Bank Bailout Facility Usage Hits New Record High As Money-Market Fund Inflows Soared Again Last Week

After Friday’s deposits data hinted – on a seasonally-adjusted and pre-revision basis – that outflows had stalled, we note that regional bank stocks have gone nowhere and, as we just found out, money market fund inflows have continued to soar.

The last week saw a $31.7 billion inflow into money market funds to a new record high of $5.42 trillion – the 6th week in a row (and 11th week of the last 12)

Source: Bloomberg

Notably, in the last 14 weeks – since SVB’s panic began – money-market funds have seen an aggregate $600 billion in inflows.

Institutional funds saw $19.77 billion in inflows while retail funds added around $12 billion…

Source: Bloomberg

This continued surge in money market fund inflows strongly suggests tomorrow’s H8 deposit report will show the bank walk/run is continuing…

Source: Bloomberg

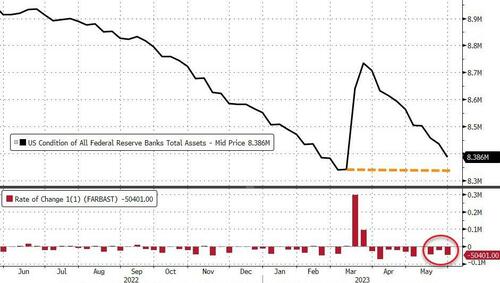

The Fed’s balance sheet shrank a dramatic $50 billion last week, almost back to pre-SVB-bailout levels…

Source: Bloomberg

And as far as QT is concerned, after last week’s very small drop, Total Securities Held Outright tumbled around $43 billion to its lowest since Aug 2021…

Source: Bloomberg

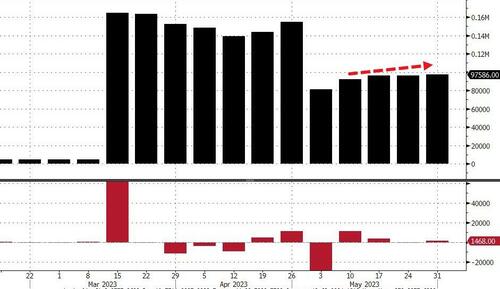

The US central bank had $97.6 billion of loans outstanding to financial institutions through two backstop lending facilities, up again from last week (the drop was FRC’s removal)…

Source: Bloomberg

…with the Fed’s Bank Term Funding Program rose by $1.7 billion to a new record high of $93.6 billion…

Source: Bloomberg

The Fed’s H4 table breakdown is as follows:

-

QT decline of $43BN, of which TSYs drop $33BN and MBS drop $12BN (TIPS +3BN)

-

Discount Window down $0.2BN from $4.2BN to $4.0BN

-

BTFP up $1.7BN from $91.9BN to $93.6BN

-

Other Credit Extensions (FDIC loans) down $4.6BN to $188.1BN

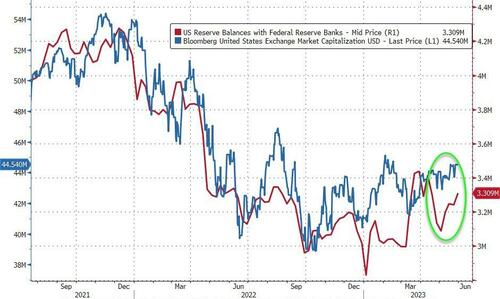

US Bank reserves at The Fed rose last week, catching up to equities’ over-exuberance…

Source: Bloomberg

Finally, as we noted late last week, this is far from over as former Dallas Fed head Robert Kaplan dropped some uncomfortable truth bombs on the US banking system:

Phase one was an asset/liability mismatch at several banks

Phase two began with the stock market deciding to do its own supervisory scrubbing

We are now heading into the third phase.

Bank leadership at small and midsize banks are considering how to shrink their loan books in order to address the mark-to-market loss of capital, as well as to guard against potential deposit instability in the future.

Bank leadership is very aware that the economy is slowing, and that we are likely about to enter a challenging credit environment.

While asset/liability mismatches are relatively easy to spot, assessing the quality of loan portfolios is much more complicated.

CEOs of many small and midsize banks are in a tough position.

They can’t easily raise equity because their stock prices are down.

As a result, they are turning to shrinking their loan books, finding places to pull back on existing loans and future loan commitments.

This is making it much harder for small and midsize businesses to get and keep their bank loans.

It is a quiet phase that won’t make headlines but is nevertheless relentlessly going on beneath the surface.

Free to speak his mind, Kaplan concludes rather ominously, “the recent banking turmoil has highlighted the disparity between too-big-to-fail banks and smaller and midsize banks. I worry that increasing the Fed funds rate from here may create further strains on the deposit base for those smaller banks. I’m concerned that, as the Fed raises rates, it is tightening the vice on small and midsize banks and the small and midsize businesses that rely on those banks for funding.”

We will find out more details of this phase of the banking crisis tomorrow after the close.

Tyler Durden

Thu, 06/01/2023 – 16:41

via ZeroHedge News https://ift.tt/ehajzpK Tyler Durden