’s impacting the younger workforce. The general decline of American workers’ health (lifestyle diseases / disorders, burnout, etc.) is having a substantial but poorly documented effect. The workforce is not just a count of warm bodies, it’s the count of those willing and able to work demanding jobs.

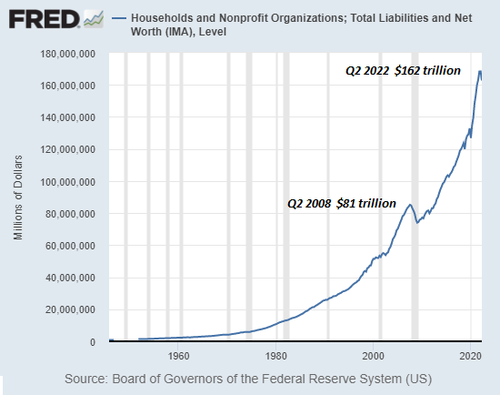

2. Turning to household wealth, note that household wealth doubled from 2008 to 2022, from $81 trillion to $162 trillion in Q2 2022. As noted here many times, the majority of this wealth is in the hands of the top 10%, who generate roughly 40% of all consumer spending.

Many of these households bought assets long ago. Asset valuations can drop substantially but the gains are so large that those who own most of the assets will still feel well-off. For example, if you bought a house for $150,000 and it was worth $1 million earlier this year, if it drops to $750,000 next year, you may regret not selling it but you’re not exactly hurting.

In other words, there are buffers in employment, wages and wealth that are substantially different from previous eras. Labor has already been cut to the bone in most of Corporate America and small business, and essential workers run the spectrum from hotel maids and other lower-skill positions to experienced welders and electricians to tech workers.

The slack got squeezed out long ago. If you struggled to hire reliable, experienced workers, you’re going to do everything else to cut expenses to keep those essential workers in a downturn.

3. Lastly, reshoring and friendshoring are bringing capital and jobs back to North America.

The perversities and vulnerabilities of Hyper-Globalization are now apparent to all, and this reality will only gather momentum.

Recessions are not equal.

A deep recession is characterized by 10% to 15% of the workforce being laid off, and credit, consumption, asset valuations and profits all fall off a cliff.

A recession in which the GDP shrinks by 1% for two quarters while employment remains stable may be more statistical than consequential. All things are not equal, and the herd running toward the “guaranteed recession” may thunder off the cliff.

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)

Tyler Durden

Tue, 11/01/2022 – 07:43

via ZeroHedge News https://ift.tt/dIZEJnx Tyler Durden