OPEC+, IEA Tensions Add To Oil’s Troubles

By Nour al Ali, Bloomberg markets live reporter and strategist

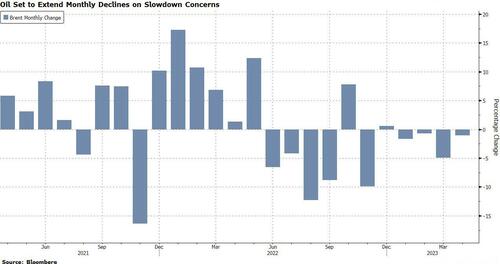

Tensions between OPEC+ and the IEA are likely to persist amid concerns about the global economy and demand. That doesn’t bode well for crude in the short term.

The Brent crude prompt spread, which flipped earlier this week to trade in contango, a bearish market structure, for the first time since January, highlights growing worries about demand and refinery consumption.

The IEA renewed its criticism of OPEC+’s production cuts, saying they stoke inflation, while OPEC’s Secretary-General, Haitham Al-Ghais, said volatility in oil prices is being driven by calls to halt investment rather than OPEC’s policies.

The spat coincides with weakening oil-refining profits over the past few weeks, causing companies to consider lower processing rates. Headline oil prices have dipped below $80 as it struggled to find support.

Bloomberg strategists see Brent’s fair value closer to $90 a barrel. But that may be difficult in the short term against the headwinds of sustained concern over recession, the potential for more monetary tightening, and weakening refining margins.

Tyler Durden

Fri, 04/28/2023 – 12:50

via ZeroHedge News https://ift.tt/IF9iHzu Tyler Durden