Turkish Lira Craters 7% In Record Drop, Hits All Time Low As State Banks Retreat From Defense

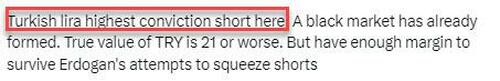

One month ago we told readers of our premium subscriber feed that shorting the Turkish Lira was our “highest conviction” trade.

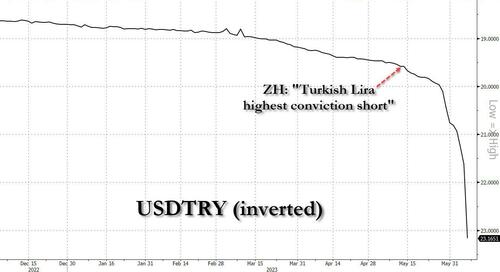

We were right: just under month later, the lira has lost almost 20%, a staggering, unprecedented move in the world of FX, and those who followed our reco (in size) can take a few months off.

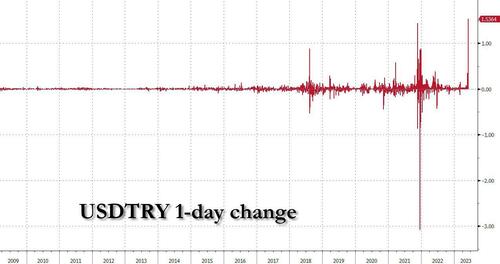

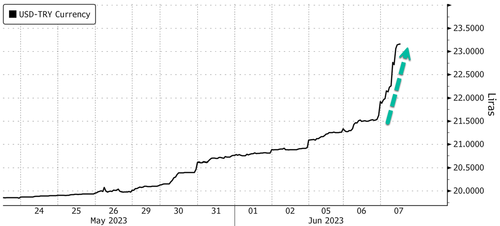

But the move is nowhere near over: overnight, the Turkish Lira tumbled as much as 7% – its biggest drop on record in absolute terms…

… to as low as 23.1678 per dollar (a record low) on Wednesday as traders said state lenders had ceased selling dollars in an attempt to support the currency, according to Bloomberg.

The ongoing plunge in the Lira, weakening for a 12th straight day, comes more than a week after Turkish President Recep Tayyip Erdogan won reelection in a runoff, an election which the president fought tooth and nail to preserve normality into, and was selling dollars at a record pace just to avoid what we are seeing now.

Erdogan has supported unconventional ultra-low interest rates and constant-exchange-rate interventions, though he has failed to tame soaring inflation. But now, the cost of the policy has depleted foreign-currency reserves, sparked an inflationary fire, and led to a foreign capital exodus as investors bet against the Lira as current policies are unsustainable.

Traders have turned their attention to Erdogan appointing former Merrill Lynch strategist Mehmet Simsek as the next treasury and finance minister. The belief is that Simsek might freeze ‘Erdoganomics’ and return to conventional economic policies by abandoning state intervention in currency markets.

This means the market might find a real fair value for Turkish assets. Since the election on May 28, the Lira has weakened more than 13% against the dollar to a record low.

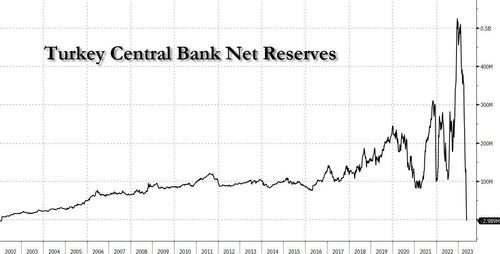

But unwinding years of unconventional policies will be challenging. A few weeks ago, we warned much more pain was coming to the Lira based on a rather dire analysis by Goldman of the central bank’s reserve position.

Since then, it’s gone from bad to worse. Reuters also jumped on the bearish Lira bandwagon. They reported that the Turkish central bank’s net forex reserves dropped into negative territory for the first time since 2002, at $-151.3 million on May 19.

Morgan Stanley also jumped on the bearish Lira trade, warning the Lira might plunge to 28 per dollar by the end of the year, but at this rate it looks like it will be there by the end of the week.

Tyler Durden

Wed, 06/07/2023 – 07:45

via ZeroHedge News https://ift.tt/cDnmjBK Tyler Durden