A Tale Of Two FICOs: As Discover Braces For Middle-Class Doom, AmEx Explodes As The Rich Splurge

For a striking glimpse into the divergence between the worlds of the haves (i.e., the “top 1%”) and the have nots (everyone else), look no further than the earnings reports of credit-card issuer Discover, which tends to target lower and middle-income consumers, and American Express, which counts the wealthiest Americans as its clients: the divergence couldn’t be greater.

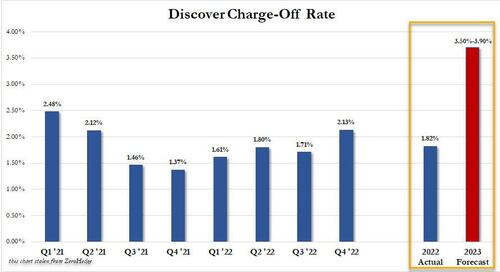

As we reported last week, there was a collective gasp from Wall Street analysts when Discover reported that its projected charge off rate for 2023 would surge, and expects it to more than double from its current 1.82% to as much as 3.90%.

The news sent DFS shares tumbling (at least initially, they have since been caught up in the market-wide squeeze that sent stocks to a 6 week high).

But what a difference a week makes: fast forward to today when unlike Discover, American Express did not predict any jump in charge offs; in fact the only thing that jumped – the most in more than two years in fact – was the company’s stock as the credit-card giant predicted that revenue and earnings for 2023 will surge well above what analysts estimated after the company saw customer spending on its cards soar to a record in the final three months of the year.

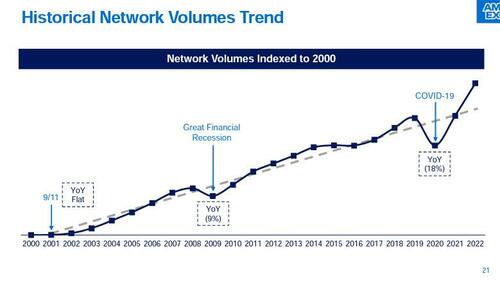

While total volume on AmEx’s network increased less than expected in the final three months of last year, the record number of new cardholders AmEx added in 2022 should help revenue climb as much as 17% in 2023, the company said. That’s about 50% higher than the 11% analysts in a Bloomberg survey were expecting.

“It’s a premium customer base, and that premium customer base, while not immune to economic downturns, certainly right now is spending on through,” Chief Executive Officer Stephen Squeri said on a call with analysts Friday. “This is a premium card member base that appreciates premium products and is spending.”

Squeri also said in the company’s press release that earnings per share should jump to a range of $11 to $11.40, both well above the consensus estimate of $10.52.

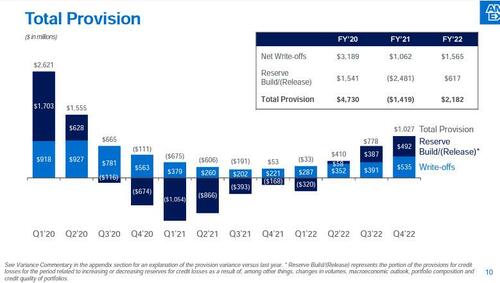

To be sure, not even Amex expects smooth sailing, and just like all US banks announced two weeks ago, the company set aside $1.03 billion in provisions for souring loans after net charge-offs rose; the provisions depressed on profit, which dropped 9% to $1.57 billion, or $2.07 a share.

At the same time, expenses increased as AmEx spent more on compensation and cardmember rewards, with total costs coming in at $11.3 billion. That compares with the $11 billion average of analyst estimates compiled by Bloomberg.

AmEx is also tightening up underwriting as it prepares for any economic weakening that may come. Those actions can include lowering existing cardholders’ credit lines and also raising the bar for new cardholders looking to get an AmEx card for the first time. There was also a potential red flag: the company is seeing a slight pullback by small business cardholders, including a drop in spending on digital ads on Facebook and Google.

And speaking of weakening, here is the downside scenario contemplated by American Express: it sees the unemployment rate rising to 8% and GDP tumbling as much as 7%.

To offset some of the profit decline, AmEx has been aggressively going after more customers, tweaking rewards on many of its cards which helped it add millions of new cardholders last year. The credit-card giant has also benefited from the rebound in travel and dining.

“We’re not oblivious to all the economic uncertainty,” Chief Financial Officer Jeff Campbell said in an interview. But “our business is not representative of every sector of the economy. We run the company based on what we see.”

Needless to say, what AXP is seeing must make it – and its shareholders – happy because while DFS shares were hammered on earnings, AXP shares soared as much as 11%, the biggest intraday surge since November 2020.

The company’s presentation is below (pdf link).

Tyler Durden

Fri, 01/27/2023 – 12:07

via ZeroHedge News https://ift.tt/1P5YdVx Tyler Durden