BOJ Is Less Than A Year Away From Running Out Of Bonds To Buy

Back in 2015, the IMF was the first organization to run the math on Japan’s endless debt monetization and warned that according to a “realistic rebalancing scenario”, the the BoJ would need to taper its JGB purchases in 2017 or 2018, “given collateral needs of banks, asset-liability management constraints of insurers, and announced asset allocation targets of major pension funds. “

Needless to say, the BOJ did not taper its QE, which first started in 2001 and, with various spurts and starts, has continued for more than two decades. In fact, as the BOJ bought ever more and more debt, last June outgoing BOJ governor Kuroda crossed a historic rubicon when the BOJ became the owner of more than 50% of all Japanese bonds, effectively destroying the JGB bond market where it was the marginal price setter, leading to such bizarro outcomes as a record four days in a row without a single trade!

Fast forward to today, when it is 2023 and about 5 years after the IMF’s initial deadline, and when Japan is hanging on by the skin of its teeth, especially after Kuroda’s December “YCC tweak” surprise blew a gaping hole in the Japanese central bank’s credibility and it is now clear that yield curve control can not be sustained.

What takes its place and when is the 1 quadrillion yen problem according to Bloomberg’s Garfield Reynolds, who goes on to note that Tokyo is going to go on spreading rates and currency market turmoil until a solution of some sort is found.

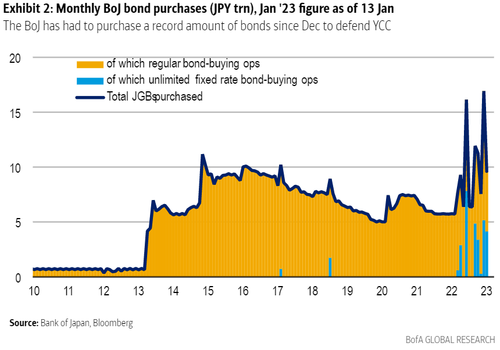

Meanwhile, the absolutely horrific and frantic pace of recent JGB purchases — some 12t yen in a mere four days — exceeds any single month of buying to date.

BOJ is on pace to do $300BN in QE this month https://t.co/VldlKLcbkw

— zerohedge (@zerohedge) January 13, 2023

The central bank’s share of the market likely jumped a full percentage point in January to 53%, and the month is only half over. Hilariously, according to Garfield’s calculations, if the BOJ keeps going like this, then it has some 33 weeks or so left until there are no JGBs left in private hands.

Assuming the government actually increases its borrowings, that would add a few more weeks, but the idea that the BOJ might buy the whole local bond market by the end of 2023 isn’t one policy makers would be especially eager to contemplate.

Tyler Durden

Tue, 01/17/2023 – 15:46

via ZeroHedge News https://ift.tt/4FTe6Gt Tyler Durden