AI-Mania Meltup In May Hides Recession Signals From Commodities & Credit Curves

Early in the day (and overnight) The Fed’s Barkin and Mester profused their usual hawkish mantras, expressing no need to pause yet, but later in the day .

-

Barkin – No Pause – “I’m looking to be convinced that demand is in fact coming down, and that that will then start to bring inflation down… However I look at it, it just looks like inflation is too high.”

-

Mester – Hike – “I would see more of a compelling case for bringing [rates] up … and then holding for a while until you get less uncertain about where the economy is going.”

-

Collins – No Pause – “…the Fed is intent on reducing inflation that’s just simply too high.”

-

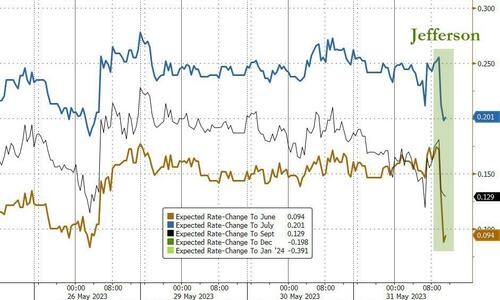

Jefferson – Pause – “…skipping a rate hike at a coming meeting would allow the Committee to see more data before making decisions about the extent of additional policy firming.”

-

Harker – Pause – “I am definitely in the camp of thinking about skipping any increase at this meeting.”

But combining all that with Beige Book and rate-hike expectations dropped today…

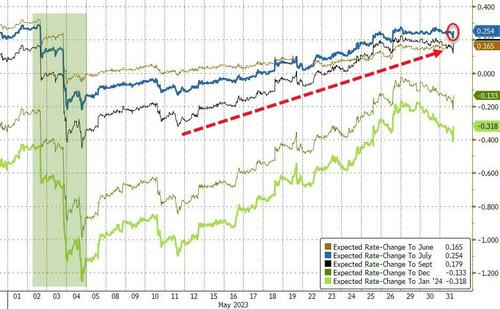

However, on the month, rate-change expectations are basically unchanged (modestly more hawkish at the longer-end), with The Fed’s statement driving a dovish dive early on but all the FedSpeak since has reversed that entire move, with a 25bps hike by July now fully priced in…

Source: Bloomberg

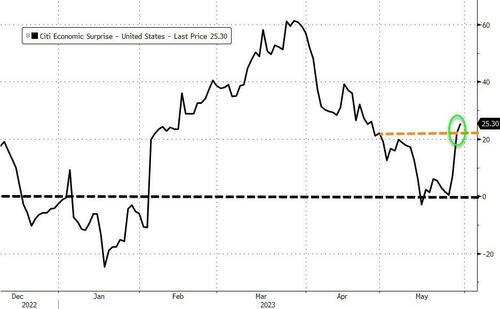

Weak Chicago PMI was trumped by strong JOLTS data on the day and pushed US Macro surprise data higher for May…

Source: Bloomberg

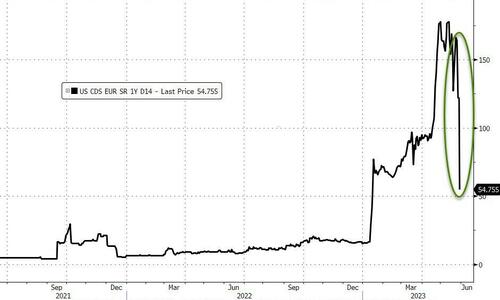

Debt-Ceiling drama is fading fast with USA CDS compressing…(though still elevated)

Source: Bloomberg

Nasdaq is the only major US equity index to end higher in May (up around an astonishing 8%) while The Dow was the big laggard, down around 4%. The S&P ended unchanged…

Source: Bloomberg

Energy stocks were clubbed like a baby seal in May while Tech took off. Today saw significant bank weakness which pulled them notably lower on the month…

Source: Bloomberg

May also saw a massive divergence between cap-weight and equal-weight portfolio performance as breadth narrowed dramatically…

Source: Bloomberg

Meme-stock mania struck in May with Goldman’s ‘high retail sentiment’ basket soaring 18%…

Source: Bloomberg

But it was AI that dominated with NVDA the darling, soaring around 40% in May (though we note today’s decline from yesterday’s record high is the biggest daily drop since early Feb). NVDA is down almost 10% from yesterday’s highs…

That weakness dragged all US majors into the red for the week with small caps weakest…

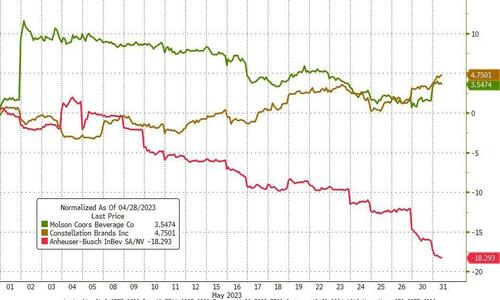

Some other notables include BUD getting slammed

Source: Bloomberg

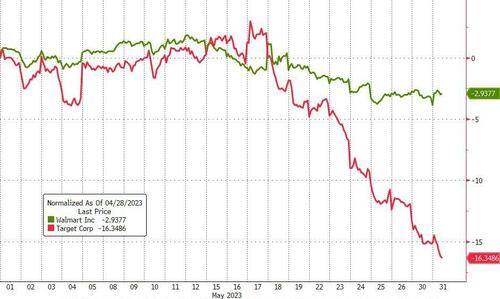

And Target was trounced…

Source: Bloomberg

Treasury yields were all higher in May with the short-end notably underperforming (flattening the yield curve significantly)…

Source: Bloomberg

The dollar rallied hard in May (after an initial drop) up to two month highs…

Source: Bloomberg

Crypto was mixed with Ethereum down 8% in May and Biotcoin down 1.5% as Ripple rallied…

Source: Bloomberg

Bitcoin’s suffered its worst month since Nov 2022 (after 4 monthly gains in a row)…

Source: Bloomberg

Copper and Crude were the ugliest commodities in May – yelling recession. NatGas was lower as were PMs…

Source: Bloomberg

WTI suffered its biggest monthly drop since Nov 2021 as China’s rebound disappointed

Gold ended back below $2000, but well above the March lows…

Finally, one has to wonder how long this divergence can last with commodities, real yields, the Treasury curve, and dollar all opposing the exuberance of the AI-driven mega-cap tech-gasm…

Source: Bloomberg

Don’t they realize that the other companies in the world – that are not seeing their share price rise – are the clients from which the future revenues for AI firms are supposed to come?

Are we near peak AI-bubble (echoing the COVID-supply-chain/crypto craze from 2021)…

Source: Bloomberg

Can’t be, right?

Tyler Durden

Wed, 05/31/2023 – 16:00

via ZeroHedge News https://ift.tt/X0rftOx Tyler Durden