Q3 GDP Revised Higher As PCE Comes In Hotter Than Expected

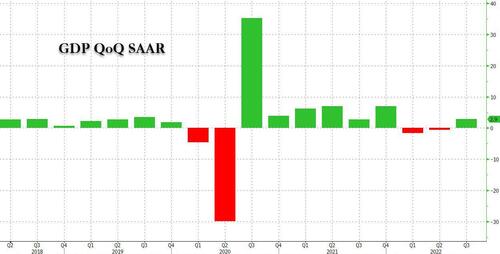

While it’s among the least relevant points of this week’s data deluge as it looks at a quarter that ended nearly 2 months ago (and much has changed since then), moments ago the BEA reported that according to its 2nd estimate of Q3 GDP, the US rebound from the “non-recession recession” of H1 when GDP was negative for 2 quarters, was even stronger than expected, with Q3 GDP revised up from 2.6% to 2.9%, above the 2.8% consensus estimate, with the BEA reporting that the increase “primarily reflected a smaller decrease in private inventory investment, an upturn in government spending, and an acceleration in nonresidential fixed investment that were partly offset by a larger decrease in residential fixed investment and a deceleration in consumer spending. Imports turned down.”

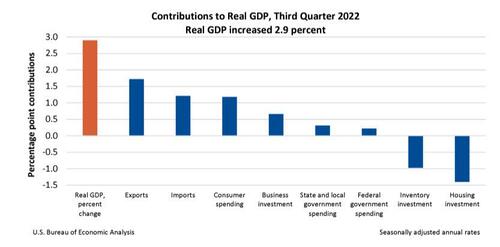

Digging deeper we find that the third-quarter increase in real GDP reflected increases in exports, consumer spending, business investment, and government spending that were partly offset by decreases in housing investment and inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

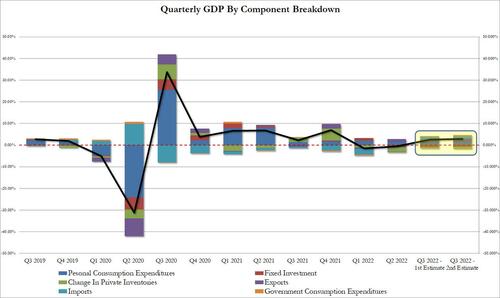

In terms of the revisions from the first to the second estimate, the update primarily reflects upward revisions to consumer spending and business investment that were partly offset by a downward revision to inventory investment. Quantifying the Q3 GDP revision changes we get the following :

- Personal consumption rose 1.18%, up from 0.97% in the first estimate. The increase in consumer spending reflected an increase in services (led by health care and “other” services) that was partly offset by a decrease in goods (led by motor vehicles and parts as well as food and beverages).

- Fixed Investment was less of a detractor, dropping -0.74%, vs -.89% in the first estimate. The increase in business investment reflected increases in equipment and intellectual property products that were partly offset by a decrease in structures. Specifically, nonresidential fixed investment, or spending on equipment, structures and intellectual property rose 5.1% in 3Q after rising 0.1% prior quarter. The decrease in housing investment was led by new single-family housing construction and brokers’ commissions.

- The change in private inventories however offset this, dropping by -0.97%, more than the -0.70% in the first estimate. The decrease in private inventory investment was led by retail trade (mainly clothing and accessory stores and “other” retailers).

- Exports saw a modest gain, adding 1.72% to Q3 GDP, up from 1.63%

- Less imports resulted in a bigger contribution to GDP, boosting it to 1.21% up from 1.14%. The decrease in imports reflected a decrease in goods (led by consumer goods).

- Finally, government consumption boosted GDP by 0.53%, up from 0.42% previously. The increase in government spending reflected increases in state and local as well as federal (led by defense spending).

In other word, the entire GDP boost (2.93%) was attributable to net trade (2.93%) which in turn was driven by energy exports to Europe and weapons exports to the Ukraine, while a slowdown in the US economy meant fewer imports.

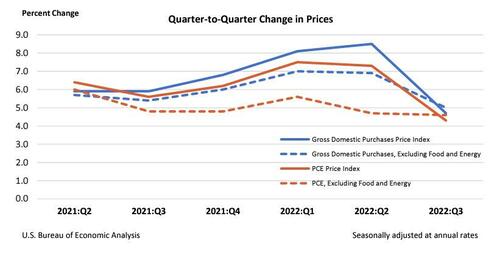

Finally, looking at the all-important PCE components, the GDP Price index came in at 4.3%, above the 4.1% expected, while core PCE Q/Q rose from 4.5% in the first estimate to 4.6%, also above the 4.5% est; this may explain why the market reaction has been rather negative to the GDP report, as the continue heat in PCE may, in the eyes of algos, offset the disastrous ADP print.

Gross domestic purchases prices, the prices of goods and services purchased by U.S. residents, increased 4.7 percent in the third quarter, an upward revision of 0.1 percentage point. Excluding food and energy, prices increased 5.0 percent, an upward revision of 0.2 percentage point. Personal consumption expenditure (PCE) prices increased 4.3 percent in the third quarter, an upward revision of 0.1 percentage point. Excluding food and energy, the PCE “core” price index increased 4.6 percent, also revised up 0.1 percentage point.

Finally, we should remind readers that this data is largely meaningless as it looks at the state of the economy during the summer, while what matters for the Fed is the here and now, and how fast the US slides into recession; which means what Powell says at 1:30pm today will be even more important.

Tyler Durden

Wed, 11/30/2022 – 09:01

via ZeroHedge News https://ift.tt/sgPTje3 Tyler Durden