Oil Soars, Futures Flat After Shock OPEC Output Cut

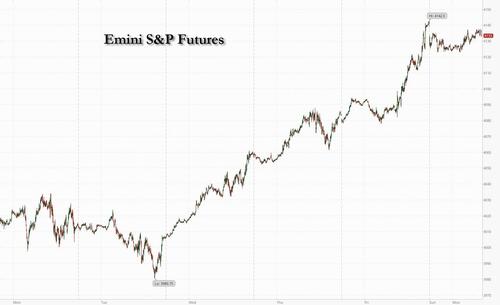

Last week’s torried rally in US equities hit the brakes on Monday as investors digested the shocking move by OPEC+ to cut oil production by a total of 1.66 million barrels a day. S&P futures were lower by 0.1% following a 3.5% gain last week, while Nasdaq 100 contracts – which entered a bull market last week – lose 0.6% as Tesla shares fell in the premarket after 1Q deliveries fell short of expectations. Spot gold falls 0.2% to $1,964. Bitcoin rises 0.9%.

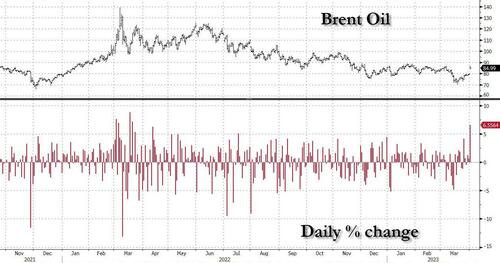

Brent crude headed for the biggest gain since April 2022 while West Texas Intermediate was poised for the best day since May. The Organization of Petroleum Exporting Countries and allies including Russia pledged on Sunday to make the cuts from next month that will exceed 1 million barrels a day, with Saudi Arabia leading the way with 500,000 barrels. Brent crude futures are up 5.3% at around $84.15, the biggest one-day gain in almost a year, while WTI adds 5.5% to trade near $79.80 lifting energy stocks: Chevron and Exxon Mobil rallied in premarket trading.

In other notable premarket moves, Tesla slipped after the electric-carmaker’s first-quarter deliveries fell short of the pace required to meet Elon Musk’s long-held goal of 50% annual growth. World Wrestling Entertainment shares fell after Bloomberg News reported that entertainment conglomerate Endeavor Group Holdings Inc. is near a deal to acquire the wrestling company for about $9 billion. Here are the other notable premarket movers:

- Apellis Pharmaceuticals (APLS) rose 17% after the biotech firm drew takeover interest from larger drugmakers. The company is speaking to advisers to consider its options amid the interest, according to a Bloomberg News report citing people familiar.

- Energy stocks rallied in premarket trading as the price of oil jumped following OPEC+’s announcement of a surprise production cut. Chevron (CVX US) +4.4%, Exxon (XOM US) +4.3%, ConocoPhillips (COP US) +5%, Marathon Oil (MRO US) +7%; oil-field services provider Schlumberger (SLB US) +4.6%, Halliburton (HAL US) +4.9%.

- Intel Corp. (INTC) is upgraded to market perform from underperform at Bernstein, which writes that things may be starting to turn around for the chipmaker. Shares little changed premarket.

- Micron (MU) shares were set to extend losses after Beijing launched a cybersecurity review of imports from the largest US memory-chip maker, escalating a semiconductor battle between the two countries. Morgan Stanley, however, said there shouldn’t be any near-term impact.

- Shares of US-listed casino operators that operate in Macau surge in premarket trading, after data showed that the city’s gaming revenue soared 247% in March, buoyed by a return of tourists from mainland China as Covid restrictions ease.

- Las Vegas Sands (LVS) rises 3.6%, Wynn Resorts (WYNN) +3.3%, MGM Resorts +1%, Melco Resorts gains (MLCO) gains 5%.

Monday’s market moves presented a contrast to a consensus view that drove up asset prices at the end of the first quarter, when Treasuries and stocks rallied amid expectations the banking turmoil in rich nations will encourage the Fed to pause interest-rate hikes and opt for a cut later this year. Those bets were now being revised: Money markets raised the probability of a quarter-point interest-rate hike in May to 65% from 55% seen earlier.

“The impact of this will feed into inflation data globally and means that inflation may take longer to return to target,” said Mark Dowding, the chief investment officer at BlueBay Asset Management. “This will mean that interest rates, once they peak, will need to stay at higher levels for longer.”

Inflation “just doesn’t go away,” said Marija Veitmane, senior multi-asset strategist at State Street Global Markets. “We have a strong labor market, a consumer who can spend, and now oil prices are coming up. It’s increasingly challenging for central banks,” she said in an interview with Bloomberg Television. “Equities are really at risk because inflation fighting is not over. The Fed needs to get aggressive and keep policy tight, and that will crater earnings.”

Meanwhile, Morgan Stanley’s Michael Wilson who has become a bearish broken record, warned the rally in tech stocks that has exceeded 20% isn’t sustainable and that the sector will return to new lows. Wilson said the rotation into tech is taking place partly because it’s being viewed as a traditional defensive sector, though he disagrees with that thesis and sees utilities, staples and health care as having the better risk-reward profile.

Outside of the energy sector, however, the equity-market sentiment was muted. Europe’s Stoxx 600 index was little changed as 14 0f its 20 subgroups posted losses. Energy stocks outperformed and helped push the major European equity benchmarks higher with the Stoxx 50 rising 0.2% and the FTSE 100 up 0.7%. Here are the notable premarket movers:

- Siemens Energy rises as much as 6.6% after being rated overweight at Morgan Stanley, which sees significant upside for the gas turbines and wind energy group

- Burford Capital shares rise as much as 42% in London, after the litigation financing firm got a boost in its bet on a lawsuit involving Argentinian oil company YPF

- European energy stocks outperform Monday, after an unexpected crude output cut from OPEC+ sent crude futures soaring

- Hennes & Mauritz shares rise as much as 1.8%, after Credit Suisse upgrades the clothing retailer to neutral from underperform

- Industrials REIT shares jump as much as 39%, after Blackstone agrees the key financial terms of a final proposal for a possible cash offer at 168p/ share

- Anglo American fluctuates between gains of 2.1% and 0.6% decline after Barclays upgrades the miner to overweight from equal-weight, citing a pullback in shares

- Oil tanker company shares extend declines, after a shock OPEC+ output cut sent crude futures soaring as much as 8%, delivering a fresh jolt to the world economy.

“We’re now probably about to enter a very short-term down leg again,” Paul Gambles, MBMG Group co-founder and managing partner, said on Bloomberg Television. “We’ve had a year of pretty irresponsible policy guides and all the damage that they’ve done is now starting to show up.”

Earlier in the session, Asian stocks dropped as a surprise announcement by OPEC+ to cut crude outputs sparked concerns over further inflation risks. The MSCI Asia Pacific Index fell as much as 0.4%, dragged by tech stocks. Energy shares were the biggest gainers on the regional gauge. Benchmarks in Japan, mainland China, Australia and Singapore rose while those in South Korea fell. The unexpected production cut by OPEC+ overshadowed Friday’s data that indicated US inflation was cooling, which may cloud outlook on the Fed’s rate hike path. Asian stocks are still relatively well-positioned to weather any shocks compared to other markets due to their high growth potential and as the Fed is seen to near the peak of its hiking cycle, according to strategists. “Asia ex Japan, the one region where we see growth strong and accelerating this year, should be a relative outperformer,” Morgan Stanley strategist Andrew Sheets said in a report. The bank remains cautious on global equities as “a sharp slowing of a previously strong economy has repeatedly been poor for stocks relative to high grade bonds.” Asian stocks gained in the past two weeks, rising about 4% from its mid-March low, as concerns over a banking crisis eased. The main Asian stock gauge is still about 5% below its late-January high.

Japanese stocks climbed, as investors looked to cooling US inflation data and as OPEC+ cut its oil production, weakening the yen. The Topix Index rose 0.7% to 2,017.68 as of market close Tokyo time, while the Nikkei 225 advanced 0.5% to 28,188.15. Toyota Motor contributed the most to the Topix gain, increasing 0.9%. Out of 2,160 stocks in the index, 1,648 rose and 445 fell, while 67 were unchanged. “The PCE seems to have calmed down and is well received in the markets.” said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management. “Mining and petroleum are rising due to high crude oil prices, but caution is required as it may lead to high resource costs.”

The commodity-heavy Australian market rose with the S&P/ASX 200 index up 0.6% to close at 7,223.00, extending gains for a sixth day, boosted by a rally in energy stocks. Oil shares jumped after OPEC+ announced a surprise oil production cut of more than 1 million barrels a day. On Tuesday, Australia’s central bank will deliver a rate decision. Economists are divided over whether the Reserve Bank of Australia will raise interest rates for an 11th consecutive meeting or pause its most aggressive tightening cycle since 1989 amid cooling economic momentum.

In FX, commodity related currencies also received a boost with the Norwegian krone and Aussie dollar the best performers among the G-10’s while the Canadian dollar climbed to a five-week high versus the greenback. The Bloomberg Dollar Index was up earlier after rising oil prices worsened jitters around US inflation, but later turned negative.

In rates, treasuries remained cheaper across the curve after yields gapped higher at the open as oil surged on OPEC+ group’s surprise plan to cut production. US two-year yields have added 8bps to 4.10% as traders bet higher oil prices will have implications for inflation and monetary policy. Monday’s losses unwind a portion of last week’s steep gains into quarter-end. Yields are higher by 5bp to 3bp across the curve with front-end-led losses flattening 2s10s, 5s30s spreads by ~2bp and ~1bp on the day; 10-year around 3.50% underperforms bunds and gilts by 1.5bp and 2bp in the sector. Money markets raised the odds on a quarter-point interest-rate hike from the Federal Reserve in May to 65% from 55%, while a half-point of subsequent easing remained priced by year-end.

In commodities, oil prices are sharply higher following the surprise move by OPEC+ to cut production. Brent crude futures are up 5.3% at around $84.15 while WTI adds 5.5% to trade near $79.80. WTI crude futures pared an 8% earlier advance to around 6%, while Fed rate-hike premium has increased slightly for the May policy announcement.

Looking at today’s calendar, US economic data slate includes March S&P Global US manufacturing PMI (9:45am), February construction spending and March ISM manufacturing (10am); week also includes durable goods orders, JOLTS, ISM services and March.

Market Snapshot

- S&P 500 futures down 0.2% to 4,128.00

- MXAP little changed at 161.99

- MXAPJ down 0.3% to 522.58

- Nikkei up 0.5% to 28,188.15

- Topix up 0.7% to 2,017.68

- Hang Seng Index little changed at 20,409.18

- Shanghai Composite up 0.7% to 3,296.40

- Sensex down 0.1% to 58,924.87

- Australia S&P/ASX 200 up 0.6% to 7,223.02

- Kospi down 0.2% to 2,472.34

- STOXX Europe 600 little changed at 458.01

- German 10Y yield little changed at 2.36%

- Euro little changed at $1.0838

- Brent Futures up 5.2% to $84.07/bbl

- Gold spot down 0.3% to $1,963.28

- U.S. Dollar Index up 0.20% to 102.72

Top overnight News

- The China reopening effect that’s been highly anticipated — and at times, perhaps dangerously so — around the world is starting to emerge. Some promising readings in the forward-looking purchasing managers’ indexes show that factory managers are seeing a healthy flow of orders ahead, and putting the quirks of the Lunar New Year season behind them. BBG

- Macau’s casinos had their best month since the earliest days of the pandemic, with gaming revenue surging 247% in March after Chinese tourists flocked to the gambling hub as the end of Covid Zero sparks a travel boom. BBG

- China’s biggest banks say they have escaped unscathed from the financial crisis in the US and Europe, following the collapse of Silicon Valley Bank and Credit Suisse. China’s top lenders — Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China and Bank of China — have all reported there was no direct damage to their books from last month’s emergency rescue of Credit Suisse by UBS and failures in the US banking sector. FT

- Chinese authorities warned the nation’s top banking executives that the crackdown on the $60 trillion industry is far from over in a private meeting late Friday, just as they were about to announce the probe of the most senior state banker in nearly two decades. BBG

- OPEC+ on Sunday announced a surprise cut to production of >1M BPD, with Saudi Arabia accounting for ~500K of the reduction (while Russia said the previously announced production cut it planned to implement from March to June would continue until the end of 2023). BBG

- Switzerland’s Federal Prosecutor has opened an investigation into the state-backed takeover of Credit Suisse by UBS Group the office of the attorney general said on Sunday. The prosecutor, based in the Swiss capital Bern, is looking into potential breaches of the country’s criminal law by government officials, regulators and executives at the two banks, which agreed on an emergency merger last month to avoid a meltdown in the country’s financial system. RTRS

- Banks are still struggling to offload ~$25-30B of “hung” debt related to LBOs, including a large chunk related to Twitter that’s increasingly unattractive. WSJ

- Donald Trump will plead not guilty when he appears in a Manhattan court tomorrow to face charges related to alleged hush money payments to porn star Stormy Daniels during the 2016 campaign, his lawyer told CNN. His team may also ask to move the case to the more conservative NY borough of Staten Island out of concern he won’t get a fair trial. He leaves Mar-a-Lago at noon today. BBG

- Auto discounts are creeping higher as OEMs work to move inventory amid tightened lending availability owing to Fed rate hikes and March’s regional banking turmoil. FT

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly positive amid strength in the energy sector after oil prices were boosted by a surprise voluntary output cut by OPEC+ members although gains in the broader market were capped heading into this week’s key events and as participants digested a slew of data releases including disappointing Chinese Caixin Manufacturing PMI. ASX 200 was underpinned by the energy-related gains and with money market pricing leaning heavily towards a pause at tomorrow’s RBA meeting, while analysts are near-evenly split between a hike and a pause. Nikkei 225 notched modest gains with upside capped following the mixed Tankan survey in which the large manufacturers’ sentiment index deteriorated for the 5th consecutive quarter and fell to its lowest since December 2020. Hang Seng and Shanghai Comp. were mixed with price action cautious after Chinese Caixin Manufacturing PMI showed activity was flat in March and following a substantial liquidity drain by the PBoC.

Top Asian News

- PBoC called for stronger defences against a financial crisis and said that China should accelerate legislation of the Financial Stability Law, as well as improve other legal arrangements to prevent and dispose of financial risks, according to three central bank officials in PBoC-affiliated publication China Finance.

- Japanese Foreign Minister Hayashi met with Chinese Foreign Minister Qin and expressed concern regarding the situation in Hong Kong and Xinjiang, while Hayashi raised the issue with Premier Li regarding a detained Japanese national who was trying to promote Japanese investment in China and Hayashi was also reported to have met with Politburo member Wang Yi. Furthermore, Japan urged China to view the Ukraine war from a rule of law perspective and take responsible actions in the UN Security Council, while China pressed Japan to change course on chip export curbs, according to Reuters and FT.

- US called for joint G7 action against China’s economic bullying, according to Nikkei.

- US lawmakers are to meet with Taiwanese President Tsai, Apple (AAPL) CEO Cook and Disney (DIS) CEO Iger, according to Bloomberg.

Equities are broadly mixed/tentative as markets digest elevated oil prices against the potential inflation/Central Bank implications, Euro Stoxx 50 +0.2%. FTSE 100 +0.7% is the current outperformer given its Energy exposure, with the sector leading the European upside while Travel & Leisure names lag given higher fuel costs. Stateside, futures are softer but similarly tentative with the NQ -0.6% lagging as yields increase ahead of Fed speak and ISM Manufacturing to kick off the shortened week. Switzerland’s Attorney General is to investigate whether the Credit Suisse (CSGN SW) takeover by UBS (UBSN SW) broke Swiss criminal law and is looking into potential breaches by government officials, regulators and bank executives, according to The Guardian. Credit Suisse (CSGN SW) expands its sustainability offering for corporate clients through a new partnership with Act Cleantech Agentur Schweiz, while it was separately reported that UBS (UBS SW) shortlisted four consultants for the Credit Suisse integration and UBS will cut its workforce by between 20%-30% after completing the takeover.

Top European News

- Hundreds of UK travellers faced disruptions for the third day at the Port of Dover as ministers insisted that the cause for the Channel crossing delays was not linked to Brexit, according to FT.

- ECB’s de Guindos said headline inflation is likely to decline considerably this year but added that underlying inflation dynamics will remain strong, while he noted that feedback between higher profit margins, wages and prices could pose more lasting upside risks to inflation. De Guindos also stated that the ECB is monitoring broad risks across the financial sector and will act to preserve liquidity in the euro area, as well as noted the Euro area banking sector is resilient with strong capital and liquidity conditions although vulnerabilities in the financial system prevail in the non-bank financial sector which grew rapidly and increased its risk-taking during the low interest rate environment, according to Reuters.

- ECB’s Panetta said there is a lot of discussion on wage growth and that they are probably paying insufficient attention to the other component of income which is profit.

- BoE Chief Economist Pill says inflation is still much too high. UK banking system is strong, via Le Temps.

- Italian Economy Minister Giorgetti said forecasts for 2023 are improving and they expect GDP variation in H1 to push overall projections up slightly but warned that higher interest rates intended to curb inflation could pose a threat to growth and said a recession should not be the price paid for fighting inflation via monetary policy, according to Reuters. – Fitch affirmed Germany at AAA; Outlook Stable.

- French President Macron and European Commission President von der Leyen are to visit China between April 5th-7th, via Chinese Foreign Ministry

- Finland’s opposition right-wing National Coalition Party is on course to win Sunday’s parliamentary election in a tight race with 48 out of 200 seats and the nationalist Finns Party are set to win 46 seats, while PM Marin’s Social Democrats are on track to win 43 seats. Furthermore, the National Coalition leader Orpo said it was a big win and that they will negotiate to form a new coalition government, according to Reuters.

FX

- The USD derived initial support from the surprise OPEC+ move, pre-JMMC, which sent the DXY to a 103.06 peak as yields climb; however, it has since waned and is now in proximity to 102.50.

- A pullback which has aided peers with petro-FX outperforming, USD/CAD below 1.35, while AUD outperforms and is back above 0.67 ahead of the RBA.

- JPY resides at the other end of the spectrum as yield differentials weigh and the Tankan survey provided no support; USD/JPY eclipsed 133.50 from a 132.83 base.

- GBP and EUR are near unchanged but well off initial lows as the USD’s strength wanes, with no real/sustained movement on Central Bank speak or final PMIs.

- PBoC set USD/CNY mid-point at 6.8805 vs exp. 6.8820 (prev. 6.8717)

Fixed Income

- Bonds are pressured by the OPEC+ action and associated inflation/monetary implications, though the complex has since pared much of the decline.

- Action which has seen a spike in yields that is more pronounced at the short-end; German and US 10yr yields above 2.35% and 3.53% respectively.

- Gilts and the EZ periphery have been moving in tandem with the above that has seen USTs pare to downside of less than 10 ticks ahead of Fed speak and ISM Manufacturing.

Commodities

- Crude is bolstered though slightly off best levels after jumping at the resumption of trade following the surprise OPEC+ voluntary production cut.

- Specifically, WTI and Brent remain at the top-end of USD 81.69-79.00/bbl and USD 86.44-83.50/bbl today’s parameters and well above Friday’s USD75.72/bbl and USD 79.80/bbl respective bests.

- In metals, the complex is mostly lower with pressure stemming from the upside in yields and initial USD strength with the yellow metal moving below the USD 1968/oz 10-DMA.

- OPEC+ members announced voluntary oil output cuts with Saudi Arabia to reduce production by 500k bpd from May until year-end and Russia will also cut by 500k bpd until year-end as a precautionary measure against further market volatility. Furthermore, Iraq is to lower output by 211k bpd, UAE will cut output by 144k bpd, Kuwait will cut 128k bpd and Oman will reduce output by 40k bpd, according to Reuters. It was also separately reported that more OPEC+ member states are expected to announce voluntary cuts, according to Energy Intel’s Bakr.

- Iraq’s oil exports averaged 3.26mln bpd in March (prev. 3.30mln bpd in Feb.), while it was separately reported that Iraq’s government reached an initial deal with KRG to resume northern oil exports this week, according to Reuters.

- US National Security Council spokesperson said they do not think OPEC+ production cuts are advisable at this moment given market uncertainty which they have made clear and the Biden administration is focused on prices for US consumers and not barrels, while the Biden administration will continue to work with all producers and consumers to ensure energy markets support economic growth and lower prices for American consumers, according to Reuters.

- EU Energy Commissioner Simson said the provision proposed by EU countries allowing a halt of Russian and Belarusian LNG imports is not yet law but is broadly supported and a very concrete step, while she added that the agreement on higher EU renewable targets is an ambitious deal and should help member states to upgrade national energy and climate plans, according to Reuters.

- Russia has reportedly moved to Dubai benchmark in recent Indian oil deal for Urals, according to Reuters sources; Rosneft is to sell oil to India at a discount of USD 8-10/bbl to Dubai quotes, and on a delivered basis.

- India extended export restrictions on gasoline and diesel as it seeks to ensure the availability of refined fuels for the domestic market, according to Reuters.

Geopolitics

- Ukrainian President Zelensky said the military situation is especially hot around the city of Bakhmut in eastern Ukraine, according to Reuters. Furthermore, Ukraine said its army still holds Bakhmut although the founder of Russia’s Wagner Group said the Russian flag was raised over the administration of Bakhmut and that Ukrainian forces remained in western parts of the town.

- Ukrainian military spokesperson says Bakhmut area is Ukrainian and Russian forecast are very far from capturing it.

- A well-known Russian military blogger was killed and at least 25 people were injured from a bomb blast in a café in St Petersburg, Russia which was formally owned by Wagner Group head Prighozhin, according to BBC.

- Russia’s ambassador to Belarus said Russian nuclear weapons in Belarus will be moved to the western borders of the country, according to RIA.

- US Secretary of State Blinken held a call with Russian Foreign Minister Lavrov and discussed the arrest of US reporter Gerskovich who was accused of spying. Blinken conveyed US grave concern over the detention and called for an immediate release, while Russia said the reporter was caught red-handed and his fate will be determined by a court. Lavrov also said it was unacceptable for Washington to politicise the case and whip up a stir, according to Reuters.

- North Korean leader Kim’s sister said Ukrainian President Zelensky is risking his country and being politically ambitious for wanting nuclear weapons, while she added that Zelensky is wrong to think the US nuclear umbrella could protect Ukraine from Russia, according to KCNA.

- US think tank said satellite images show an increasing level of activity at North Korea’s main nuclear site and that it may be close to completing a new reactor, according to NBC News.

- US Joint Chiefs of Staff Chair Milley said on Friday that his understanding and analysis of China is that at least their military, and perhaps others, have come to some sort of conclusion that war with the US is inevitable although he reiterated that he doesn’t believe war is inevitable.

- Iran claimed it chased off a US spy plane that entered Iranian air space near the Gulf of Oman, according to Tasnim.

- Large explosions were reported in Syria’s capital Damascus which state media said were caused by a car bomb around the Mezzah military airport area.

US Event Calendar

- 09:45: March S&P Global US Manufacturing PM, est. 49.3, prior 49.3

- 10:00: Feb. Construction Spending MoM, est. 0%, prior -0.1%

- 10:00: March ISM Manufacturing, est. 47.5, prior 47.7

- March Wards Total Vehicle Sales, est. 14.6m, prior 14.9m

DB concludes the overnight wrap

This week marks the start of the second quarter of 2023. Before we dive into this week, we want to highlight the release of our regular performance review for Q1. It’s been a tumultuous start to the year in markets, with substantial volatility in March after the collapse of Silicon Valley Bank led to fears about broader contagion across the banking system. However, despite the recent turmoil and the weakness among bank stocks, financial assets more broadly managed to record some strong gains over the quarter as a whole, with advances for equities, credit, sovereign bonds, EM assets and crypto. The only major exception to that pattern were commodities, with oil prices losing ground in every month of Q1 despite a strong rally last week. The full report can be seen here.

With the calendar flipping over we also want to highlight our how credit has continued to largely fallow our 2023 playbook. Obviously, we did not expect a banking crisis, which has led to €IG underperforming more than we initially expected. However, our views that Europe’s gas premium to the US would recede, that a US recession was not imminent as the monetary policy lag would take longer to play, and that less supply could keep HY & Loans tighter than expected has largely played out. Q1 ended with $IG spreads at 138bps, while $HY spreads were at 455bps. Both levels were within striking distance of our forecast from November; 140bps and 465bps respectively. €IG starts Q2 at 170bps (150bps forecasted), while €HY spreads are up to 481bps (450bps forecasted).

Over the weekend, OPEC+ unexpectedly announced an output cut starting in May that will exceed 1 million barrels a day. Russia has agreed to keep production at their current reduced level, while Saudi Arabia will see the largest cuts, slowing production by 500k barrels a day. The White House came out strongly against the move, due to concerns with consumer prices and the inflationary effects of higher fuel costs. It will take some time to see exactly how much this impacts global prices as demand concerns linger, but this is another potential factor exerting upward pressure on inflation after largely being an ameliorating factors this year. As we note above, oil prices fell every month for the last quarter, leading to the worst Q1 performance since 2020 when global shutdowns throttled demand. Brent crude futures are starting this quarter up +5.60% to $84.24/bbl, with WTI futures up +5.58% to $79.89/bbl after both initially were more than 8% higher at the start of trading.

Looking ahead to this week, the US jobs report on Friday should be the main focus. It will be the last jobs numbers before the next Fed meeting on May 3rd and markets will be looking for signs of cooling in the labour market after 475bps of tightening from the Fed over the last year. The report follows recent strong nonfarm payrolls beats, hotter-than-expected inflation data, and a 25bps Fed hike despite US regional bank concerns. Our US economists expect nonfarm payrolls to gain +250k (vs +311k in February) and both the unemployment rate and hourly earnings growth to remain unchanged (3.6% and +0.2%, respectively). Prior to the Friday’s report, JOLTS (Tuesday) and ADP (Wednesday) data will also be in focus.

Today we will get a sense of how global growth evolved over the course of the month with the release of US ISM manufacturing data later on, followed by services on Wednesday. Coupled with the jobs report, whether the ISM indices also show robust growth, especially in components like employment and prices, will be key to assess economy’s resilience. Still, factors like the recent banking turmoil may not yet feed through to major economic indicators. Our US economists see both gauges declining from February levels (manufacturing 47.1 vs 47.7 and services 54.4 vs 55.1).

In Europe, the key data releases include trade balance (Tuesday), factory orders (Wednesday) and industrial production (Thursday) for Germany, industrial production (Wednesday) and trade balance (Friday) in France as well as retail sales and PMIs for Italy. Our European economists overview what the latest prints on those indicators, among others, say about the European economy here, providing context for this week’s readings. Going forward, they underscore the recent banking stress as a new headwind and see risks as being tilted to the downside.

The major data points out of Asia include the China Caixin PMI data and Japan Tankan indices which we highlight below along with Japanese labour cash earnings and household spending on Friday. Friday’s data are expected to show total cash earnings per worker at 0.9% YoY, up from January’s 0.8%, and real household spending down -0.2% MoM vs 2.7% in January.

Asian equity markets are trading slightly higher, catching up to the late US rally last week and shrugging off the surprise production cut from OPEC+. As I type, the Nikkei (+0.33%), the KOSPI (+0.28%), the CSI (+0.40%) and the Shanghai Composite (+0.15%) are holding on to their opening gains whilst the Hang Seng (-0.27%) is bucking the regional trend. Outside of Asia, US stock futures are trading in the red with those tied to the S&P 500 (-0.33%) and NASDAQ 100 (-0.73%) edging lower after a spree of positive sessions last week. Meanwhile, yields on the 10yr Treasuries (+4.34bps) have risen to 3.51% with the 2yr Treasury yields jumping +7.85bps to 4.10% as fears over inflation are stoked by rising oil prices.

Overnight in Japan, the Tankan manufacturer sentiment index deteriorated to 1.0 in March (3.0 expected; 7.0 last quarter) for its fifth straight quarterly decline and reaching the worst level since December 2020. Meanwhile, the business mood among big non-manufacturers’ improved for a fourth quarter to +20.0 (20.0 expected) from +19.0 in December, as hopes of a recovery in tourism abound after the country reopened its borders.

Elsewhere, China’s Caixin manufacturing PMI for March dropped to 50.0 (51.4 expected) from a eight-month high of 51.6 in February, indicating that growth in the nation’s manufacturing sector remains subdued after an initial post-COVID bounce.

In FX, the euro is down -0.31% to $1.0805, hovering near a one-week low, while the Japanese yen weakened -0.18% to 133.10 per dollar as we go to press.

Now, looking back on last week. On Friday, we had a wave of key economic data, including the key US February Core PCE price index which came in softer than consensus at 0.3% month-on-month (+0.4% expected), down from 0.6%. In year-on-year terms the print was also below expectations, at 5.0% (vs. 5.1% expected). Along the same lines, the University of Michigan’s measure of 1 year inflation expectations came down two tenths to 3.6% (vs 3.8% expected), although 5-to-10-year expectations rose to 2.9% (vs 2.8% expected). We had a similar downside surprise for the March Euro Area CPI release, coming in at 0.9% month-on-month (vs 1.1% expected), and 6.9% year-on-year (vs 7.1% expected), down from 8.5% the previous month.There was little response in the fed futures market following said data releases. The rate priced in for the Fed’s next meeting in May climbed a modest +0.6bps on Friday, and +9.8bps on the week, leaving the market-implied probability of a hike in May at 58%.

With the inflation data clearly softer than anticipated, equity markets finished the week well in the green with the S&P 500 rising +3.48% (+1.44% on Friday), extending its rally for a third consecutive day. US banks have continued to recover from their turmoil in mid-March, with the S&P 500 banks climbing a strong +4.50% week-on-week (+0.93% on Friday) and the KBW index, which captures US regional banks, up +4.60% last week (+0.89% Friday). The NASDAQ closed the week up +3.37% (+1.74% on Friday) after a strong performance by the technology sector, locking in its best quarter since 2020. European equity outperformed, as the STOXX 600 climbed +4.03% week-on-week (+0.66% on Friday).

Although equities were on the up over last week, there was a large sell-off in weekly terms in fixed income as banking sector jitters subsided and risk-on sentiment prevailed. US 10yr Treasury yields rose +9.2bps (-8.1bps on Friday), their largest up move since the last week of February. The sell-off was greater for 2yrs as yields rose +25.9bps week-on-week (-9.4bps on Friday), the greatest gain since September. This story was echoed in Europe, as 10yr bund yields climbed +16.3bps (-8.4bps on Friday) last week in its largest up move since before Christmas. German 2yr yields fell back -6.6bps on Friday, while jumping +29.0bps week-on-week.

Finally in commodities, oil continued rallying on Friday as supply remains constrained as protests in Europe have shut down refineries and an Iraqi-Kurdish-Turkish dispute keeps a key pipeline turned off, with WTI crude (+1.75%) and brent crude (+0.63%) up on Friday to close the week at $75.67/bbl and $79.77/bbl respectively. In week-on-week terms, Brent crude closed up +6.37% and WTI contracts +9.25%. Gas also rallied, as European natural gas futures ended the week up +16.42%, with more than half of these gains occurring on Friday (+9.71%) on reports of cooler weather expected through April and supply risks of their own.

Tyler Durden

Mon, 04/03/2023 – 08:10

via ZeroHedge News https://ift.tt/KLDtRvM Tyler Durden