Fed’s Favorite Inflation Indicator Slows Only Marginally, Americans’ Savings Rate Rises To 15-Mo Highs

After US and German GDP gravely disappointed and inflation measures on both sides of the pond remain far more elevated that hoped for, this morning’s print of The Fed’s favorite inflation indicator will likely drive today’s early action among the algos.

Core PCE was expected to be flat at +4.6% YoY (and it was, but Feb was revised up to +4.7%) but the headline PCE printed hotter than expected at +4.2% YoY (although well down from the +5.1% prior)…

Source: Bloomberg

Even more focused, is the Fed’s view on Services inflation ex-Shelter, and the PCE-equivalent shows that is very much stuck at high levels…

Source: Bloomberg

However, while acyclical core inflation slipped, cyclical core inflation continued to march higher, which is a greater problem for the Fed. Cyclical core PCE inflation, which tracks inflationary pressures that are linked to the current economic cycle, is at the highest on record going back to 1985.

Source: Bloomberg

Americans’ Personal Income rose 0.3% MoM (slightly hotter than the 0.2% exp) and spending was unchanged (better than the 0.1% decline expected)…

Source: Bloomberg

On a YoY basis, Spending growth slowed to +6.0% (in line with income growth), but at its slowest since Feb 2021…

Source: Bloomberg

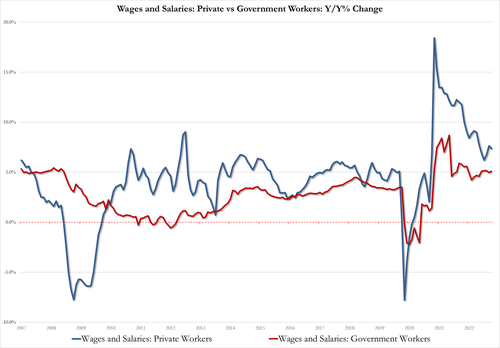

There is a possible silver lining in that Private workers wage growth slipped to 7.4% in March from 7.6% in Feb. However, Govt workers wage growth accelerated to 5.1% in March vs 5.0% in Feb

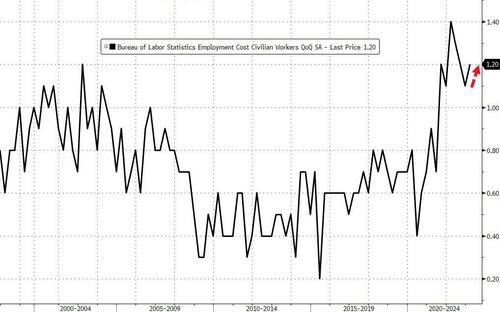

Spoiling that party, quite frankly, is that the Employment Cost Index rose 1.2% QoQ in Q1, hotter than the 1.1% expected…

On an inflation-adjusted basis, (real) spending was flat MoM…

Source: Bloomberg

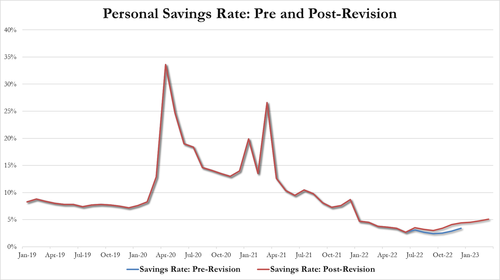

As a result of all that, the savings rate in March rose to 5.1% (from 4.8%) – its highest since Jan 2022…

Simply put, this inflation data is NOT enough to provide any support for The Fed.

Tyler Durden

Fri, 04/28/2023 – 08:40

via ZeroHedge News https://ift.tt/y2KdNE7 Tyler Durden