Tesla Reports Record Deliveries Of 422,875 In Q1 2023, Helped By Price Cuts

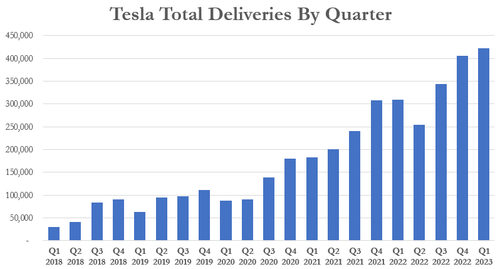

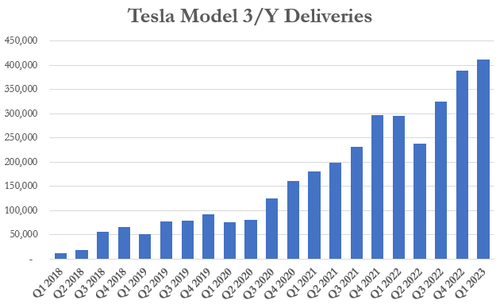

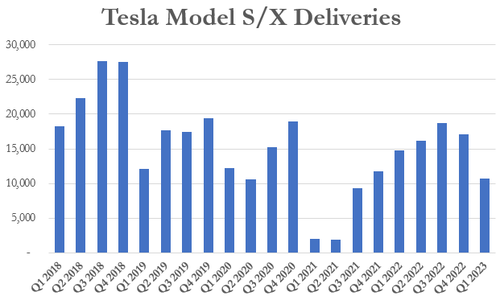

Tesla reported Q1 2023 deliveries on Sunday, posting a figure of 422,875 vehicles delivered, beating most current consensus Wall Street estimates. The company delivered 10,695 Model S/X vehicles and 412,180 Model 3/Y vehicles.

Original analyst expectations were for 430,008 vehicles, according to Refinitiv data cited by Reuters. Multiple outlets are reporting the number as a miss (it was, compared to original estimates) and a beat (it was, compared to current lower-balled estimates).

This Q1 figure was a 36% increase year over year and a 4% increase sequentially, compared to the 405,278 deliveries the company posted in Q4 2022. Bulls are likely to see the beat as good news, while bears will likely argue that the “beat” wasn’t enough given the drastic price cuts Tesla has put into place since the end of last year.

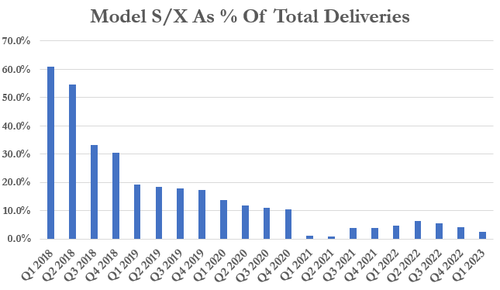

“We continued to transition towards a more even regional mix of vehicle builds, including Model S/X vehicles in transit to EMEA and APAC,” the company’s release said. Despite this mix change, the Model S and Model X are becoming dwindling contributors to Tesla’s delivery bottom line.

Martin Viecha, Tesla’s head of IR, said Sunday: “Sequential growth continues even in the first quarter.”

Analyst Dan Ives weighed in, reminding people that the figure reported keeps the company on pace for a 1.8 million delivery goal it had set for the year. Ives suggested this longer-term goal could be what drives sentiment in the stock in the upcoming week.

For Tesla this delivery number keeps the company on pace for a 1.8 mm delivery unit bogey for the year. That remains front and center for investors awaiting these 1Q delivery numbers in a murky macro.

— Dan Ives (@DivesTech) April 2, 2023

Ben Rose, president of Battle Road Research, told the New York Times: “While the precise impact of recent price cuts and tax credits are difficult to determine, both act as tailwinds for the company.”

Tesla bull Gene Munster told Reuters: “If they wouldn’t have done the price cut, it would have been ugly. I think what it tells you is the economy is getting tough. They showed an acceleration, but they didn’t accelerate to the level that Elon had suggested it would.”

In the beginning of March, we noted that Tesla cut prices on its Model S and Model X vehicles. This decision followed its investor day event held at the end of February, wherein Elon Musk stated that price cuts had sparked demand for more affordable models.

Musk claimed that the demand for Teslas was nearly unlimited and would increase significantly as the company made its vehicles more affordable. The recent price reductions for the S and X models implied at the time that these vehicles may not have experienced the same boost in demand as the rest of the lineup when the company reduced prices earlier this year. The Q1 figures seem to tell that same story.

In January, Tesla slashed the prices of its more affordable vehicles by as much as 20%, which enabled buyers to qualify for the tax incentive by putting the vehicles under a $55,000 cap. Musk directly addressed the price cuts during the investor day, stating: “We found that even small changes in the price have a big effect on demand, very big.”

Recall, days ago we highlighted work from GLJ Research’s Gordon Johnson, who slashed his delivery estimates due to pull forward of a “demand crush”. Johnson is of the camp that the tailwind provided by price cuts is already growing weary.

He said days ago that consensus for the quarter currently sat at 418,756, suggesting a “beat” is on tap. He was accurate about beating that figure, but says that the 1.8 million target for the year may not be the incredible news the street is looking for.

“With our model pointing to an avg. 1Q23 price cut across all of TSLA’s cars of -$6.0K/car, or -11.7% QoQ, vs. sales growth of just +5.2% QoQ,” he said such a figure would be “nothing short of a disaster”.

“Even if TSLA gets to 1.8mn cars sold in 2023 (i.e., 450K cars/quarter of sales), things still look (very) bad from an earnings perspective,” he wrote. Johnson’s estimate was for $2.67/share in EPS versus consensus of $3.98/share for Tesla for the year:

So, taking an assumed 2023 profit per car of $9,196, then subtracting $4,500, one arrives at a new profit per car of $4,969. Then, applying the low-end of TSLA’s guidance for 1.8mn cars sold in 2023, or $4,969 * 1.8mn, one arrives at a 2023 net profit of $8.452bn. Finally, dividing this number (i.e., $8.452bn) by TSLA’s shares outstanding of 3.164mn, one arrives at an EPS of $2.67/share (vs. the current Consensus est. of $3.98/share, suggesting sharp cuts to TSLA’s earnings are on tap through 2023), or 71.8x earnings, and a -27.0% fall in EPS YoY. Consequently, even with a ~450K delivery number, the 2023 outcome for TSLA’s stock, as Consensus is forced to reckon with falling earnings, is likely (much) lower.

We’ll wait to see if those numbers are eventually updated due to the new delivery figures.

Tyler Durden

Sun, 04/02/2023 – 16:30

via ZeroHedge News https://ift.tt/vO0TReA Tyler Durden