Global Smartphone Shipments Plunge Most On Record

A new report via Massachusetts-based International Data Corporation (IDC) revealed worldwide smartphone shipments experienced the most significant quarterly drop on record over the holiday season as cooling consumer demand suggests trouble for smartphone manufacturers ahead of earnings releases.

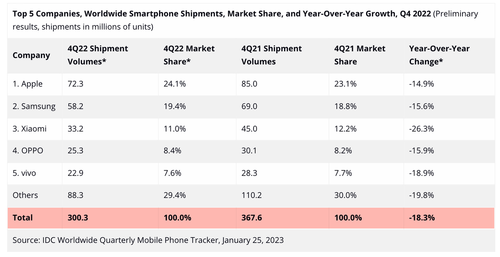

Fourth-quarter global smartphone shipments plunged 18.3% year over year to 300.3 million units.

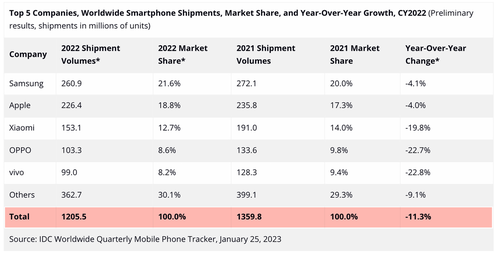

The decline was the largest on record for one quarter and contributed to an annual reduction of 11.3%. 1.21 billion smartphones were shipped for the year, the lowest yearly total since 2013.

IDC blamed the shipment drop on “significantly dampened consumer demand, inflation, and economic uncertainties.”

Commenting on the challenging global smartphone market is Nabila Popal, research director with IDC’s Worldwide Tracker team, who said:

“We have never seen shipments in the holiday quarter come in lower than the previous quarter. However, weakened demand and high inventory caused vendors to cut back drastically on shipments.

“Heavy sales and promotions during the quarter helped deplete existing inventory rather than drive shipment growth. Vendors are increasingly cautious in their shipments and planning while realigning their focus on profitability.

“Even Apple, which thus far was seemingly immune, suffered a setback in its supply chain with unforeseen lockdowns at its key factories in China. What this holiday quarter tells us is that rising inflation and growing macro concerns continue to stunt consumer spending even more than expected and push out any possible recovery to the very end of 2023.”

Also, Anthony Scarsella, research director with IDC’s Worldwide Quarterly Mobile Phone Tracker, sheds light on dwindling consumer demand and perhaps more turmoil for the industry this year:

“We continue to witness consumer demand dwindle as refresh rates climb past 40 months in most major markets.

“With 2022 declining more than 11% for the year, 2023 is set up to be a year of caution as vendors will rethink their portfolio of devices while channels will think twice before taking on excess inventory. However, on a positive note, consumers may find even more generous trade-in offers and promotions continuing well into 2023 as the market will think of new methods to drive upgrades and sell more devices, specifically high-end models.”

IDC’s report was published one week before Apple reveals quarterly earnings. On Monday, UBS wrote in a note to clients that it expects iPhone softness in the December quarter.

None of this should surprise readers as we’ve thoroughly detailed the waning demand for smartphones and PCs that have triggered a semiconductor bust.

Tyler Durden

Thu, 01/26/2023 – 21:50

via ZeroHedge News https://ift.tt/XmLyViq Tyler Durden