Stealth Easing In Japan Makes Inflation A Key Global Macro Risk

Authored by Simon White, Bloomberg macro strategist,

The Bank of Japan is using the banking sector to buy JGBs in a tacit admission of concerns around financial stability.

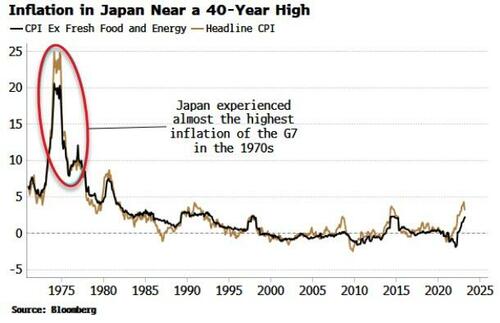

This raises the likelihood inflation, already near a 40-year high, could keep rising, posing a risk to global asset markets.

Kazuo Ueda chaired his first BOJ meeting overnight, maintaining the +/-50 bps around 0% range target for 10-year JGB yields, and keep the short-term rate at -0.1% (but most notably scrapping its guidance on future interest rate levels, as Ueda is clearly preparing the ground for taking a more flexible stance on policy).

But, with inflation at a level not seen since the early 1980s, and signs that it is becoming entrenched, history may not be kind to the central bank’s insistence on sticking with such easy policy.

The BOJ has had to buy a monumental amount of JGBs to maintain its yield cap in the face of pressure from rising yields around the world. But this brings its own new set of problems.

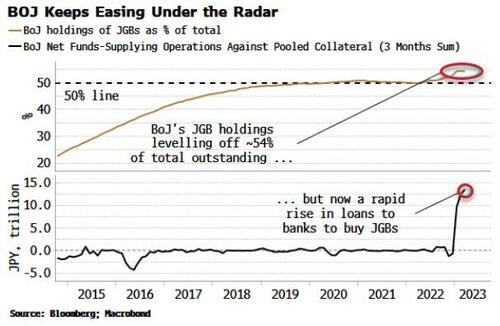

The BOJ now owns more than half of JGBs outstanding, which poses risks for financial stability. In a tacit acknowledgement of this, the central bank is now extending loans to banks, effectively so they can buy JGBs on its behalf. The chart below shows the shift clearly.

Japan’s inflation may look untroublesome at a low-sounding 3.2%, but it has risen sharply.

Core’s rapid rise, along with an increase in more structural measures of inflation to multi-decade highs, give a strong indication price rises in Japan are becoming embedded.

In Japan this is even more worrisome given the sheer amount of currently-dormant liquidity created over the last 20 years, with the BOJ’s balance sheet now the largest in the world in GDP terms. This liquidity is inflammable kindling that could lead to much higher inflation.

There is a belief that when the BOJ ends its YCC policy this will prompt a flood of capital to come back to Japan to take advantage of higher yields. But if inflation is a problem, that may not necessarily be the case, as real returns could still be poor.

Domestic equities would likely benefit as investors seek a better inflation hedge than bonds. They would also make a phenomenal inflation hedge for overseas investors (currency hedged). The yen would markedly weaken as inflation rose, and global capital flows would likely be large and volatile as some capital came back home, and some left, while the BOJ (or banking sector) ended up owning an increasing proportion of JGBs, adding to global financial-stability risks.

Tyler Durden

Fri, 04/28/2023 – 08:17

via ZeroHedge News https://ift.tt/joNVHK3 Tyler Durden