Crisis Over? Europe’s Gas Stocks At Seasonal Record High

By John Kemp, senior energy market analyst

Northwest Europe is half-way through the winter heating season and gas inventories are at a record high following an extended period of exceptionally mild temperatures since the middle of December.

Preparation and luck have combined to rescue Europe from potential gas shortages this winter:

- Preparation by policymakers and forward-looking gas markets ensured inventories began the winter season at the one of the highest levels on record.

- Market-driven high prices have significantly reduced gas and electricity consumption by major industrial customers and more modestly by residential and commercial users.

- Luck in the form of exceptionally mild weather has transformed comfortable stocks in mid-December into plentiful inventories by mid-January.

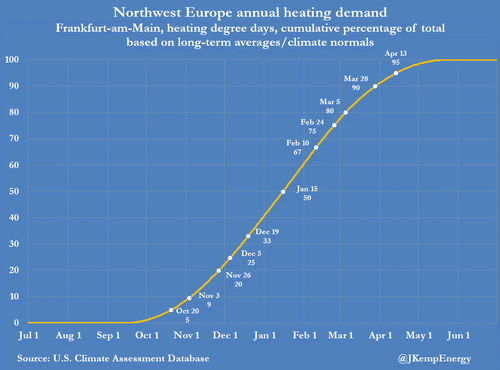

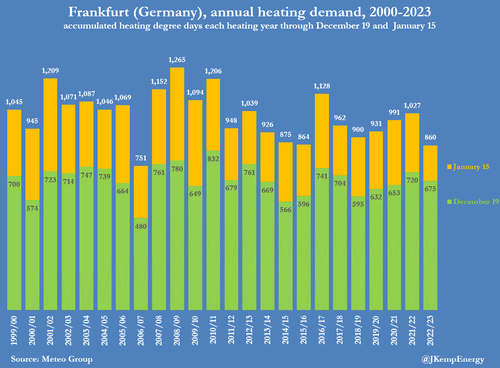

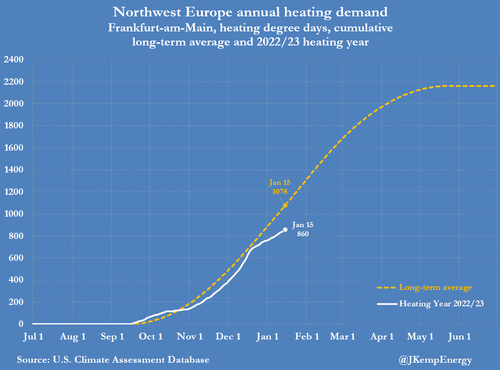

At Frankfurt in Germany, a proxy for the densely populated northwest Europe mega-region, half of winter heating demand occurs on average on or before January 15.

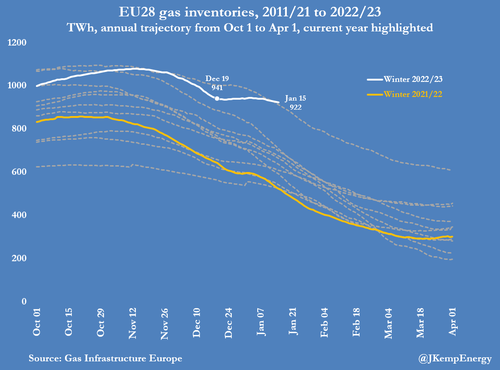

On January 15, inventories across the European Union and the United Kingdom amounted to 922 terawatt-hours (TWh), according to Gas Infrastructure Europe (“Aggregated gas storage inventory”, GIE, January 17).

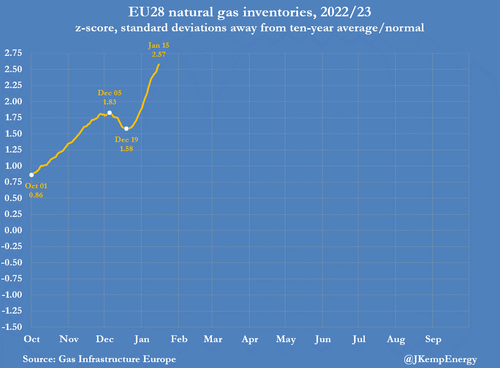

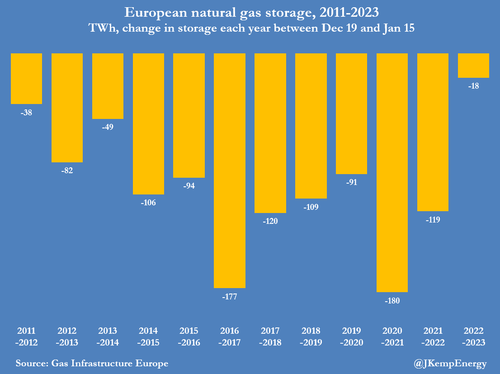

Stocks were 268 TWh (+41% or +2.57 standard deviations) above the prior ten-year average, up from a surplus of 173 TWh (+23% or +1.58 standard deviations) when the warm spell began on December 19 and 92 TWh (+10% or +0.86 standard deviations) at the start of the winter season on October 1.

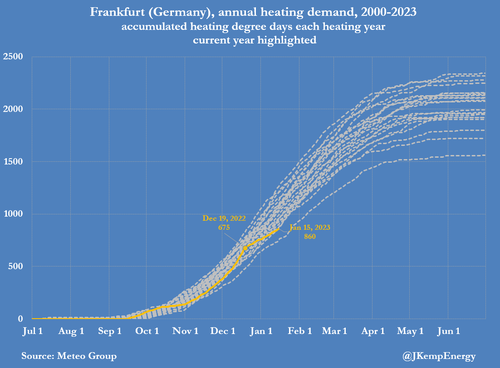

Heating demand started this winter close to the long-term average, with an unusually mild October offset by colder-than-normal temperatures in the first part of December. By December 19, Frankfurt had experienced a total of 675 heating degree days, very close to the long-term average of 682.

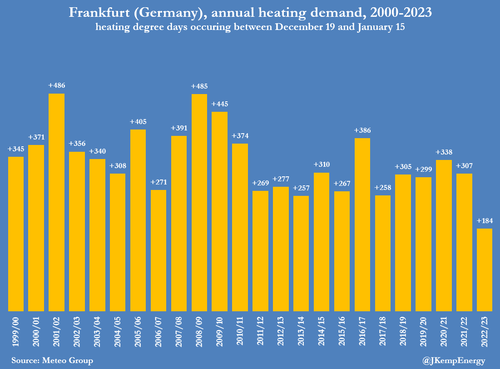

Between December 19 and January 15, however, the region experienced an exceptional and extended period of much warmer temperatures that reduced heating demand significantly.

Frankfurt experienced an additional 184 heating degree days, the lowest this century, and compared with a seasonal average of 341.

Cumulative heating demand so far this winter was 20% below the long-term seasonal average by January 15 compared with a 5% deficit by December 19.

As a result of mild weather, gas inventories depleted by just 18 TWh over the 27 days ending on January 15, compared with an average ten-year depletion of 113 TWh.

EMERGENCY OVER

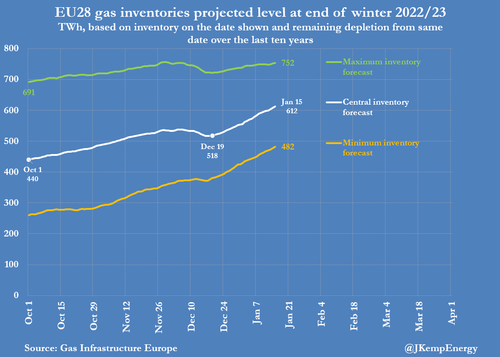

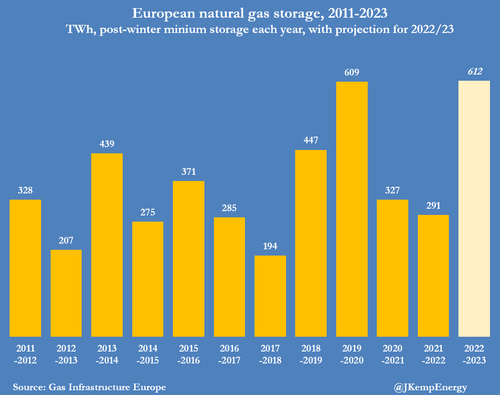

Stocks are now projected to fall to a low of 612 TWh before winter ends, up from a projected low of 518 TWh on December 19 and 440 TWh when the winter season started on October 1.

Inventories are on course to end the winter at the highest level on record, with storage sites still more than 54% full.

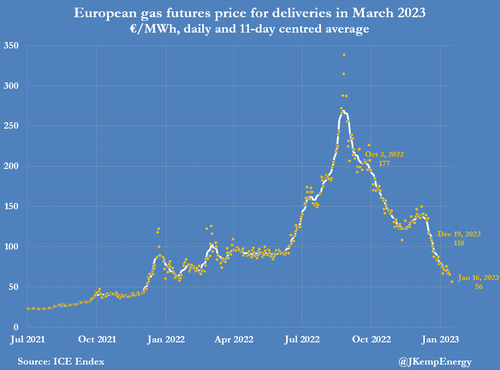

Prices have already slumped to redirect more liquefied natural gas (LNG) to other regions of the world, encourage more consumption in Europe and stem inventory accumulation.

Futures prices for deliveries in March 2023 have halved to €56 per megawatt-hour from €110 on December 19 and €177 at the start of winter.

Lower prices will buy back some consumption lost earlier this winter from the most price-sensitive customers directly exposed to wholesale markets, mostly power producers and energy-intensive industrial users.

Gas-fired electricity generators are likely to operate for more hours at the expense of coal-fired and fuel oil-fired competitors, absorbing some of the surplus. Manufacturers of fertilizer, iron and steel, ceramics, glass and chemicals, as well as non-ferrous smelters, are likely to restart some idled capacity if prices remain lower.

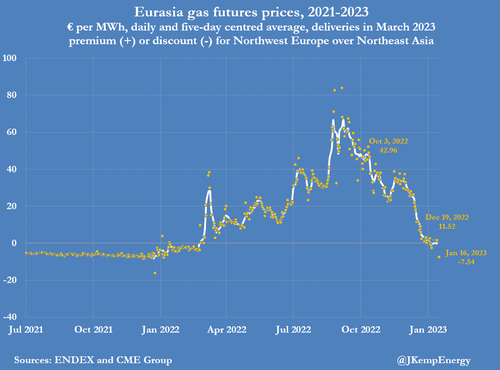

Futures for gas delivered to Northwest Europe are now trading at a discount to gas delivered to Northeast Asia, from a premium over €11 per megawatt-hour on December 19 and almost €43 at the beginning of winter.

Relatively lower European prices should reduce the incentive to maximise LNG inflows and redirect more gas to importers in East and South Asia, which will also limit the further build up of a surplus in Europe.

Tyler Durden

Wed, 01/18/2023 – 03:30

via ZeroHedge News https://ift.tt/qkSjxaP Tyler Durden