Adani Group Stocks Crash, Dragging Down Indian Markets; Bill Ackman Says Hindenburg’s Report “Credible”

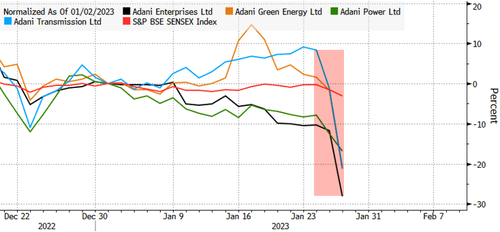

India’s richest man, Gautam Adani, Founder and Chairman of the Adani Group, watched more of his corporate empire implode on Friday, with over $50 billion in market capitalization wiped out in two trading sessions following a report by US short-seller Hindenburg Research.

Adani Enterprises plunged 18.5% on Friday, closing at 2,761 rupees. Shares slid below 3,276 rupees, a level at which investors were allocated shares in a recent equity sale. Other units like Adani Green Energy Ltd. and Adani Total Gas crashed by a daily limit of 20%. Sellers were out in force as daily volumes exceeded three-month averages.

Hindenburg issued the short report late Tuesday night, claiming Adani Group conducted a “brazen stock manipulation and accounting fraud scheme over the course of decades.”

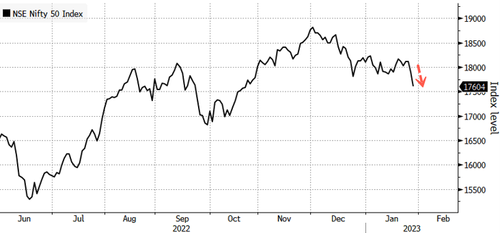

Turmoil spilled into the broader main equity index of the country. NSE Nifty 50 Index sank to its lowest levels since Oct. 21.

“It seems like there might be more downside and this report can become a big legal issue as it is causing reputational damage too,” Sameer Kalra, founder of Target Investing in Mumbai, told Bloomberg.

On Thursday, Adani Group’s legal team released a statement that said it’s exploring legal action against Hindenburg for its “maliciously mischievous, unresearched” report.

Hindenburg released the report as Adani Enterprises was preparing to attract more investors for its share sale. The transaction would be India’s largest-ever primary follow-on public offering.

Joining Hindenburg’s party is Pershing Square’s Bill Ackman. He tweeted late Thursday night that the short report on Adani Group companies was “highly credible and extremely well researched.”

“Adani’s response to Hindenburg Research is the same as Herbalife’s response to our original 350-page presentation,” Ackman tweeted, referring to his short-selling campaign against Herbalife Nutrition Ltd. five years ago.

Adani’s response to @HindenburgRes is the same as @Herbalife’s response to our original 350-page presentation. Herbalife remains a pyramid scheme. I found the Hindenburg report highly credible and extremely well researched. @AdaniOnline response speaks volumes. Caveat emptor. https://t.co/og6DLbPzp5

— Bill Ackman (@BillAckman) January 27, 2023

Even before Hindenburg, CreditSights noted months ago that Adani’s conglomerate is “deeply overleveraged” with “stretched balance sheets.” However, the US short seller seems to put a massive spotlight on the group’s corporate governance.

… and maybe it’s time for Carl Icahn to chime in.

Hey @Carl_C_Icahn time to go long Adani https://t.co/WRDFnsI9Gh

— zerohedge (@zerohedge) January 27, 2023

Hindenburg’s newest campaign to take on India’s richest person and roil markets of an entire country is undoubtedly a step up from publishing short reports on small US companies, such as correctly calling the fraud in electric-vehicle maker Nikola.

Here’s something to ponder.

Adani’s debt bubble will probably be the cause of the first Indian financial crisis. They have loans from the largest banks and part of every major mutual fund portfolio. The market will go down with it

— T Anurag ⚡ (@T_Anurag_Nair) January 27, 2023

Tyler Durden

Fri, 01/27/2023 – 07:51

via ZeroHedge News https://ift.tt/Neguvia Tyler Durden