The White House Just Changed Its Plan To Refill SPR At $70 Per Barrel

Several months ago, we mocked the ridiculous idea spawned by some of the “best and brightest” progressives currently cogitating and advising the 80-year-old in the White House, according to which even as Biden was actively steamrolling US energy companies by vowing to end US fossil fuel usage in a few decades and single-handedly crushing the price of oil through the biggest ever release of crude from the strategic petroleum reserve (where the term “emergency” now means not war or a natural disaster but Democrats lagging in the polls) he would be throwing them a bone by “promising” to buy oil if and when it hit a price of $72/barrell, as otherwise US producers would have zero incentive ever to invest even one dollar in growth (or even maintenance) capex, thereby guaranteeing much, much higher oil prices once the current SPR drain inevitably drew to a close (which may or many not happen in what’s left of the president’s lifetime).

Progressives cheering the latest SPR news unaware that the government is literally giving out tens of billions in risk-free dollars to US energy producers arbing the SPR trade. https://t.co/572IYI8t9L

— zerohedge (@zerohedge) July 26, 2022

And while on paper this noble lie may have looked appealing – after all by giving an oil price floor, Biden would at least tacitly encourage US majors to invest in much needed growth capex – we warned that it was still nonetheless just that: a lie.

Today, that was confirmed after Biden’s Energy Security Advisor Amos Hochstein said that the White House would look to refill the nation’s Strategic Petroleum Reserves when oil prices were “consistently” at $70 per barrel, Bloomberg said.

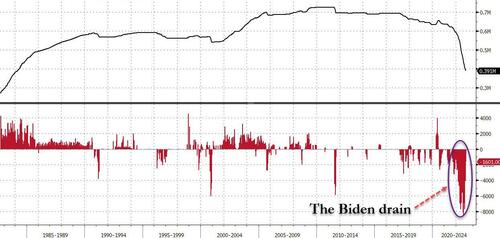

As a reminder, in mid-October, the White House released a fact sheet that outlined the administration’s intention to refill the SPR when oil prices were between $67 and $72 per barrel, following the President’s release of 200 million barrels from the SPR to help bring down the price of oil.

According to the White House statement at the time, the Administration was counting on its repurchase of crude oil helping to create some certainty around future crude oil demand, stimulating greater domestic oil production. The United States has added 15 oil-directed drilling rigs since that announcement was made.

And now, just as we expected, the Administration is walking back that plan by clarifying that its repurchase program would begin only when crude oil prices were $70 or below “consistently”.

Hochstein did not say how long prices would need to stay at the level before repurchasing would begin.

One thing is certain: if and when oil prices are below $70 “consistently”, the White House will next lower the bogey to $60, $50, $40 and so on… as E&Ps watch in disgust and scrap any plans to expand production in the next decade.

Oil prices have been experiencing significant volatility over the past month, with OPEC’s production plans, the EU’s price cap plan and export ban, China’s Covid struggles, and stagnating U.S. production at the center of the volatility.

The amount of crude oil in the Strategic Petroleum Reserve has declined by 204.3 million barrels so far this year, with the current levels at just 389.1 million barrels—the lowest level since March 1984.

“Refining and refilling the reserve at $70 a barrel is a good price for companies and it’s a good price for the taxpayers, and it’s critical to our national security,” The White House said in October. It lied, just as it has lied about everything else.

Tyler Durden

Tue, 11/29/2022 – 22:25

via ZeroHedge News https://ift.tt/1T38lVN Tyler Durden