Yen Plummets After BOJ Crushes Hawks: Will Take Up To 1.5 Years To Review Current Policy

In a slap to the face of all those who naively expected that the BOJ would finally unveil some hawkish pivot (ignoring the fact that it owns more than 100% of Japan GDP in JGBs, has a DV01 in the tens of billions, and any market recoil to a hawkish BOJ pivot would instantly implode the world’s 2nd biggest bond market) overnight the BOJ scrapped a key part of its forward guidance on interest rates in Kazuo Ueda’s first board meeting as governor, signaling the first step towards unwinding its ultra-loose monetary policy… an unwind which won’t come for over a year however, if ever, and by then Japan will be back in deflation with deeply negative rates anyway so nobody will remember any of this and the BOJ will be back on its merry debt monetization course.

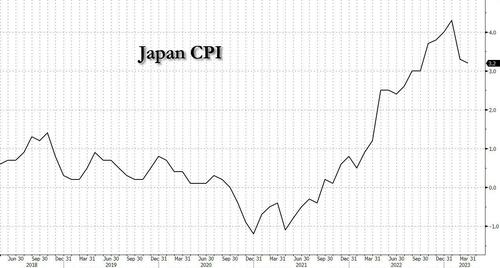

Which is not to say the BOJ did nothing: with Japan’s inflation scorching and sticky above 3%…

… Kuroda’s successor Ueda had to do something, which is why the BOJ head announced a plan to review its past monetary policy moves, laying the groundwork to gradually phase out his predecessor’s massive stimulus programme. But not yet: for now the BOJ kept its ultra-low interest rates on Friday, and maintained a commitment to “patiently” keep policy accommodative while saying it would spend one to one-and-half years on the review, which will look into various unconventional monetary steps taken over the past 25 years during Japan’s battle with deflation and low inflation, Ueda said.

The idea was to use lessons learnt from the review in guiding policy during his five-year term, Ueda said, though he added that the BOJ could always change policy before concluding the review. At the same time, the central bank removed a pledge from its guidance for interest rates to stay at “current or lower levels” in a move that yen bulls see giving the BOJ more leeway for a future policy tweak.

Ueda’s debut policy meeting marked a cautious start for the 71-year-old governor who took office this month, leaving room for him to make future changes but sending a clear signal to markets that he would be in no rush to do so.

In a news conference, the new chief said the broad-based review won’t be tied to near-term policy shifts and stressed the need to wait for more evidence to conclude inflation would sustainably achieve the BOJ’s 2% target.

“While trend inflation is gradually heightening, it will take some time to achieve our inflation target,” Ueda said after the BOJ’s widely-expected decision to make no changes to its yield curve control (YCC) policy. Unlike in the US where a wage-price spiral terrifies the central bank, in Japan the BOJ would give a kidney if it could get a burst of sustained wage inflation.

“The risk of missing our price target with premature monetary tightening is bigger than the risk of experiencing inflation exceeding 2% due to a delayed tightening. The cost of waiting for trend inflation to heighten is low,” he said, in a 180 reversal from what western central bankers have been saying.

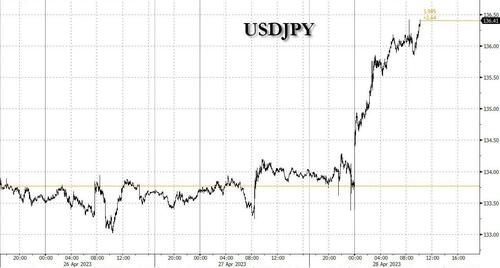

The yen tumbled, and Japanese bonds and stocks rallied after Ueda crushed hopes for an early hawkish pivot and would take his time to withdraw the stimulus of his dovish predecessor, Haruhiko Kuroda, who retired this month after a decade at the helm.

“The fact that the BOJ left a reference to further easing as needed confirmed its stance to continue monetary easing,” said Naomi Muguruma, senior market economist at Mitsubishi UFJ Morgan Stanley Securities.

Some analysts saw the BOJ getting some breathing space with the 10-year yield having fallen below its 0.5% cap, thanks in part to a decline in U.S. Treasury yields on expectations the Federal Reserve will soon pause its interest rate hike cycle.

“The Fed and the U.S. economy are bailing them out from doing something right away, buying them some time. It doesn’t mean we get no change to YCC for the next one to 1-1/2 years,” said Jim Leaviss, CIO of public fixed income at M&G in Tokyo.

There is uncertainty on how soon the BOJ may end ultra-easy policy, as it weighs emerging signs of wage growth against lingering headwinds from slowing global growth. In fresh quarterly projections released in a report issued on Friday, the board revised up its core consumer inflation to 1.8% in the current year ending in March 2024, and 2.0% in the following year. Under previous projections made in January, the BOJ expected inflation to hit 1.6% this year and 1.8% in fiscal 2024.

But the BOJ projected inflation to slow to 1.6% in fiscal 2025 and said risks to that price outlook were skewed to the downside, highlighting a lack of conviction among central bank policymakers on the durability of price growth.

“Our forecasts show that we’re getting quite close to achieving (our price target). But we’re not quite confident about our longer-term inflation forecast,” Ueda said.

The growing side-effects of YCC, such as market distortions caused by the BOJ’s huge bond buying and the strain on bank profits from ultra-low interest rates, also complicate the timing of an exit, analysts say.

Ueda said the BOJ must be vigilant to such side-effects, even as it keeps monetary policy ultra-loose.

“It’s true we’re seeing side-effects here and there. We need to closely scrutinise these developments,” he said. “We must avoid getting the balance of benefits and costs wrong, so will be vigilant and disclose information as much as possible.”

Tyler Durden

Fri, 04/28/2023 – 10:20

via ZeroHedge News https://ift.tt/f5loHms Tyler Durden