Bonds & Bullion Bid As Fed ‘Pause’ Narrative Builds; Stocks Soar On Massive Squeeze

The labor market continued to show resilience today (claims and ADP solid) ahead of tomorrows payrolls print (but wage growth slowed) but job gains were fragmented. At the same time, the manufacturing side of the economy continued to deteriorate significantly (along with prices), productivity was revised ugly, but construction increased more than expected. So take your pick on that smorgasbord.

FedSpeak continued to push the idea of a skip/pause in June with Phily Fed’s Patrick Harker saying “I do believe that we are close to the point where we can hold rates in place and let monetary policy do its work to bring inflation back to the target in a timely manner.

But St. Louis Fed President Jim Bullard commented that interest rates are now “at the low end of what is arguably sufficiently restrictive given current macroeconomic conditions” in an essay posted on his bank’s website.

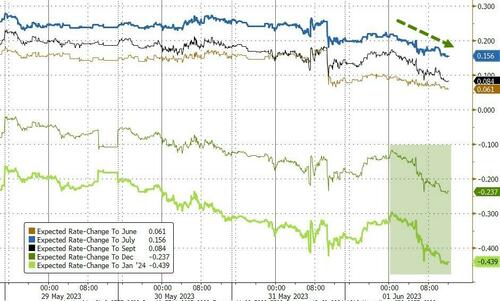

Putting all that into the bowl and the market adjusted dovishly with rate-hike expectations for June/July fading and rate-cut expectations for year-end rising fast…

Source: Bloomberg

Stocks were in the mood to party and it was one-way traffic higher led by Small Caps and Mega-Cap tech. Some late-day profit-taking wiped some of the lipstick off this pig (but Nasdaq and Small Caps managed 1% gains on the day still). The Dow was the smallest winner…

The Nasdaq is now on pace for its longest weekly win streak since 2020.

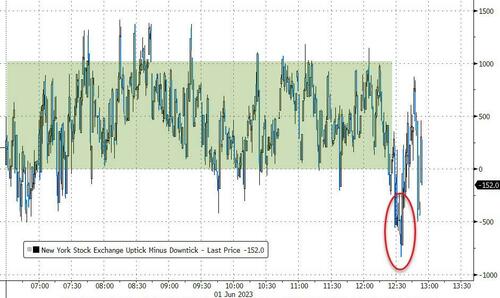

Stocks soared thanks to a massive short-squeeze that hit shortly after the cash open…

Source: Bloomberg

The morning saw almost no selling pressure at all but the late-day saw a big sell-program hit with around 30mins to go…

Source: Bloomberg

Notably, the squeeze was initiated by several positive delta impulses from 0-DTE traders, but at around 1200ET, 0-DTE puts were aggressively bid reversing the flow dramatically (slowing the uptrend in stocks), but the market’s continued rise prompted covering of those puts and call-buying which prompted another leg higher to the short-squeeze…

Banks were up – perfectly recovering yesterday’s plunge…

AI stocks soared intraday with NVDA up another 5% and even c3.AI bounced significantly after its overnight pukefest…

Treasuries were bid today with the short-end outperforming (2Y -6bps, 30Y -3bps), extending gains this week…

Source: Bloomberg

Bear in mind that 2Y yields are 50bps higher than they were at the last payrolls print…

Source: Bloomberg

The dollar suffered its biggest daily drop since January today

Source: Bloomberg

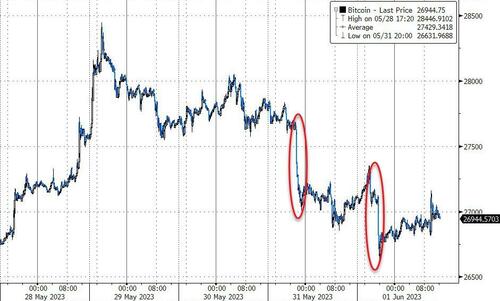

Bitcoin legged lower again overnight, but bounced back up to hold around $27,000…

Source: Bloomberg

Gold futures rallied today, topping $2000 briefly intraday…

Oil prices also soared today, with WTI topping $71…

Finally, Target stock started the day ugly for the 10th day in a row – the longest losing streak since the peak of the dotcom bubble in Feb 2000. A buying panic wave stepped in around 1200ET lifting it green. Then the machines battled to keep it green as selling pressure took it back into the red…

Consumer weakness? Or Conservative backlash? Ask JPM, they downgraded the giant retailer.

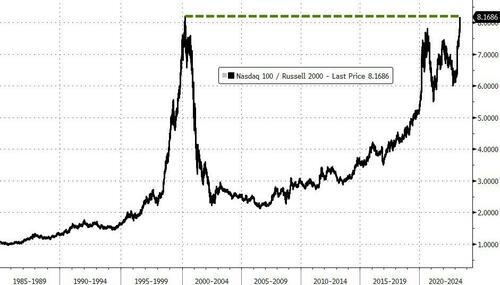

And then there’s this…

Mission Accomplished?

Tyler Durden

Thu, 06/01/2023 – 16:01

via ZeroHedge News https://ift.tt/j7tc1Vm Tyler Durden